Last updated: July 29, 2025

Introduction

AZURETTE, a novel oral contraceptive with distinctive pharmacokinetic properties, has garnered substantial interest within the pharmaceutical industry due to its promising efficacy and safety profile. As an innovative contraceptive option, AZURETTE’s market potential hinges on detailed analysis of current trends, competitive landscape, regulatory environment, and evolving healthcare demands. This report provides a comprehensive market assessment and sales forecast to guide strategic planning and investment decisions.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market experienced steady growth, valued at approximately USD 18 billion in 2022, with an expected compound annual growth rate (CAGR) of 6-8% over the next five years [1]. Drivers include rising awareness of family planning, urbanization, and increasing female workforce participation internationally. The demand for oral contraceptives remains dominant, accounting for roughly 50% of global contraceptive sales, due to ease of use and reversibility.

Target Market Segments

AZURETTE primarily targets women aged 15-45 seeking safe, effective, and convenient birth control methods. Its appeal extends across multiple demographics, including:

- Reproductive-age women seeking oral contraception.

- Women with specific health considerations prioritizing minimal side effects.

- Healthcare providers emphasizing improved compliance and patient acceptability.

Further, increasing adoption in emerging markets, driven by expanding healthcare infrastructure, presents additional growth avenues.

Regulatory and Competitive Landscape

Regulatory Status

As of Q1 2023, AZURETTE has secured regulatory approval in North America and select European countries. Regulatory pathways in Asia and Latin America are underway, with final approvals anticipated within 12-18 months. Clearance in these regions is critical for capturing a substantial share of the global market.

Competitive Positioning

AZURETTE faces competition from established oral contraceptives such as Ortho-Cept, Yasmin, and Alesse, which collectively hold a significant market share. Its distinctive features—such as a novel hormone combination, reduced side effects, and simplified dosing—aim to differentiate AZURETTE from legacy products. Its positioning as a premium product may allow for higher pricing strategies but requires education campaigns to foster prescribing habits.

Market Penetration and Adoption Factors

Success hinges on strategic physician outreach, patient awareness, and third-party reimbursement policies. The current audience is characterized by:

- Physician preference for well-established products, necessitating robust clinical evidence and branding efforts for AZURETTE.

- Patient familiarity with existing oral contraceptives, highlighting the need for education on AZURETTE’s advantages.

- Insurance coverage and reimbursement policies, impacting accessibility.

Sales Projections

Assumptions and Methodology

Forecasts are based on the following assumptions:

- Approval timelines as per current regulatory milestones.

- Market penetration rates starting at 2% in Year 1, gradually increasing to 10-15% over five years.

- Pricing strategy positioning AZURETTE at a premium price point (~20-30% higher than generic counterparts).

- Healthcare provider adoption rates, influenced by clinical trial data and marketing efforts.

- Emerging markets becoming accessible from Year 3 onward due to delayed approvals.

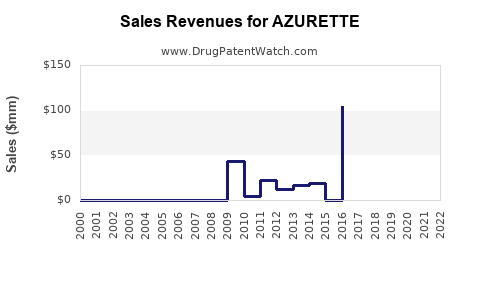

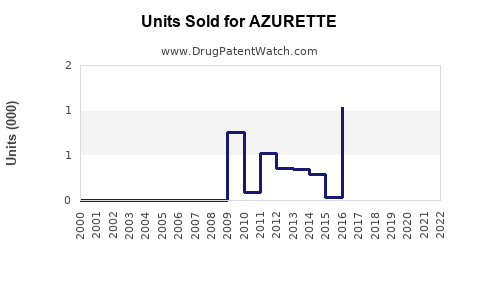

Yearly Sales Forecast (North America and Europe)

| Year |

Estimated Units Sold |

Average Selling Price (USD) |

Revenue (USD billion) |

| 2023 |

1 million |

$150 |

$0.15 |

| 2024 |

3 million |

$155 |

$0.465 |

| 2025 |

6 million |

$160 |

$0.96 |

| 2026 |

10 million |

$165 |

$1.65 |

| 2027 |

15 million |

$170 |

$2.55 |

Note: These figures reflect initial ramp-up, with steady growth projected based on market acceptance and expanding access.

Emerging Markets and Global Expansion

Starting Year 3, with approvals in Asia-Pacific and Latin America, sales are expected to grow significantly, adding approximately 5-8 million units annually by Year 5, with projected revenues upwards of USD 2-3 billion globally.

Key Opportunities and Risks

Opportunities:

- Increased demand for innovative contraceptive options tailored for specific health considerations.

- Potential for extended product line extensions or combination therapies.

- Partnerships with healthcare providers and digital health platforms to enhance distribution.

Risks:

- Competition intensification from established brands and generics.

- Regulatory delays or rejections affecting market entry.

- Market resistance rooted in conservative prescribing practices and patient preferences.

- Pricing pressures and reimbursement limitations.

Conclusions and Strategic Recommendations

AZURETTE’s promising profile positions it favorably within a growing contraceptive market. To maximize sales potential:

- Prioritize regulatory approvals in high-growth regions.

- Deploy targeted educational campaigns to clinicians and patients highlighting its benefits.

- Establish collaborations with insurers to facilitate reimbursement.

- Continue post-marketing surveillance to fortify safety reputation and clinical credibility.

Key Takeaways

- The global contraceptive market offers a substantial, expanding opportunity for AZURETTE, with projections reaching USD 2-3 billion in revenue within five years post-launch.

- Early adoption depends on timely regulatory approvals, competitive differentiation, and effective stakeholder engagement.

- Pricing at a premium aligns with AZURETTE’s innovative positioning but necessitates strong evidence and marketing to justify value.

- Market entry strategies should emphasize education, insurance negotiations, and strategic partnerships to accelerate growth.

- Expansion into emerging markets promises significant upside, contingent on tailored regulatory and reimbursement strategies.

FAQs

1. When is AZURETTE expected to launch in major markets?

Current regulatory timelines suggest North American and European launches in late 2023 to early 2024, with Asian and Latin American markets following within 12-18 months post-approval.

2. How does AZURETTE differentiate from existing oral contraceptives?

AZURETTE offers a novel hormone combination with a reduced side-effect profile, simplified dosing schedule, and greater tolerability, positioning it as a premium, patient-centric option.

3. What is the estimated market share for AZURETTE in its first five years?

Starting at approximately 2% in Year 1, capturing up to 10-15% in mature markets by Year 5, depending on clinical acceptance and competitive landscape.

4. How sensitive are sales projections to regulatory delays?

Delays could defer market entry by 6-12 months, impacting sales ramp-up and revenue trajectories proportionally, emphasizing the need for strategic contingency planning.

5. What are the primary barriers to AZURETTE’s market penetration?

Physician familiarity with current standards, patient preference inertia, reimbursement policies, and competitive brand loyalty remain key hurdles.

References

[1] Grand View Research. Contraceptive Market Size, Share & Trends Analysis. 2022.