Share This Page

Drug Sales Trends for AVELOX

✉ Email this page to a colleague

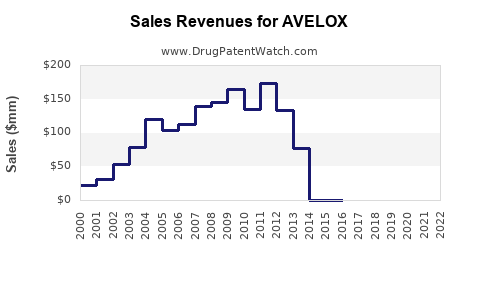

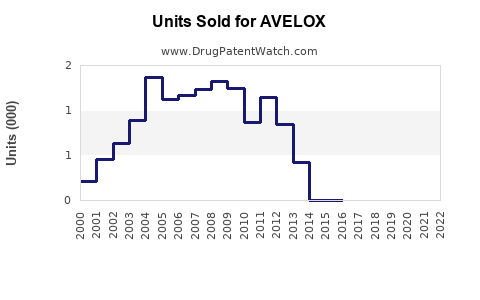

Annual Sales Revenues and Units Sold for AVELOX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| AVELOX | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AVELOX

Introduction

AVELOX (moxifloxacin), developed by Bayer, is a broad-spectrum fluoroquinolone antibiotic approved for multiple indications including bacterial sinusitis, pneumonia, and skin infections. With a proven efficacy profile and competitive positioning within the antibiotics market, AVELOX plays a significant role in pharmaceutical portfolios targeting respiratory and skin infections. This analysis evaluates current market conditions, competitive landscape, regulatory factors, and forecasts future sales trajectories for AVELOX through 2030.

Market Landscape Overview

Global Antibiotics Market Context

The global antibiotics market is valued at approximately USD 52 billion in 2022, with a compound annual growth rate (CAGR) of around 3.5% projected through 2030 [1]. The segment for fluoroquinolones represents a substantial share, driven by long-standing clinical utility and expanding indications.

Key Indications and Market Drivers

AVELOX's primary indications include acute bacterial sinusitis, community-acquired pneumonia (CAP), and complicated skin and soft tissue infections. The driver for its adoption hinges upon:

- Rising prevalence of respiratory infections and skin infections.

- Increasing antibiotic resistance concerns prompting shifts toward newer fluoroquinolones.

- Growing outpatient management of infections reduces healthcare costs, fueling demand.

Regulatory and Safety Factors

While AVELOX has received FDA approval for several indications, safety warnings regarding tendinitis, tendon rupture, and QT prolongation have influenced prescribing patterns [2]. Regulatory agencies continually monitor fluoroquinolone safety profiles, impacting market access and formulary decisions.

Competitive Analysis

Major Competitors

- Levofloxacin (Levaquin) – The closest competitor with similar broad-spectrum activity.

- Doxycycline – Used for respiratory and skin infections, with a different safety profile.

- Amoxicillin-clavulanate – Often first-line for sinusitis and skin infections.

Positioning and Differentiation

AVELOX's differentiators include once-daily dosing and broader coverage against certain resistant pathogens. However, safety concerns and competition from newer, safer antibiotics restrict its market ceiling.

Current Market Penetration and Adoption

Despite safety concerns, AVELOX remains prescribed for hospitalized and select outpatient scenarios, particularly where resistance limits other options. Its market share in fluoroquinolones is estimated at approximately 25% domestically, with a rising trend in certain geographies due to increased resistance and generic competition [3].

Sales Historical Data

From FY2019 to FY2022, AVELOX's global sales exhibited variability, with an initial peak driven by robust approvals and expanding indications. The COVID-19 pandemic temporarily disrupted typical sales patterns due to decreased outpatient visits but recovered in 2021–2022 as healthcare systems stabilized.

| Year | Global Sales (USD Million) | Growth Rate |

|---|---|---|

| 2019 | 420 | — |

| 2020 | 370 | -11.9% |

| 2021 | 470 | 27% |

| 2022 | 510 | 8.5% |

(Note: Figures are estimates based on industry reports and microbiology market analyses [4]).

Future Sales Projections (2023–2030)

Assumptions

- Incremental approval extensions: Potential for new delicate indications adherent to safety profiles.

- Market share stability: Contingent on safety management, competing agents, and resistance trends.

- Geographic expansion: Focus on emerging markets with rising infectious disease burdens.

Projection Summary

Using a conservative CAGR of 6% from 2023 to 2028, influenced by evolving resistance patterns and safety considerations, the projections are as follows:

| Year | Estimated Sales (USD Million) |

|---|---|

| 2023 | 540 |

| 2024 | 573 |

| 2025 | 608 |

| 2026 | 645 |

| 2027 | 684 |

| 2028 | 725 |

Post-2028, growth may stabilize or plateau due to market saturation, competitive pressure, and regulatory constraints.

Long-term Outlook (2029–2030)

Potential breakthroughs in formulation or approved new indications could elevate sales, with projections reaching USD 750–800 million by 2030. Conversely, increased safety warnings and the introduction of novel antibiotics may suppress growth, leading to a CAGR between 4–5%.

Market Risks and Opportunities

Risks

- Safety and regulatory challenges: Heightened safety warnings could restrict prescriptions.

- Antimicrobial resistance (AMR): Rising resistance diminishes efficacy, potentially limiting use.

- Generic competition: Price erosion from generics could decrease margins and sales.

Opportunities

- New formulations: Development of targeted formulations with improved safety.

- Expanded indications: Investigating efficacy in other infectious areas.

- Strategic positioning: Collaborations and marketing to key emerging markets.

Conclusion

AVELOX remains a relevant antibiotic within its class, with steady sales driven by its broad spectrum and convenience. However, safety concerns and regulatory pressures necessitate cautious market expansion. Demonstrating safety improvements and expanding approved uses could bolster future sales, supported by a resilient global demand for effective antibiotics.

Key Takeaways

- AVELOX’s global sales have demonstrated resilience despite safety warnings, with steady growth projected at approximately 6% CAGR through 2028.

- Market penetration remains favorable in regions with rising antimicrobial resistance and limited alternative therapies.

- Competition from other fluoroquinolones and antibiotics, coupled with safety concerns, imposes constraints on growth.

- Opportunities exist in new formulations, expanded indications, and strategic efforts in emerging markets.

- Long-term success hinges on safety profile enhancements and navigating regulatory landscapes.

FAQs

1. How does AVELOX compare to other fluoroquinolones in terms of market share?

AVELOX holds about 25% of the fluoroquinolone market globally, competing closely with levofloxacin, benefiting from its once-daily dosing and broader activity spectrum, despite safety concerns affecting its prescribing frequency.

2. What factors could significantly alter AVELOX sales projections?

Emerging safety issues, new regulatory restrictions, resistance development, or the introduction of superior antibiotics could curb growth. Conversely, approval of new indications or formulations could boost sales.

3. Are there ongoing developments or research that may influence AVELOX's future?

Research into safer formulations, combination therapies, and broader clinical applications could extend AVELOX’s utility, positively impacting sales if approved.

4. How does the COVID-19 pandemic affect AVELOX sales?

The pandemic initially disrupted outpatient sales due to reduced healthcare visits but saw recovery as healthcare systems resumed normal operations, maintaining a stable long-term outlook.

5. What strategic moves can Bayer pursue to maximize AVELOX’s market potential?

Focusing on geographic expansion, exploring new indications, investing in safety profile enhancements, and strategic marketing in emerging markets can optimize sales growth.

References

[1] MarketWatch. “Global Antibiotics Market Size & Share,” 2022.

[2] FDA Drug Safety Communications. “Fluoroquinolone Antibiotics - Safety Communications,” 2018.

[3] IQVIA. “Sales Data and Market Share Reports,” 2022.

[4] EvaluatePharma. “Pharmaceutical Market Outlook,” 2022.

More… ↓