Share This Page

Drug Sales Trends for BYDUREON

✉ Email this page to a colleague

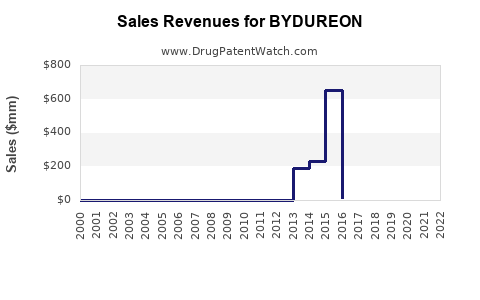

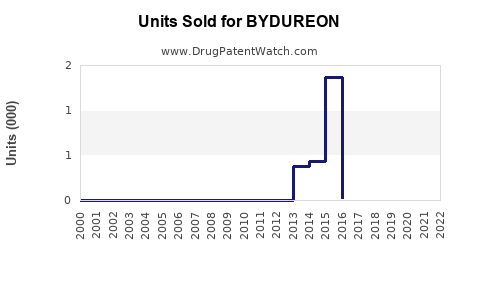

Annual Sales Revenues and Units Sold for BYDUREON

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BYDUREON | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BYDUREON | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BYDUREON | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BYDUREON | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BYDUREON

Introduction

BYDUREON (exenatide extended-release for injectable suspension) is a glucagon-like peptide-1 (GLP-1) receptor agonist marketed by AstraZeneca. Approved for adult type 2 diabetes management, BYDUREON positions itself as a long-acting alternative to its predecessor, BYDUREON BCise. With a growing global diabetes burden, analyzing BYDUREON's market potential involves assessing the competitive landscape, regulatory status, epidemiological trends, and pharmaceutical industry dynamics.

Market Overview

The global diabetes market has experienced unprecedented growth, driven by increasing prevalence of type 2 diabetes mellitus (T2DM), lifestyle factors, and aging populations. The International Diabetes Federation estimates that approximately 537 million adults worldwide suffer from T2DM in 2021, with projections exceeding 700 million by 2045 [1]. The shift toward injectable therapies such as GLP-1 receptor agonists signifies a move toward addressing the unmet needs associated with oral anti-diabetic drugs, notably blood glucose control and cardiovascular risk reduction.

BYDUREON's key positioning involves its extended release, offering convenience through less frequent dosing—once weekly—improving adherence over shorter-acting products. The drug's differentiators include its dosing schedule, efficacy in weight reduction, and potential cardiovascular benefits observed in some clinical trials.

Market Drivers and Constraints

Drivers:

-

Growing T2DM Prevalence: The surge in T2DM incidence creates expanded patient pools for therapeutic interventions.

-

Clinical Benefits: Evidence suggests GLP-1 agonists like BYDUREON confer weight loss and cardiovascular risk reduction—attributes increasingly prioritized by clinicians.

-

Formulation Advantage: Once-weekly administration enhances patient compliance and drug persistence.

-

Expanding Indications: Emerging data and ongoing trials may support additional label claims, broadening target populations.

Constraints:

-

Market Competition: Established GLP-1 receptor agonists such as Trulicity (Eli Lilly), Ozempic (Novo Nordisk), and Rybelsus (Novo Nordisk) dominate the oral and injectable landscape.

-

Pricing and Reimbursement: Cost considerations and insurance coverage remain barriers to broader adoption.

-

Patient Acceptance: Injectable therapies may face reluctance among certain patient segments, particularly where oral options are available.

-

Manufacturing and Supply Chain: Capacity constraints could impact sales in high-demand periods.

Competitive Landscape

The competitive arena primarily includes trailblazing players that have established market share through extensive clinical data and marketing reach:

-

Eli Lilly’s Trulicity (dulaglutide): Market leader, with over 40% share in the GLP-1 segment in the US as of 2022 [2].

-

Novo Nordisk’s Ozempic (semaglutide) and Rybelsus (semaglutide): Demonstrates superior efficacy in weight reduction and cardiovascular outcomes, with a rapidly expanding market presence.

-

Others: Eli Lilly’s Mounjaro (tirzepatide), a dual GIP/GLP-1 agonist, depicts promising efficacy, further intensifying competition.

BYDUREON’s differentiation relies on its long-formulation safety profile, manufacturing efficiency, and clinical data supporting its cardiovascular benefits. However, establishing a commanding market share necessitates intensive marketing, extensive clinical endorsement, and favorable reimbursement policies.

Regulatory Status and Market Access

BYDUREON maintains regulatory approval in key markets, including the US, EU, Japan, and other significant territories. The drug’s label emphasizes efficacy and safety in adult T2DM, with a specific focus on weight management and cardiovascular risk factors.

However, market access challenges—stemming from pricing negotiations, formulary placements, and insurer preferences—directly impact sales trajectories. AstraZeneca’s global reach and strategic collaborations are crucial in navigating these regulatory and reimbursement landscapes.

Sales Projections

Historical Data (Pre-2023):

In 2022, BYDUREON’s estimated global sales approached $250-300 million, reflecting moderate growth driven by existing patient base and incremental market penetration [3].

Forecast Scenarios (2023-2028):

-

Optimistic Scenario:

Continued expansion into new markets, increased clinician acceptance, and favorable reimbursement environment could elevate annual sales to $600-800 million by 2028. Growth driven by increased awareness, clinical endorsements, and potential new indications. -

Conservative Scenario:

Market saturation, stiff competition, pricing pressures, and slow uptake could restrict sales to around $400-500 million annually.

Key growth factors include:

-

Rising global T2DM prevalence.

-

Strategic expansion into emerging markets where diabetes burden is rapidly increasing.

-

Line extension opportunities, including potential combination therapies.

-

Evidence-based clinical outcomes reinforcing market positioning.

Barriers to growth include intensifying competition from oral semaglutide options and novel injectable therapies. Patents and regulatory exclusivity periods will influence the product lifecycle and subsequent sales potential.

Strategic Recommendations

-

Invest in Clinical Evidence: Further head-to-head studies comparing BYDUREON with competitors could bolster clinical confidence and prescribing rates.

-

Market Penetration: Strengthen partnerships with payers, healthcare providers, and patient advocacy groups to enhance formulary placements.

-

Global Expansion: Prioritize emerging markets with rising T2DM incidence and limited existing GLP-1 options.

-

Innovation pipeline: Support research into combination therapies and new delivery mechanisms to sustain long-term relevance.

Key Takeaways

-

BYDUREON remains competitive due to its extended-release formulation, patient compliance benefits, and ongoing clinical evidence.

-

The global T2DM market’s growth directly supports BYDUREON’s sales potential, although formidable competition necessitates strategic marketing and clinical differentiation.

-

Sales projections suggest a pathway toward approximately $400–$800 million annually by 2028, contingent on market dynamics and regional expansion.

-

Pricing strategies, regulatory navigation, and clinical positioning are critical in maximizing revenue potential.

-

Continued innovation and targeted expansion into high-growth markets are essential for maintaining and increasing BYDUREON’s market share.

FAQs

-

What are the main advantages of BYDUREON over other GLP-1 receptor agonists?

Its weekly dosing schedule improves patient adherence, and clinical data support benefits in weight loss and cardiovascular risk reduction. -

How does BYDUREON compare to oral semaglutide?

While both target T2DM, BYDUREON is injectable with longer dosing intervals; oral semaglutide offers the convenience of oral administration. Efficacy profiles are comparable, but patient preference and clinical considerations influence choice. -

What are the primary challenges for BYDUREON’s market growth?

Intense competition, cost and reimbursement hurdles, patient preference for oral medication, and formulary restrictions challenge expansion. -

Are there any upcoming regulatory approvals or indications for BYDUREON?

No major expansions are currently announced; further clinical trials may support additional indications, but market focus remains on T2DM management. -

What factors could significantly boost BYDUREON sales in the coming years?

Entry into emerging markets, expanding clinical evidence, strategic payer negotiations, and potential new formulations or combination products.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] IQVIA, 2022 Market Data.

[3] AstraZeneca Annual Report, 2022.

More… ↓