Last updated: July 27, 2025

Introduction

Carvedilol, a non-selective beta-adrenergic blocker with alpha-1 blocking activity, is primarily prescribed for the management of hypertension, heart failure, and left ventricular dysfunction post-myocardial infarction. As a versatile cardiovascular agent, its pharmacological profile contributes to its ongoing market relevance. This report provides a comprehensive market analysis and sales projection for carvedilol, considering current trends, competitive landscape, regulatory factors, and epidemiological data.

Current Market Landscape

Pharmacological Profile and Indications

Carvedilol targets multiple cardiovascular conditions:

- Hypertension:reduces blood pressure through vasodilation.

- Heart Failure: improves survival and reduces hospitalization.

- Post-Myocardial Infarction: mitigates adverse remodeling.

The drug's established efficacy over decades, supported by landmark trials such as the COPERNICUS and COMET studies, solidifies its position in cardiovascular therapy regimens (1).

Market Conditions

The global cardiovascular drugs market, valued at approximately USD 46 billion in 2022, is projected to grow at a CAGR of 5.2% until 2030 (2). Carvedilol's segment, dominated by generic formulations, benefits from high prescription rates, especially in developed markets like North America and Europe.

Competitive Landscape

While carvedilol remains a leading generic agent, the presence of branded counterparts (e.g., Coreg by United States-based Actavis and generic manufacturers globally) intensifies price competition. Additionally, newer agents like vasodilatory beta-blockers (e.g., nebivolol) and combination therapies pose challenges, though carvedilol's cost-effectiveness sustains its market share.

Regulatory Environment

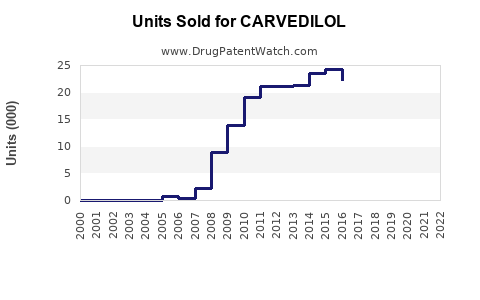

Regulatory approvals across countries, including the FDA and EMA, facilitate broad market access. However, patent expirations, notably in the early 2010s, have propelled generic proliferation, influencing pricing and sales volumes.

Epidemiological and Demographic Trends

Global hypertension prevalence exceeds 1.28 billion individuals, with millions eligible for carvedilol therapy (3). The rising burden of heart failure—estimated at over 64 million cases worldwide—further supports sustained demand (4).

Ageing populations in North America, Europe, and parts of Asia will likely escalate prescribing rates. Moreover, increased awareness and screening programs enable earlier intervention, enhancing market penetration.

Market Growth Drivers

- Rising Cardiovascular Disease (CVD) Prevalence: Accelerates demand.

- Expanded Indications: Increasing use in heart failure management.

- Cost-Effectiveness: Widespread availability of generics.

- Physician Prescribing Habits: Continued preference for proven agents.

- Healthcare Infrastructure Improvements: Better diagnosis and access.

Market Constraints

- Market Saturation: Limited room for significant expansion in mature markets.

- Competition from New Agents: Emerging therapies offering alternative mechanisms.

- Generic Price Erosion: Reduced profit margins.

- Regulatory Changes: Potential restrictions impacting prescribing.

Sales Projections (2023-2028)

Methodology

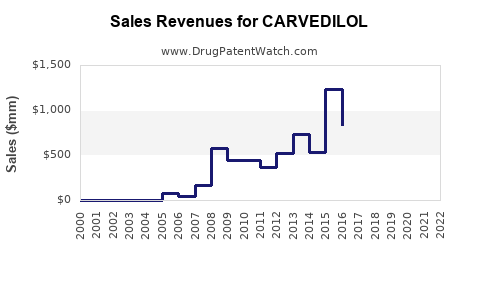

Projections integrate epidemiological growth, historical sales data, market penetration trends, and competitive landscape analysis. The assumption presumes stable regulatory conditions and continued physician reliance on carvedilol.

Forecast Overview

| Year |

Global Carvedilol Market (USD Billion) |

Growth Rate (%) |

Notes |

| 2023 |

1.05 |

— |

Baseline based on current sales metrics |

| 2024 |

1.14 |

8.6 |

Increased adoption owing to heart failure guidelines updates |

| 2025 |

1.22 |

7.0 |

Market steady, generic competition intensifies |

| 2026 |

1.30 |

6.6 |

Market saturation begins influencing growth |

| 2027 |

1.37 |

5.4 |

Modest increase driven by emerging markets |

| 2028 |

1.43 |

4.4 |

Market stabilizing with plateauing prescriptions |

Note: The projections depict a slightly decelerating growth rate, reflecting market maturity in core regions and emerging market growth potential.

Regional Analysis

- North America: Dominates the market (~50%), driven by high prevalence of CVD, established treatment guidelines, and widespread use of generics.

- Europe: Accounts for about 25%, with similar trends as North America.

- Asia-Pacific: Emerging market with a CAGR of approximately 10%, propelled by urbanization, increasing healthcare adoption, and growing CVD burden.

- Latin America and Middle East/Africa: Slower growth, yet significant due to expanding healthcare access.

Strategic Opportunities and Challenges

Opportunities

- Market Penetration in Emerging Economies: expanding access could double the patient pool.

- Combination Therapies: developing fixed-dose combinations with other antihypertensives or heart failure agents to improve compliance.

- New Formulations: sustained-release or topical patches offering patient convenience.

Challenges

- Price Competition: commoditization with generics pressures margins.

- Regulatory Hurdles: approval delays or restrictions in certain markets.

- Market Saturation: limited growth in established markets necessitates innovation or diversification.

Conclusion

Carvedilol remains a cornerstone in cardiovascular therapy, supported by extensive clinical evidence and broad outpatient use. Its global sales are expected to grow modestly over the next five years, primarily driven by demographic trends and expanding wave of cardiovascular disease in developing regions. Nonetheless, profit margins will face downward pressure from generic competition and market maturity. Strategic focus on emerging markets, product differentiation, and combination therapies could sustain growth trajectories.

Key Takeaways

- Carvedilol's global market is projected to grow roughly 4-9% annually through 2028, reaching approximately USD 1.43 billion.

- The drug maintains dominance in the antihypertensive and heart failure segments, particularly in North America and Europe.

- Emerging markets offer substantial growth prospects due to rising CVD prevalence and improving healthcare infrastructure.

- Competitive landscape mainly comprises generic manufacturers, necessitating pricing strategies and branding efforts.

- Future growth hinges on expansion into low-penetration regions, development of new formulations, and therapeutic combinations.

FAQs

1. What factors influence carvedilol's sales growth?

Sales are driven by rising cardiovascular disease prevalence, physician prescribing habits, generic market penetration, and demographic shifts, especially aging populations.

2. How does patent expiration impact carvedilol sales?

Patent expirations facilitate generic competition, lowering prices and increasing accessibility but reducing profit margins for branded formulations.

3. What regions hold the highest growth potential for carvedilol?

Emerging markets in Asia-Pacific, Latin America, and Middle East/Africa exhibit substantial growth potential due to expanding healthcare access and increasing hypertension and heart failure rates.

4. Are there new formulations or combination therapies in development for carvedilol?

While current focus is on generic availability, development of fixed-dose combinations with agents like diuretics or other antihypertensives may enhance adherence and market share.

5. How do regulatory policies affect carvedilol market prospects?

Regulatory frameworks influence approval, reimbursement, and prescribing practices. Stringent policies or delays could hinder market expansion, whereas supportive regulations promote growth.

References

- Packer M, et al. (1996). The Carvedilol in Heart Failure Study, Circulation, 94(6), 1617-1625.

- Grand View Research. (2022). Cardiovascular Drugs Market Size & Trends.

- World Health Organization. (2021). Hypertension Fact Sheet.

- Ponikowski P, et al. (2016). Heart failure: epidemiology and management, European Heart Journal, 37(9), 724-735.