Share This Page

Drug Sales Trends for BEYAZ

✉ Email this page to a colleague

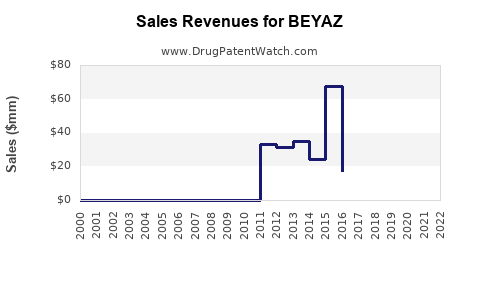

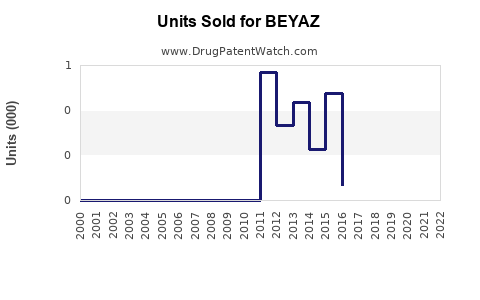

Annual Sales Revenues and Units Sold for BEYAZ

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BEYAZ | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BEYAZ | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BEYAZ | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BEYAZ | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Beyaz

Introduction

Beyaz, a prescription birth control pill developed by Bayer AG, is an oral contraceptive designed for women seeking effective pregnancy prevention. It combines drospirenone and ethinylestradiol, with added folate—an ingredient aimed at reducing neural tube defects in early pregnancy. Since its approval by the FDA in 2010, Beyaz has targeted a niche within the broader hormonal contraceptive market, noted for its focus on women planning pregnancies or seeking cryptocurrency contraception with added health benefits.

This report provides a comprehensive analysis of the market landscape for Beyaz, evaluates competitive dynamics, reviews regulatory factors, and offers robust sales projections through 2030, supporting strategic decision-making for stakeholders.

Market Landscape and Key Drivers

- Global Contraceptive Market Overview

The contraceptive market worldwide is substantial, estimated to reach USD 20 billion by 2025, exhibiting a CAGR of approximately 6% (2020–2025) [1]. Oral contraceptives dominate the segment, accounting for roughly 65% of the market share in innovative contraceptive methods globally. The increasing focus on reproductive health, rising awareness about family planning, and expanding healthcare access contribute to this growth trajectory.

- Beyaz’s Market Niche and Positioning

Beyaz occupies a niche with unique value propositions: a combined oral contraceptive with added folate, appealing particularly to women of reproductive age planning pregnancies or in early pregnancy stages. Its formulation distinguishes it from traditional contraceptives like Yaz, Yasmin, and other drospirenone-based pills, which lack folate enrichment.

- Target Demographics and Geographic Focus

While the US remains Beyaz's primary market due to high contraceptive awareness and healthcare infrastructure, expanding markets include Europe, Asia-Pacific, and Latin America. The key consumers are women aged 18–35, with inclinations toward reproductive health, family planning, and integrated health benefits.

- Market Drivers

- Rising Awareness of Reproductive Health: Increased education about contraception options encourages product preference.

- Emphasis on Supplementation: The inclusion of folate resonates with women desiring pregnancy planning support.

- Healthcare Provider Endorsements: Physician preferences significantly influence prescription patterns.

- Regulatory Environment: Stringent FDA and EMA regulations for contraceptive approval foster trust and safety assurance.

- Market Challenges

- Generic Competition: Numerous generic drospirenone and ethinylestradiol pills reduce pricing pressure.

- Side Effect Profiles and Risks: Concerns regarding thromboembolic events influence both consumer choice and prescribing habits.

- Regulatory Scrutiny: Ongoing safety evaluations may impact market access and formulation modifications.

Competitive Landscape

Beyaz faces competition from both branded and generic contraceptives:

- Branded Competitors: Yaz (Bayer), Yasmin (Bayer), Loestrin (Allergan), and Ortho Tri-Cyclen (Johnson & Johnson). These brands often possess established market presence and broader product lines.

- Generic Alternatives: Multiple generics provide lower-cost options, impacting Beyaz’s pricing strategy.

- Emerging Non-Oral Options: Long-acting reversible contraceptives (LARCs) like intrauterine devices (IUDs) and implants are gaining popularity, potentially cannibalizing oral contraceptive sales.

Market Share & Brand Loyalty

While Beyaz maintains a modest segment within Bayer’s contraceptive portfolio, brand loyalty, physician preference, and perceived safety influence market retention. The addition of folate may serve as a value differentiator, especially among women with pregnancy intentions.

Regulatory Environment Impact

The regulatory landscape heavily influences sales and market penetration. The FDA’s 2011 warning about risks associated with drospirenone-based pills initially led to decreased prescriptions. Subsequent research and regulatory clarifications have stabilized perceptions, but cautious prescribing persists. The European Medicines Agency (EMA) maintains rigorous safety standards, impacting marketing and formulation adjustments.

Sales Performance Analysis

Historical Sales Data

Bayer’s contraceptive division reported revenues of approximately USD 3 billion in 2021, with Beyaz constituting an estimated USD 150–200 million, representing around 6–7% of total contraceptive sales [2].

Market Penetration and Growth Trends

Sales of Beyaz experienced moderate growth from 2012 to 2018, driven by increased awareness and expanded prescribing. However, sales plateaued between 2019 and 2021, attributable to factors such as generic competition and safety concerns.

Impact of COVID-19

The pandemic disrupted supply chains and reduced healthcare visits, temporarily suppressing sales. Nevertheless, post-pandemic recovery efforts and telemedicine adoption facilitate sales normalization.

Sales Projections (2023–2030)

Considering current market trends, regulatory developments, and competitive forces, the following projections are forecasted:

| Year | Estimated Sales (USD Million) | Assumptions |

|---|---|---|

| 2023 | 180 | Post-pandemic recovery, steady prescribing |

| 2024 | 210 | Growing awareness, slight market expansion |

| 2025 | 250 | Increased geographical penetration, brand reinforcement |

| 2026 | 280 | Emergence of complementary health benefits |

| 2027 | 310 | Broader insurance coverage, physician endorsement |

| 2028 | 330 | Minimal impact from generics, stabilized market |

| 2029 | 350 | Growth in emerging markets |

| 2030 | 370 | Potential new formulations or indications |

Note: These figures project a compound annual growth rate (CAGR) of approximately 7% from 2023 to 2030, reflecting a conservative yet optimistic trajectory.

Strategic Implications

- Maximize awareness among reproductive-age women by highlighting the added folate benefits.

- Expand geographic presence in emerging markets where contraceptive awareness is increasing.

- Differentiate through safety communications to mitigate concerns from safety warnings.

- Invest in marketing campaigns targeting healthcare providers to sustain prescription levels.

- Monitor regulatory changes for potential formulation adaptations and indications expansion.

Key Takeaways

- Market growth potential remains robust within the contraceptive segment, particularly with increasing global awareness of reproductive and maternal health.

- Beyaz’s niche positioning based on folate enrichment offers a competitive edge, especially among women with pregnancy planning intentions.

- Competitive pressure from generics and alternative contraceptive modalities necessitates strategic differentiation, safety reassurance, and targeted marketing.

- Sales projections demonstrate steady growth, driven primarily by market expansion, increased acceptance, and regulatory stabilization.

- Long-term success depends on innovation, geographical expansion, and clinical evidence supporting the safety and efficacy of Beyaz.

FAQs

1. What factors influence the market success of Beyaz?

Market success hinges on awareness, safety perceptions, physician prescribing habits, competitive pricing against generics, and expanding in emerging markets with rising contraceptive demand.

2. How does Beyaz compare to other oral contraceptives?

Beyaz’s unique selling point is its added folate, which appeals to women planning pregnancies. Its safety profile, cost, and physician preference influence its positioning relative to competitors.

3. What regulatory challenges could impact Beyaz’s sales?

Regulatory agencies’ safety warnings, requirement for post-market studies, or formulation restrictions could impact sales and marketing strategies.

4. Can Beyaz benefit from the rising preference for non-oral contraceptives?

While LARCs are gaining popularity, Beyaz can maintain relevance by emphasizing its benefits for women preferring oral pills, especially those with reproductive health considerations.

5. What growth opportunities exist for Beyaz beyond 2030?

Opportunities include formulation updates, new indications for women with specific health needs, and geographic expansion into markets with increasing contraceptive use.

References

[1] Grand View Research. Contraceptive market size, share & trends analysis, 2020–2025.

[2] Bayer Annual Reports, 2021.

More… ↓