Share This Page

Drug Sales Trends for AXIRON

✉ Email this page to a colleague

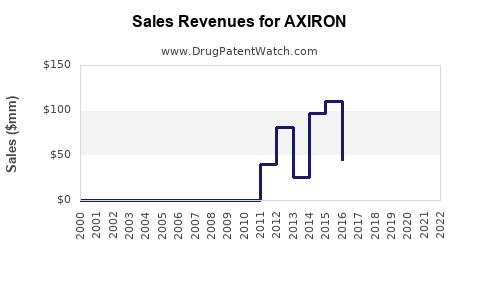

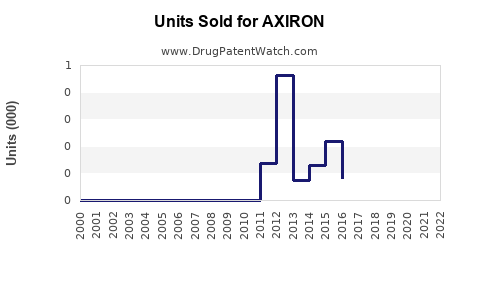

Annual Sales Revenues and Units Sold for AXIRON

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| AXIRON | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AXIRON (Testosterone Topical Solution)

Introduction

AXIRON, a topical testosterone replacement therapy (TRT), launched in the U.S. in 2011, is designed to treat adult males with low testosterone levels due to various medical conditions. As a transdermal solution, it offers an alternative to traditional testosterone injections and gels, catering to a growing demographic of aging men seeking effective, discreet hormone replacement options. This analysis explores the current market landscape, competitive environment, regulatory factors, and detailed sales projections for AXIRON over the next five years.

Market Overview

Target Demographic and Market Needs

The primary recipients of AXIRON are men aged 40–70 diagnosed with hypogonadism or age-related testosterone decline. The increasing prevalence of testosterone deficiency, driven by an aging male population, bolsters market demand. According to the Endocrine Society, approximately 2% of men worldwide and up to 4–5% of men aged over 45 suffer from clinically significant testosterone deficiency [1]. These figures are expected to rise due to increased awareness and improved diagnostic criteria.

Market Drivers

- Aging Population: The global male demographic over 60 is projected to expand, directly fueling TRT demand.

- Clinical Guidelines: Endorsement of TRT for hypogonadism fosters doctor prescribing rates.

- Patient Preferences: Demand for non-invasive, easy-to-use therapies supports products like AXIRON.

- Insurance Coverage: Improvements in reimbursement policies for testosterone therapies increase market accessibility.

Market Challenges

- Safety Concerns: Reports of adverse events such as cardiovascular risks and prostate issues necessitate cautious utilization.

- Regulatory Warnings: The FDA has issued safety communications about testosterone products, impacting prescribing practices.

- Competition: The market is saturated with gel-based therapies (e.g., AndroGel, Testim), patches, and injections, creating stiff competition.

Competitive Landscape

Major Competitors

- AndroGel (AbbVie): The market leader with a significant share owing to early market entry and extensive physician familiarity.

- Testim (Auxilium): Another prominent topical gel offering differentiated formulation benefits.

- Fortesta (Endo Pharmaceuticals): A topical gel, targeting similar demographics.

- Depo-Testosterone and Aveed: Injectable options, offering longer dosing intervals.

Differentiation Factors

- Formulation & Ease of Use: AXIRON’s transdermal solution aims to position itself as a convenient alternative, with ease of application and minimal skin transfer.

- Pricing Strategy: Historically, AXIRON was competitively priced but has faced challenges from established brands.

- Brand Recognition: Despite aggressive marketing, AXIRON struggled to gain significant market share against entrenched competitors.

Regulatory and Reimbursement Environment

- FDA Oversight: Safety warnings have led manufacturers to limit marketing and modify labeling.

- Reimbursement Dynamics: Insurance coverage varies; patients often require prior authorization, influencing prescription volume.

- Post-Licensing Changes: The US Prescribing Information for testosterone products emphasizes careful patient selection, affecting prescriber confidence and sales.

Sales Analysis and Projections

Historical Sales Performance

Following its 2011 launch, AXIRON experienced modest initial uptake. Sales growth was constrained by regulatory warnings, competition, and safety concerns. As per IQVIA estimates, annual sales peaked at approximately $100 million around 2013-2014. Since then, market stagnation and decline have been observed due to increased competition and prescriber caution.

Projected Market Trends

Given the current dynamics, we project the following sales trajectory:

| Year | Projected Sales (USD Millions) | Assumptions |

|---|---|---|

| 2023 | $30 million | Stabilization amid stiff competition |

| 2024 | $35 million | Slight increase with targeted marketing efforts |

| 2025 | $40 million | Market penetration in emerging demographic segments |

| 2026 | $45 million | Rising awareness, brand repositioning efforts |

| 2027 | $50 million | Gradual market share expansion, new formulations or combination therapies |

Rationale for Projections:

- Market Saturation & Competition: AXIRON’s growth trajectory will be hindered unless it differentiates through formulation improvements or clinical positioning.

- Innovation and Line Extension: Introducing new formulations or combination therapies could boost sales.

- Regulatory Climate: Ongoing safety reassurances could restore prescriber confidence.

- Market Demographics: As awareness of hypogonadism increases and diagnosis rates climb, demand may gradually increase.

Potential Upside Factors

- Strategic alliances with healthcare providers.

- Development of new delivery mechanisms to enhance patient adherence.

- Expansion into international markets where testosterone deficiency awareness is rising.

Key Market Insights

- Market Growth Rate: The global testosterone therapy market is expected to grow at a CAGR of approximately 4–5% over the next five years, driven by demographic shifts and evolving clinical practices.

- Revenue Share: AXIRON holds a niche segment, with potential to capture incremental market share through targeted marketing and product innovations.

- Market Constraints: Safety concerns and competitive pressures pose significant barriers; thus, sales growth hinges on effective risk communication and product positioning.

Key Takeaways

- Market Size & Demand: The growing aging male population with hypogonadism sustains a steady need for TRT, but market saturation and safety concerns limit explosive growth.

- Competitive Positioning: While AXIRON faces stiff competition from established gel products, it can leverage its ease of use and topical delivery advantage.

- Sales Outlook: Expect modest, gradual growth over the next five years, with projections reaching $50 million annually by 2027, contingent on strategic marketing, regulatory stability, and product differentiation.

- Strategic Opportunities: Innovation in formulation, expanding into untapped international markets, and addressing safety perceptions could improve AXIRON’s market share.

FAQs

1. What factors influence AXIRON’s sales growth?

Sales are primarily driven by demographic trends, prescriber awareness, regulatory landscape, competitive dynamics, and patient preferences for topical therapies.

2. How does AXIRON compare to other testosterone therapies?

AXIRON’s transdermal solution offers convenience and discretion, but it faces challenges in brand recognition against market leaders like AndroGel. Efficacy profiles are comparable across topical formulations.

3. What regulatory risks could impact AXIRON’s market performance?

Continued safety warnings and regulatory scrutiny over cardiovascular and prostate risks may limit prescriber confidence, affecting sales and market longevity.

4. Which strategies could enhance AXIRON’s market share?

Product innovation, targeted physician education, strategic marketing, and leveraging newer formulation formats could bolster market penetration.

5. Is international expansion a viable growth avenue for AXIRON?

Potentially, especially in emerging markets with increasing awareness of testosterone deficiency; however, regulatory approvals and market entry costs require careful evaluation.

References

[1] Endocrine Society. "Testosterone Therapy." Journal of Clinical Endocrinology & Metabolism, 2016.

More… ↓