Last updated: July 27, 2025

Introduction

Amoxicillin combined with clavulanic acid (often known as Amox/K Clav) is a widely prescribed broad-spectrum antibiotic. Its efficacy against a range of bacterial infections makes it a cornerstone in antimicrobial therapy. As antibiotic resistance escalates and healthcare paradigms shift, understanding the market landscape and forecasting sales trajectories are essential for pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Product Profile and Therapeutic Indications

Amox/K Clav is indicated predominantly for respiratory tract infections, skin and soft tissue infections, urinary tract infections, and odontogenic infections. Its broad-spectrum activity against penicillin-resistant bacteria underpins its clinical utility ([1]).

Market Penetration and Usage Trends

Globally, Amox/K Clav remains a top-selling antibiotic, transcending geographies from North America to Asia. Its widespread use is facilitated by:

- Over-the-counter availability in some markets.

- Inclusion in empiric antibiotic therapy guidelines.

- Established safety profile in adult and pediatric populations.

However, rising antimicrobial resistance (AMR), especially beta-lactamase producing strains, poses challenges but also sustains demand through the development of new formulations and combination therapies ([2]).

Competitive Landscape

The competitive landscape is characterized by:

- Brand-name formulations: Augmentin (by GlaxoSmithKline), among others.

- Generic versions: Numerous manufacturers have entered this segment, intensifying price competition.

- Formulation innovations: Extended-release, chewables, and pediatric formulations are expanding market segments.

The dominance of key brands varies geographically, with emerging markets exhibiting higher generic penetration and developed markets favoring branded formulations for perceived quality assurance.

Market Drivers

- Rising Incidence of Bacterial Infections: Increasing prevalence of respiratory and skin infections globally sustains consistent demand.

- Growing Pediatric Population: The pediatric segment maintains high consumption due to common infections and safety profile.

- Expanding Healthcare Access: Improved healthcare infrastructure elevates prescription rates.

- Antibiotic Stewardship and Prescribing Practices: Optimized use based on guidelines enhances market potential, though overuse and AMR threaten long-term growth.

Market Challenges

- Antimicrobial Resistance (AMR): Resistance emergence, particularly beta-lactamase enzymes, reduces effective coverage, prompting the development of newer combinations.

- Regulatory Scrutiny: Governmental policies aimed at curbing antibiotic overuse impact sales.

- Generic Market Saturation: Price competition limits margins.

- Public Awareness: Campaigns on antibiotic misuse hamper overprescription.

Regional Market Dynamics

North America: Mature market with high-brand loyalty, stringent regulations, and focus on stewardship programs. Sales primarily driven by outpatient settings.

Europe: Similar to North America; strong generic presence and evolving stewardship policies.

Asia-Pacific: Rapidly growing markets driven by increased healthcare infrastructure, infectious disease burden, and OTC availability. Untapped potential but regulatory challenges remain.

Latin America & Africa: Growing demand driven by infectious disease prevalence; access remains variable.

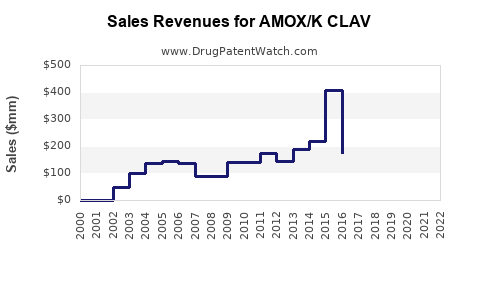

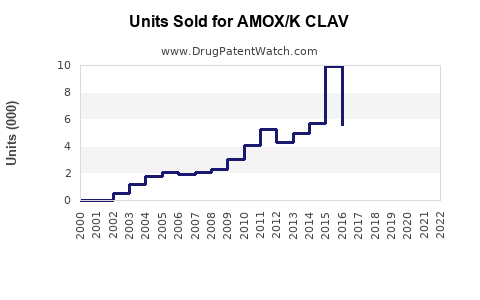

Sales Projections (2023-2030)

Using available market data and growth models, the following projections are feasible:

-

Compound Annual Growth Rate (CAGR): Estimated at 3-5% globally over the forecast period, with variations based on region.

-

2023 Market Value: Estimated at $1.8 billion-$2.2 billion, reflecting widespread use in developed markets and emerging economies.

-

Market Growth Factors:

- Increased adoption due to rising bacterial infection rates.

- Expansion of formulations tailored for pediatric and outpatient use.

- Market expansion in emerging economies.

-

Impact of Resistance Trends:

- In resistant regions, the use of Amox/K Clav may decline unless combined with newer agents or formulations.

- Growth may shift toward combination therapies or formulations addressing resistance.

-

Forecasts:

- North America & Europe: Steady but moderate growth, potentially plateauing due to saturation.

- Asia-Pacific & Latin America: Higher growth rates, 6-8%, driven by expanding healthcare access.

- Total global sales could reach $3 billion by 2030, assuming steady growth and market penetration.

Regulatory and Market Access Trends

Organizations focusing on antimicrobial stewardship and regulatory agencies advocating for rational antibiotic use may influence future sales. Reimbursement policies and formulary preferences are pivotal, particularly in cost-sensitive geographies.

Market Opportunities

- New Formulations: Developing extended-release, pediatric-specific, or combination formulations to address resistance.

- Biomarker-Guided Therapy: Precision prescribing could optimize sales by aligning usage with pathogen susceptibility.

- Partnerships and Licensing: Collaborations with generic manufacturers can enhance market reach.

Market Risks

- AMR and Prescribing Restrictions: Rising resistance and regulatory interventions may curtail growth.

- Price Erosion: Due to proliferation of generics.

- Alternative Therapies: Emerging antibiotics or non-antibiotic approaches for resistant infections could supplant Amox/K Clav.

Key Takeaways

- Stable Market Demand: Amox/K Clav maintains consistent relevance for bacterial infections globally.

- Growth Driven by Emerging Markets: High growth potential in Asia-Pacific, Latin America, and Africa.

- Competitive Pricing and Formulation Innovation crucial—especially amid generic proliferation.

- Antimicrobial Resistance: A double-edged sword—necessitates innovation but also poses threat to sustained sales.

- Market Monitoring: Continuous tracking of resistance patterns, regulatory changes, and prescriber behavior is essential for accurate sales forecasting.

FAQs

1. How does antimicrobial resistance impact the sales of Amox/K Clav?

Resistance diminishes the drug’s efficacy, leading clinicians to seek alternative therapies. However, in regions with limited access to newer antibiotics, Amox/K Clav retains its place, although long-term resistance trends could reduce overall sales.

2. Are generic versions significantly affecting the market?

Yes. Generic proliferation drives down prices, compresses margins for branded products, but simultaneously ensures broader access, particularly in emerging economies, thus sustaining overall volume sales.

3. What are the prospects for Amox/K Clav in emerging markets?

They are promising due to increasing healthcare access, high infectious disease burden, and demand for cost-effective antibiotics, with projected CAGR of 6-8% through 2030.

4. How are regulatory policies shaping the future sales of Amox/K Clav?

Stricter prescription guidelines and antimicrobial stewardship programs may restrict over-the-counter sales and encourage rational use, potentially limiting volume growth but improving market stability.

5. What innovation trends could influence Amox/K Clav sales?

Development of formulations targeting resistant bacteria, improved dosing regimens, and combination therapies with novel agents are key trends likely to influence future sales dynamics.

References

[1] WHO. "Antibiotic Resistance," 2022.

[2] Antimicrobial Resistance Review, CDC, 2021.