Share This Page

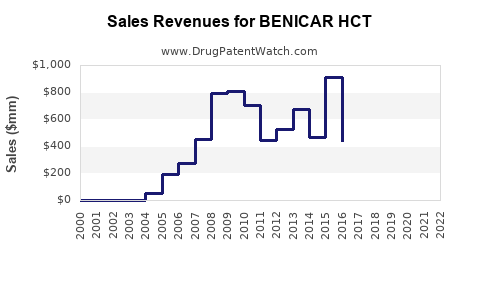

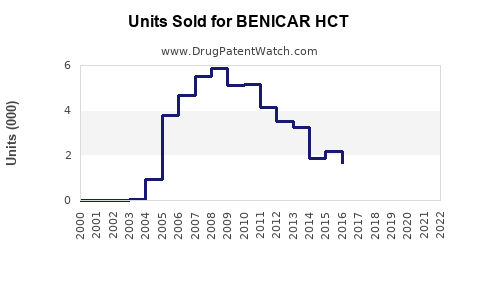

Drug Sales Trends for BENICAR HCT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BENICAR HCT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BENICAR HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BENICAR HCT

Introduction

BENICAR HCT, a combination antihypertensive medication comprising olmesartan medoxomil and hydrochlorothiazide, targets hypertension management by leveraging angiotensin II receptor blockade and diuretic therapy. The drug holds a pivotal position in the global antihypertensive market due to its efficacy, safety profile, and favorable positioning in combination therapy. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and projects future sales trajectories for BENICAR HCT.

Market Overview

Global Hypertension Treatment Market

The antihypertensive drugs market is a significant segment within the broader cardiovascular therapeutics domain. The global market was valued at approximately USD 30 billion in 2020 and is projected to reach USD 45 billion by 2027, with a compound annual growth rate (CAGR) of 5.4% [1]. Factors fueling this growth include increasing hypertension prevalence, aging populations, rising awareness, and advancements in drug formulations.

Prevalence and Demographics

Hypertension affects over 1.3 billion individuals worldwide, with projections indicating continued rise due to urbanization, sedentary lifestyles, and health disparities [2]. The elderly demographic (aged 60+) accounts for a considerable share, given their higher risk profile, thus amplifying demand for effective combination therapies like BENICAR HCT.

Treatment Patterns and Guideline Recommendations

Modern hypertension management favors combination therapies for achieving target blood pressure levels efficiently. Fixed-dose combinations (FDCs), including olmesartan and hydrochlorothiazide, enhance adherence, reduce pill burden, and often improve clinical outcomes. Agencies such as the American College of Cardiology (ACC) and American Heart Association (AHA) endorse such multi-drug regimens as first-line or early therapy options [3].

Competitive Landscape

Key Players and Product Portfolio

The antihypertensive market features several players manufacturing ARB (Angiotensin Receptor Blocker) and thiazide diuretic combinations, including:

- AstraZeneca (Benicar HCT)

- Novartis (Diovan HCT)

- Boehringer Ingelheim (Micardis HCT)

- Eli Lilly (C * particular to specific markets)

AstraZeneca’s BENICAR HCT, launched in multiple markets since its approval, maintains a strong position owing to its efficacy and tolerability. Its patent coverage, marketing strategies, and distribution channels are critical for market penetration.

Patent and Regulatory Environment

BENICAR HCT benefits from patent protections expiring in select regions, opening opportunities for generic competition post-expiry, which could impact sales. Regulatory approvals from agencies such as the FDA, EMA, and other national bodies influence market access and reimbursement dynamics.

Market Penetration and Prescriber Preferences

Prescribers favor combination agents to optimize therapy adherence and reduce adverse effects. The drug's positioning is reinforced by clinical trial data demonstrating blood pressure reduction and favorable safety profile.

Market Dynamics and Growth Drivers

Epidemiological Trends

The rising prevalence of hypertension remains the dominant driver. Increased screening initiatives and awareness campaigns further expand diagnosed populations eligible for pharmacotherapy.

Product Differentiation and Patient Compliance

BENICAR HCT’s tolerability, once-daily dosing, and fixed-dose formulation improve patient compliance, translating into better persistence and adherence—factors positively influencing sales growth.

Expanding Therapeutic Indications

While primarily used for hypertension, emerging evidence supports its use in heart failure and renal protection, potentially expanding the market scope.

Reimbursement and Healthcare Policies

Increased coverage and reimbursement rates, especially in developed economies, facilitate patient access, propelling sales.

Sales Projections

Short-Term Outlook (Next 3 Years)

Assuming stable regulatory conditions, incremental growth is anticipated due to ongoing sales in established markets like North America and Europe. A compounded annual growth rate (CAGR) of approximately 4-6% is projected, driven by increasing hypertension prevalence and improved adherence.

Medium to Long-Term Outlook (3-10 Years)

Post-patent expiry, the entry of generic formulations is expected to exert downward pricing pressure, potentially capping sales growth unless new formulations or indications emerge. However, steady growth may continue through market expansion in Asia-Pacific, Latin America, and African regions, where hypertension awareness and healthcare infrastructure are improving. Overall, cumulative sales could approach USD 1.2–1.5 billion globally by 2030, factoring in the incremental volume gains outweighing price erosion.

Impact of Market Entrants and Biosimilars

The entrance of biosimilars or generic equivalents will likely lead to significant price reductions and increased market penetration, especially in cost-sensitive regions.

Challenges and Risks

- Patent Cliffs: Patent expiration leads to generic competition.

- Pricing Pressures: Price erosion due to biosimilars/generics.

- Regulatory Barriers: Variability across regions may delay launches.

- Market Saturation: In mature markets, incremental sales might plateau.

- Reimbursement Policies: Shifts in healthcare budgets may influence prescribing patterns.

Strategic Implications

To sustain growth, AstraZeneca and other stakeholders should invest in:

- Developing extended-release formulations.

- Strengthening clinical evidence for broader indications.

- Expanding into emerging markets with targeted pricing strategies.

- Enhancing patient education and adherence programs.

Key Takeaways

- The global antihypertensive market offers robust growth opportunities for BENICAR HCT, driven by increasing hypertension prevalence and preference for combination therapies.

- Competitive pressure from generics post-patent expiry necessitates diversification into new indications and formulations to sustain revenue streams.

- Expanding coverage in emerging markets, coupled with strategic partnerships, can significantly boost sales.

- Monitoring regulatory shifts and reimbursement policies remains critical for guiding market entry and expansion strategies.

- Continuous innovation and evidence generation will uphold BENICAR HCT’s positioning amid evolving market dynamics.

FAQs

Q1: How does BENICAR HCT compare to other antihypertensive combination therapies?

A: BENICAR HCT offers a well-established efficacy profile, favorable tolerability, and once-daily dosing, aligning with current clinical guidelines emphasizing adherence. Its combination of olmesartan and hydrochlorothiazide is comparable or superior to other ARB-thiazide FDCs regarding blood pressure reduction and side effect profile.

Q2: What factors influence the future sales of BENICAR HCT?

A: Patent expiration and subsequent generics entry, expanding hypertension prevalence, healthcare policy changes, and regional market growth are primary factors affecting sales. Product innovation and expanded indications can offset generic competition.

Q3: Which regions present the most significant growth opportunities for BENICAR HCT?

A: Emerging markets in Asia-Pacific, Latin America, and Africa offer expanding patient populations with increasing healthcare infrastructure investments. Developed markets benefit from aging populations and higher hypertension awareness.

Q4: How will generic competition impact BENICAR HCT sales?

A: Generics significantly reduce drug prices and increase accessibility, leading to volume-driven sales but potentially diminishing revenue per unit. Maintaining market share may require differentiation strategies or line extensions.

Q5: Are there new formulations or indications that could enhance BENICAR HCT’s market?

A: Development of sustained-release formulations, combination with novel agents, or evidence for additional cardiovascular protections can expand its therapeutic profile, fostering growth amidst generic competition.

References

[1] MarketsandMarkets. Hypertension Drugs Market Forecast, 2020-2027.

[2] World Health Organization. Hypertension Fact Sheet. 2021.

[3] American College of Cardiology. Hypertension Guidelines. 2017.

More… ↓