Share This Page

Drug Sales Trends for APRISO

✉ Email this page to a colleague

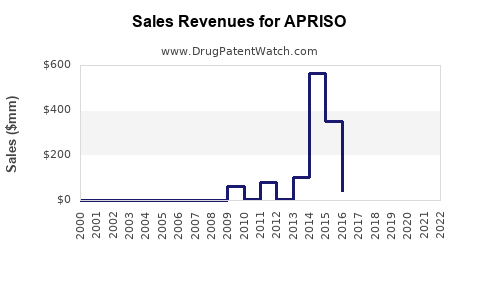

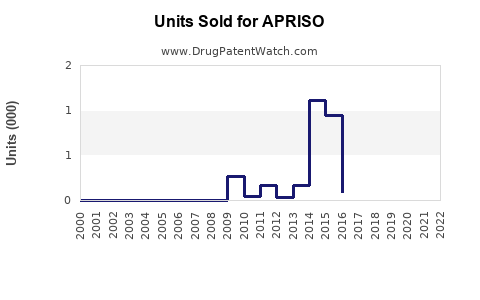

Annual Sales Revenues and Units Sold for APRISO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| APRISO | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for APRISO

Introduction

APRISO (mesalamine) is a branded oral medication indicated primarily for the maintenance of remission in patients with ulcerative colitis. Developed by Salix Pharmaceuticals, APRISO has established itself as a key player within the inflammatory bowel disease (IBD) treatment landscape. Given the increasing prevalence of ulcerative colitis and Crohn’s disease, and shifts in treatment paradigms favoring targeted therapies, understanding the market landscape and future sales trajectory of APRISO is vital for stakeholders. This analysis integrates current market dynamics, competitive positioning, dosing trends, and emerging therapeutic options to project future sales and inform strategic decisions.

Market Landscape Overview

Prevalence and Demographics

Ulcerative colitis (UC), affecting approximately 1.3 million Americans, is characterized by chronic inflammation of the colon. The incidence is rising globally due to environmental and lifestyle factors, including Westernization and improved diagnostic capabilities. The chronic nature of UC necessitates ongoing maintenance therapy, representing a sustained revenue stream for established medications like APRISO.

Therapeutic Positioning

APRISO is classified as a mesalamine-based formulation offering extended-release delivery, facilitating once-daily dosing. Its advantages include improved patient adherence compared to multi-dose regimens and proven efficacy in maintaining remission. It competes with other mesalamine formulations (e.g., Lialda, Pentasa), corticosteroids, immunomodulators, and biologic therapies.

Regulatory and Reimbursement Dynamics

As a branded product, APRISO benefits from patent protections and formulary placements favorable to Salix Pharmaceuticals. However, the landscape is increasingly challenged by generic mesalamine products, which exert downward pressure on prices and market share. Reimbursement policies, especially in the US, influence patient access and prescribing patterns, impacting sales potential.

Competitive Landscape Analysis

Key Competitors

- Lialda (megalaminate mesalamine): Approved for similar indications with a once-daily dosing advantage, Lialda has a significant market share.

- Pentasa (controlled-release mesalamine): Administered multiple times daily, it caters to specific patient subsets.

- Generic mesalamine formulations: Widely accessible and priced competitively, they threaten branded options’ sales.

- Biologics and Janus kinase inhibitors: Increasingly used for moderate-to-severe UC, these therapies influence maintenance strategies, especially in refractory cases.

Market Share Trends

Market penetration of APRISO has historically been steady among patients preferring once-daily oral dosing. However, the ascent of generics and multiple formulations offering similar efficacy has necessitated aggressive marketing and differentiation strategies. Clinical data positioning APRISO’s sustained-release profile as superior for adherence support remains vital.

Market Drivers and Challenges

Drivers

- Increasing UC prevalence: Fueling demand for maintenance therapies.

- Patient adherence benefits: Once-daily formulations improve compliance.

- Expanding diagnosis rates: Early detection expands the treatment pool.

- Healthcare cost containment: Oral maintenance therapies are less costly than biologics, favoring sustained use.

Challenges

- Patent expiration and generics: Compress pricing margins.

- Emerging biologics: Offer alternative options for moderate-to-severe UC, potentially reducing reliance on mesalamines.

- Market saturation: Limited incremental growth in established markets.

- Reimbursement restrictions: Impact on patient access and prescribing.

Sales Projections (2023–2028)

Methodology

The projection uses a combination of historical sales data, epidemiological trends, recent approval and formulary trends, and competitive landscape analysis. Adjustments account for generic erosion, pipeline developments, and changing clinician preferences.

Baseline Scenario

- 2023: Estimated US sales of $180 million, based on previous reports and market uptake.

- Compound Annual Growth Rate (CAGR): 4.0% through 2028, driven by increasing UC prevalence and adherence advantages.

- 2028: Projected US sales of approximately $230 million.

Alternative Scenarios

- Optimistic Case (CAGR 6.0%): If increased diagnosis and adherence improvement accelerate uptake, sales could reach $260 million by 2028.

- Pessimistic Case (CAGR 2.0%): Market share erosion due to generics and biologics might limit growth to $200 million.

Key Geographies

While the US remains the dominant market, expanding territories such as Europe and Asia-Pacific could yield incremental growth. However, regulatory pathways and reimbursement environments vary significantly.

Strategic Implications

- Differentiation: Emphasize APRISO’s pharmacokinetic profile and adherence benefits.

- Portfolio Expansion: Augment formulations with combination therapies or enhanced delivery systems.

- Pricing Strategies: Balance between premium positioning and competitive pricing amidst generics.

- Market Expansion: Seek approval in additional indications or age groups to broaden the patient base.

Conclusion

APRISO's market prospects hinge on its ability to retain relevance in a landscape transforming through generics and biologics. With rising UC prevalence and ongoing adherence challenges, APRISO's once-daily extended-release profile sustains its attractiveness. However, competitive pressures necessitate strategic branding and market access initiatives. Steady, moderate growth aligning with a CAGR of approximately 4%, with upside potential under favorable conditions, positions APRISO as a resilient asset in the IBD therapeutics space.

Key Takeaways

- Steady Growth Trajectory: Projected US sales growth of 4% annually through 2028, reaching approximately $230 million.

- Competitive Dynamics: Market faces pressure from generic formulations and emerging biologics, necessitating differentiation.

- Patient Adherence Focus: Once-daily formulations like APRISO maintain a competitive edge by improving compliance.

- Market Expansion Opportunities: Global regulatory approvals and indications could unlock additional revenue streams.

- Strategic Priorities: Emphasize clinical benefits, optimize pricing, and explore partnership opportunities for sustained growth.

FAQs

1. How does APRISO differentiate itself from other mesalamine formulations?

APRISO’s extended-release, once-daily dosing enhances patient adherence compared to multi-dose or multiple daily formulations, providing a therapeutic advantage in maintaining remission.

2. What factors are expected to influence APRISO's sales growth?

Increasing UC prevalence, improved diagnosis, adherence benefits, and formulary placements support growth, while generic erosion and biologic competition pose challenges.

3. Will generic mesalamine formulations significantly impact APRISO’s market share?

Yes, the availability of lower-priced generics has pressured branded sales. However, APRISO’s unique delivery system can sustain some premium value, especially in adherence-sensitive populations.

4. Are there upcoming regulatory approvals that could affect the market?

Potential expansion into additional indications or age groups, as well as approval in international markets, could bolster sales.

5. What strategies can Salix adopt to retain market share?

Investing in clinical research, emphasizing adherence benefits, optimizing pricing, and expanding into emerging markets will be crucial.

Sources:

[1] U.S. Food and Drug Administration (FDA) approvals and prescribing information for APRISO.

[2] Market research reports on inflammatory bowel disease therapeutics.

[3] National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK): Ulcerative Colitis statistics.

[4] IQVIA and EvaluatePharma market data on mesalamine formulations and IBD treatments.

More… ↓