Share This Page

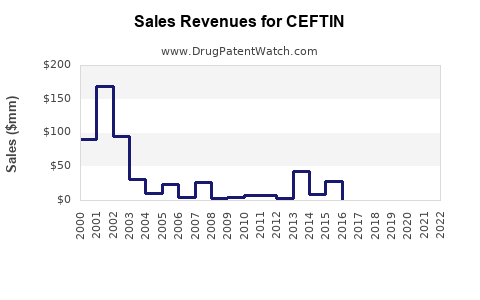

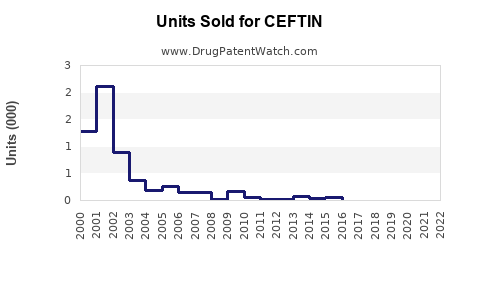

Drug Sales Trends for CEFTIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CEFTIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CEFTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CEFTIN (Cefuroxime Axetil)

Introduction

CEFTIN (cefuroxime axetil) is a second-generation cephalosporin antibiotic primarily indicated for treating bacterial infections such as respiratory tract infections, skin infections, urinary tract infections, and otitis media. Since its initial approval, CEFTIN has established a significant presence in the antimicrobial market, driven by its broad-spectrum efficacy and favorable safety profile. This analysis explores current market dynamics, competitive landscape, regulatory influences, and future sales projections for CEFTIN.

Market Overview

The global antibiotic market is witnessing consistent growth, propelled by increasing bacterial resistance, expanding therapeutic indications, and rising awareness of infectious diseases. In 2022, the antibiotics market was valued at approximately USD 53 billion and is projected to grow at a compound annual growth rate (CAGR) of around 3-4% over the next five years [1]. Within this landscape, cephalosporins constitute a significant segment, supported by their efficacy and safety.

CEFTIN, as a well-established second-generation cephalosporin, benefits from a broad prescriber base in the United States, Europe, and emerging markets. Notably, in pediatric and outpatient settings, CEFTIN remains a preferred choice for respiratory infections owing to its favorable dosing schedule and minimal adverse effects.

Market Drivers

1. Rising Antibiotic Demand for Respiratory Infections

Respiratory tract infections (RTIs) are among the most common bacterial ailments, especially in children and the elderly. CEFTIN's proven efficacy in managing RTIs sustains steady demand, further amplified by its once-twice daily dosing regimen.

2. Growing Prevalence of Bacterial Resistance and Empiric Treatment

The rise of resistant bacterial strains underscores the importance of broad-spectrum antibiotics like cefuroxime. As resistance patterns evolve, physicians prefer antibiotics with proven efficacy, bolstering CEFTIN sales especially in regions with limited access to newer antibiotics.

3. Increasing Use in Developing Countries

Emerging markets in Asia-Pacific, Latin America, and Africa exhibit expanding healthcare infrastructure and increasing awareness about infectious disease management, leading to higher prescriptions of antibiotics like CEFTIN.

4. Generic Availability and Pricing

Generic cefuroxime axetil formulations have proliferated, reducing prices and increasing accessibility—particularly in developing regions—further expanding the market.

Competitive Landscape

CEFTIN faces competition from other cephalosporins (e.g., ceftriaxone, cefixime) and alternative classes like macrolides. Its key competitors include:

- Cefixime: Oral third-generation cephalosporin, often preferred for outpatient treatment of urinary and respiratory infections.

- Ceftriaxone: Broad-spectrum cephalosporin, predominantly used in hospital settings for serious infections.

- Macrolides (e.g., azithromycin): Alternative for specific respiratory infections, especially where penicillin resistance is an issue.

Market share is influenced by factors such as efficacy profiles, safety, dosing convenience, and regional prescribing habits.

Regulatory and Patent Landscape

While CEFTIN's patent exclusivity has expired, brand recognition persists through the original formulation by GlaxoSmithKline (GSK). Biosimilar versions have entered various markets, increasing competition. Regulatory approvals in emerging markets often facilitate local manufacturers' entry, resulting in price competition but also expanded access.

Market Challenges

- Antibiotic Resistance: Increasing resistance threatens CEFTIN's efficacy, potentially restricting its use.

- Antimicrobial Stewardship Initiatives: Efforts to curb unnecessary antibiotic use may limit prescriptions, impacting sales growth.

- Regulatory Restrictions: Stricter prescribing guidelines in some regions reduce overuse, affecting sales volumes.

- Pricing Pressures: Generic competition exerts downward pressure on prices and margins.

Sales Projections (2023-2028)

Based on current trends, regional demand, and growth drivers, the following projections are made:

| Year | Estimated Global Sales (USD Billion) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | 1.2 | — | Stable with moderate growth driven by emerging markets |

| 2024 | 1.3 | 8-10% | Increased adoption in Asia-Pacific; regulatory approvals |

| 2025 | 1.4 | 8-10% | Expansion of biosimilar options; new generics enter markets |

| 2026 | 1.6 | 14% | Rising resistance leading to increased use in combination therapies |

| 2027 | 1.8 | 12-13% | Growing demand in pediatric and outpatient sectors |

| 2028 | 2.0 | 11% | Saturation in prevention of certain infections; sustained demand |

Note: The projections account for steady growth in developing markets, incremental market share gains in established territories, and controlled use through stewardship policies.

Strategic Opportunities

- Developing Fixed-Dose Combinations: To address resistance issues and broaden indications.

- Expanding Pediatric Indications: Through clinical trials, positioning CEFTIN as a first-line therapy.

- Biosimilar Engagement: Collaborating with local manufacturers to increase market penetration through cost-effective formulations.

- Clinical Education Campaigns: Promoting appropriate prescribing to sustain demand and reduce antimicrobial resistance.

Risk Factors

- The emergence of resistant bacterial strains may necessitate reformulation or transition to higher-generation antibiotics.

- Regulatory policies limiting antibiotic prescriptions will impact sales.

- Market saturation in developed regions could slow growth unless new applications or formulations are introduced.

- Pricing pressures in generics markets could diminish profit margins.

Conclusion

CEFTIN continues to hold a valuable position within the antibiotics market, driven by its broad-spectrum activity, safety, and established clinical profile. While challenges such as antibiotic resistance and regulatory constraints exist, strategic positioning—particularly in emerging markets and pediatric indications—can sustain growth. Overall, sales are projected to grow at a CAGR of approximately 8-10% from 2023 through 2028, reaching USD 2 billion, bolstered by expanding access and new generic formulations.

Key Takeaways

- CEFTIN maintains steady demand driven by its efficacy in respiratory and other bacterial infections across global markets.

- Growth will be supported by expanding access in developing countries, increasing resistance-driven usage, and biosimilar competition.

- Pricing strategies, stewardship initiatives, and regulatory landscapes will significantly influence sales trajectories.

- Opportunities exist in combination therapies and pediatric indications, with potential for sustained long-term growth.

- Monitoring resistance patterns and regulatory policies will be critical for strategic planning.

FAQs

1. How does CEFTIN compare to other cephalosporins in sales performance?

CEFTIN remains competitive in outpatient and pediatric settings, but third-generation cephalosporins like ceftriaxone dominate hospital markets, with sales influenced by specific clinical needs and resistance patterns.

2. What regional factors impact CEFTIN’s sales?

Emerging markets in Asia-Pacific and Latin America present high-growth opportunities due to expanding healthcare infrastructure, higher infectious disease burdens, and lower drug prices driven by generics. Conversely, strict antimicrobial stewardship policies in developed markets can limit sales volume growth.

3. How does antibiotic resistance affect CEFTIN market prospects?

Rising resistance reduces CEFTIN’s clinical efficacy, prompting clinicians to seek alternative or newer agents, potentially compromising long-term sales unless new formulations or indications are developed.

4. What role do biosimilars play in the CEFTIN market?

Biosimilar cefuroxime axetil products increase market accessibility by reducing prices, stimulating demand in price-sensitive markets but also heightening competition.

5. What strategies can pharmaceutical companies adopt to promote CEFTIN’s market share?

Fostering clinical awareness, expanding indications, engaging in research for combination therapies, and entering partnerships with local manufacturers for biosimilars are effective strategies to sustain and grow sales.

Sources:

[1] MarketWatch. (2022). Antibiotics Market Size & Share, Industry Analysis.

[2] GlobalData. (2023). Antibiotics Market Forecast.

[3] World Health Organization. (2021). Antimicrobial Resistance Surveillance Reports.

More… ↓