Last updated: July 27, 2025

Introduction

Atorvastatin, marketed under the brand name Lipitor among others, is a widely prescribed statin used to lower cholesterol levels and reduce cardiovascular risk. As one of the most prescribed lipid-lowering agents globally, its market dynamics are shaped by evolving healthcare policies, patent expirations, and the rise of generic alternatives. This analysis provides a comprehensive overview of the current market landscape, competitive environment, regulatory factors, and projections for atorvastatin sales over the next five years.

Market Overview

Global Market Size and Growth Trends

The global statin market, valued at approximately USD 13 billion in 2022, is projected to grow at a CAGR of approximately 3-4% through 2028 [1]. Atorvastatin constitutes roughly 35-40% of the total statin market share, owing to its widespread efficacy, extensive clinical data, and brand recognition. Its key markets include North America, Europe, Asia-Pacific, and Latin America.

A significant driver of growth remains the increasing prevalence of hyperlipidemia and cardiovascular diseases (CVD). According to the World Health Organization, CVD accounts for 17.9 million deaths annually, with hyperlipidemia being a primary risk factor [2]. The rising burden in emerging markets, driven by lifestyle changes and urbanization, expands the potential customer base.

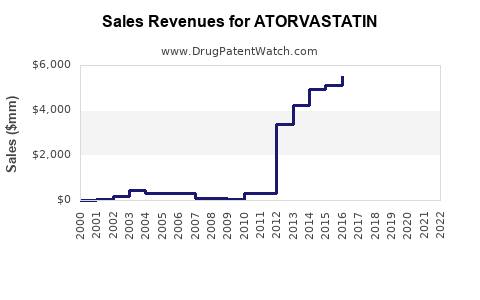

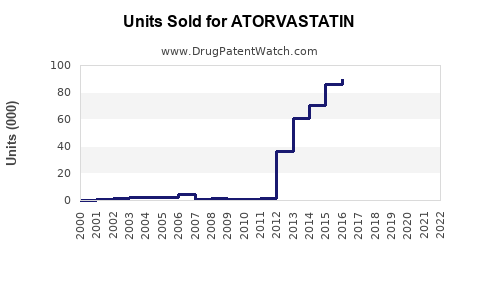

Patent Landscape and Generic Competition

Lipitor's patent expired in 2011 in most markets, triggering a surge in generic atorvastatin formulations. Generic entries have reduced retail prices by up to 60-80%, maintaining affordability but exerting pressure on branded sales. Despite this, some branded formulations with improved formulations or fixed-dose combinations retain market share through brand loyalty.

Generic penetration varies regionally, with North America witnessing extensive generic adoption, while certain Asian markets still favor branded options due to regulatory and distribution factors.

Competitive Environment

Major Players

While Pfizer originally developed Lipitor, the post-patent landscape is characterized by multiple generic manufacturers. Top generic producers include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz, among others. Branded competitors like Rosuvastatin (Crestor) and simvastatin offer alternative lipid-lowering options, maintaining competitive pressure.

Innovations and Formulation Trends

The market is witnessing incremental innovations such as fixed-dose combinations (e.g., atorvastatin with amlodipine), which enhance adherence and therapeutic outcomes. Additionally, efforts to develop more potent or tolerable statins continue, though atorvastatin remains a staple due to robust clinical data.

Regulatory and Reimbursement Dynamics

Regulatory Approval and Monitoring

Regulatory agencies such as the US FDA, EMA, and others continuously review safety profiles, leading to periodic label updates. While no major regulatory threats currently threaten atorvastatin, evolving guidelines emphasizing statin therapy thresholds influence prescribing patterns.

Reimbursement Policies

Reimbursement levels significantly impact sales. Countries with universal healthcare or favorable formularies promote broader access to generic atorvastatin, whereas disparities in coverage can limit market expansion.

Sales Projections (2023-2028)

Baseline Scenario

In the current environment, the global atorvastatin market is expected to grow modestly. The following projections assume sustained demand, ongoing patent expiries, and increasing prevalence of CVD.

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

Key Drivers |

| 2023 |

5.2 |

2.5% |

Continued generic penetration, expanding indications, rising CVD burden |

| 2024 |

5.4 |

3.8% |

Growth in emerging markets, new fixed-dose combinations |

| 2025 |

5.7 |

4.2% |

Greater formulary inclusion, technological improvements |

| 2026 |

6.0 |

4.5% |

Market saturation in mature regions, increased healthcare access |

| 2027 |

6.3 |

4.8% |

Aging populations, increased awareness |

| 2028 |

6.6 |

4.5% |

Continued market expansion, generic competition stabilizes |

Note: These projections incorporate macroeconomic factors, epidemiological trends, and competitive dynamics.

Growth by Region

- North America: Continued growth driven by advanced screening and treatment guidelines.

- Europe: Steady demand, with some contraction due to generic competition but offset by increasing prevalence.

- Asia-Pacific: Rapid expansion, driven by aging populations and increasing healthcare infrastructure.

- Latin America: Moderate growth, contingent on healthcare reforms and access expansion.

Market Opportunities and Challenges

Opportunities include:

- Expansion into emerging markets with rising cardiovascular risk profiles.

- Development and promotion of fixed-dose combination therapies.

- Adoption of digital health tools to improve patient adherence and monitoring.

Challenges encompass:

- Sustained price erosion due to generic competition.

- Evolving clinical guidelines favoring personalized or alternative therapies.

- Potential safety concerns and regulatory restrictions affecting prescribing practices.

Key Drivers and Risks

| Drivers |

Risks |

| Rising prevalence of CVD globally |

Market saturation and price pressure from generics |

| Developing markets with expanding healthcare access |

Regulatory changes impacting formulary inclusion |

| Innovation in fixed-dose combinations |

Emergence of new lipid-lowering agents (PCSK9 inhibitors, inclisiran) |

| Increasing awareness and screening programs |

Patent litigations or regulatory hurdles |

Conclusion

The atorvastatin market remains a substantial segment within lipid-lowering therapies, with steady growth expected through 2028. While generic competition constrains premium pricing, volume growth driven by global disease burden, emerging markets, and formulary strategies sustains revenue streams. Strategic investments in formulations, combination therapies, and digital adherence solutions will be crucial to capitalize on market opportunities.

Key Takeaways

- The global atorvastatin market is projected to grow at approximately 4% annually through 2028, driven by rising CVD prevalence and expanding healthcare access.

- Generic formulations dominate sales but present ongoing price erosion challenges; branded versions retain market share through formulation improvements.

- Emerging markets represent significant growth opportunities, with increasing government and private sector investments.

- Innovations such as fixed-dose combinations and digital adherence solutions will be vital to maintaining therapeutic relevance.

- Competitive pressures include alternative therapies, new lipid-lowering agents, and regulatory policies influencing prescribing and reimbursement.

FAQs

1. How has patent expiration affected atorvastatin sales?

Patent expiration in 2011 led to a surge in generic atorvastatin availability, significantly reducing prices and impacting branded sales. Despite this, the overall volume of prescriptions remained high due to the drug’s proven efficacy and safety profile.

2. What are the main factors influencing atorvastatin sales growth?

Key factors include rising global CVD prevalence, expanding access in emerging markets, patent expiries fostering generic competition, and technological innovations such as fixed-dose combinations.

3. How does generic competition influence pricing and profitability?

Intense generic competition drives prices down, compressing profit margins for manufacturers of branded formulations. However, high prescription volumes can offset margins, ensuring sustained revenues.

4. What emerging trends could impact the future market?

Development of combination therapies, digital health adherence tools, and novel lipid-lowering agents like PCSK9 inhibitors are potential disruptors. Regulatory updates emphasizing personalized medicine may also influence market structure.

5. What strategic steps should pharmaceutical companies consider?

Investments in formulation innovation, expanding into underserved markets, and emphasizing patient engagement technologies can secure competitive advantage amid evolving pricing and regulatory landscapes.

References

[1] GlobalData. (2022). Statin Market Size and Forecasts.

[2] World Health Organization. (2021). Cardiovascular Diseases Statistics.