Share This Page

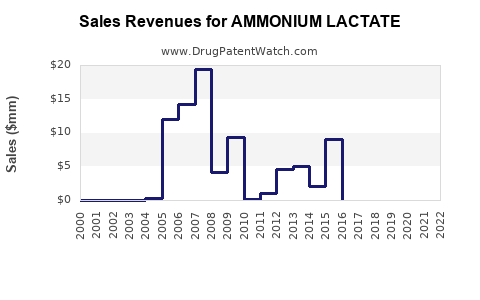

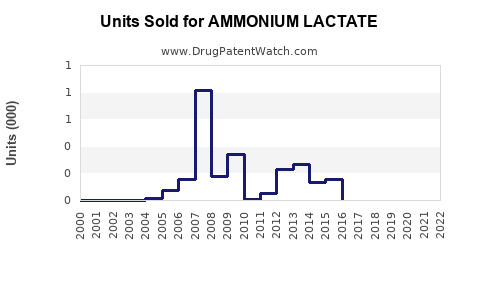

Drug Sales Trends for AMMONIUM LACTATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AMMONIUM LACTATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| AMMONIUM LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ammonium Lactate

Introduction

Ammonium lactate, a topical and systemic dermatological agent primarily utilized for managing conditions associated with dry, scaly skin, has retained a niche but steady demand within the pharmaceutical and cosmeceutical sectors. Its primary applications include treatment for xerosis, ichthyosis, and related dermatologic disorders. As a derivative of lactic acid, ammonium lactate offers keratolytic and humectant properties, making it a favored component in dermatological formulations.

The valuation of this market hinges on several critical factors, including the growing prevalence of skin conditions, expanding cosmetic awareness, and ongoing innovation in topical formulations. This analysis offers a comprehensive review of current market dynamics and projects future sales trajectories.

Market Overview

1. Market Segmentation

-

By Application:

- Dermatology (medical skin conditions)

- Cosmeceuticals (anti-aging, moisturizing products)

-

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Platforms

-

Geographical Distribution:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

2. Key Drivers

- Rising incidence of dermatological conditions, notably xerosis and ichthyosis, due to aging populations and increased skin sensitivity.

- Growing consumer preference for over-the-counter (OTC) skincare products incorporating ammonium lactate as a hydrating and exfoliating agent.

- Continuous innovation by pharmaceutical and cosmetic companies to develop enhanced formulations.

- Expansion into emerging markets driven by increasing healthcare awareness and disposable incomes.

3. Market Challenges

- Limited awareness among consumers about ammonium lactate's benefits beyond dermatology.

- Pricing pressures and competition from alternative agents such as urea and other alpha-hydroxy acids.

- Regulatory hurdles for classification and approval as a medicinal or cosmetic ingredient.

Current Market Dynamics

Demand Trends

The demand for ammonium lactate stays robust within clinical dermatology mainly in North America and Europe, where dermatological care for xerosis and ichthyosis remains a consistent patient need ([1]). The aesthetic skincare segment also drives increasing interest, particularly in the Asia-Pacific region, where rising disposable income and beauty standards bolster the consumption of moisturizing and exfoliating products.

Supply Overview

Manufacturers like BASF, Lonza, and Croda have sustained significant production capacities. Technological advances are focused on improving formulation stability and skin absorption efficacy, tailored toward both pharmaceutical-grade and cosmetic-grade applications.

Regulatory Landscape

Ammonium lactate is generally regarded as safe (GRAS) when used appropriately, with regulatory approval primarily for OTC products across jurisdictions ([2]). Regulatory harmonization efforts and evolving safety profiles are poised to facilitate broader market access.

Sales Projections (2023–2033)

Methodology

Forecasting considers historical sales patterns, current demand, demographic trends, and market expansion strategies. Compound annual growth rate (CAGR) calculations assume modest but steady increase reflecting both dermatology and cosmetic sectors, alongside pipeline innovations.

Projected Market Value

The global ammonium lactate market was valued at approximately USD 150 million in 2022 ([3]). Anticipated growth is driven by both existing dermatology needs and cosmetic applications, with a forecasted CAGR of 6.2% from 2023 to 2033.

| Year | Estimated Market Value (USD Million) |

|---|---|

| 2023 | 160 |

| 2025 | 180 |

| 2027 | 205 |

| 2029 | 235 |

| 2031 | 270 |

| 2033 | 310 |

By 2033, global sales could reach approximately USD 310 million, with Asia-Pacific expected to outpace other regions due to the rapid urbanization and increasing skin health awareness.

Regional Outlook

- North America: Maintains dominant share (~40%). Healthcare infrastructure and cosmetic market maturity bolster steady growth.

- Europe: Continues growth (~20%) driven by aging populations and high cosmetic consumption.

- Asia-Pacific: The fastest-growing regional segment (~25%), fueled by emerging markets like China and India.

- Latin America & MEA: Combined contribution (~15%) with moderate growth prospects.

Market Opportunities and Strategic Insights

- Innovation: Developing formulations that combine ammonium lactate with other active ingredients (e.g., urea, ceramides) can meet unmet consumer demands for multifaceted skin solutions.

- Regulatory Differentiation: Companies investing in clear, compliant packaging and labeling will gain a competitive advantage.

- Emerging Markets: Targeted marketing and distribution investments in Asian and Latin American markets are crucial.

- E-Commerce: Growing online channels enable direct-to-consumer sales, expanding reach for both prescription and OTC products.

Competitive Landscape

Major players invest heavily in R&D to refine their formulations and expand application ranges. Their strategies include partnerships with cosmetic brands, acquisition of regional distributors, and consumer education campaigns.

| Company | Market Focus | Notable Moves |

|---|---|---|

| BASF | Pharmaceutical & cosmetic | Launch of stabilized formulations |

| Croda | Cosmetic Actives | Expanding production capacity |

| Lonza | Specialty chemicals | Innovation in skin hydration compounds |

Regulatory Outlook and Impact

As global regulators refine safety standards, ammonium lactate's classification remains relatively stable. EU and FDA approvals facilitate market access, but variations in labeling and permissible concentrations influence product development. Continuous regulatory assessments could introduce new guidelines, impacting sales and formulation practices.

Key Takeaways

- Steady Growth Path: The ammonium lactate market is poised for a CAGR of approximately 6.2% through 2033, driven predominantly by dermatological and cosmetic segments.

- Regional Shifts: Asia-Pacific will lead growth, propelled by rising disposable incomes and increased skincare awareness.

- Innovation Focus: Formulation advancements blending ammonium lactate with other active ingredients will unlock new application possibilities.

- Regulatory and Consumer Education: Evolving approvals and targeted education efforts can enhance adoption and market penetration.

- Distribution Expansion: Online sales channels and emerging markets present strategic opportunities to boost sales.

Conclusion

Ammonium lactate remains a valuable compound across dermatology and cosmeceuticals, with a supportive clinical and consumer environment underpinning its future growth. Companies that adeptly innovate, navigate regulatory landscapes, and capitalize on regional market potential will secure significant market share in the coming decade.

FAQs

Q1: What are the primary dermatological conditions treatable with ammonium lactate?

A1: It is primarily used for xerosis (dry skin), ichthyosis, psoriasis, and other skin conditions characterized by excessive dryness and scaliness.

Q2: How does ammonium lactate compare with other keratolytic agents?

A2: It offers a mild exfoliating effect combined with moisturizing properties, making it suitable for sensitive skin, whereas agents like urea may have a stronger keratolytic action.

Q3: What are the main regions driving amino lactate sales?

A3: North America and Europe dominate current sales, but rapid growth is expected in Asia-Pacific, Latin America, and the Middle East.

Q4: Are there any significant regulatory hurdles for ammonium lactate products?

A4: It remains generally regarded as safe (GRAS) in cosmetic and OTC dermatological products, but formulation-specific approval processes may vary regionally.

Q5: What opportunities exist for new entrants in the ammonium lactate market?

A5: Innovating formulations, developing combination products, and expanding distribution channels, especially online, present significant opportunities.

Sources

- MarketWatch, "Dermatology and Cosmeceuticals Market Trends," 2022.

- U.S. FDA, "Regulatory Status of Ammonium Lactate," 2021.

- Zion Market Research, "Global Topical Agents Market," 2022.

More… ↓