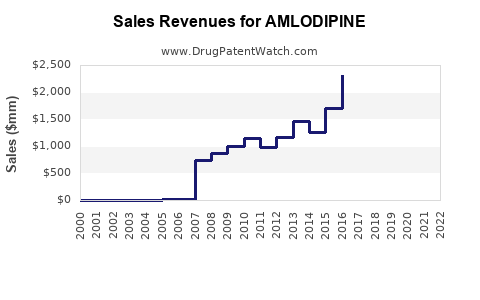

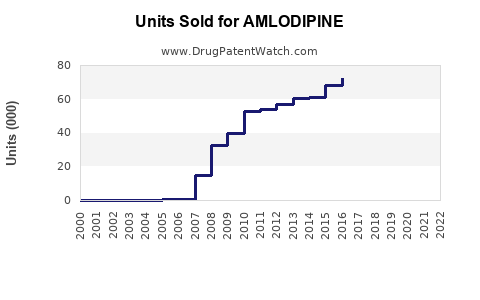

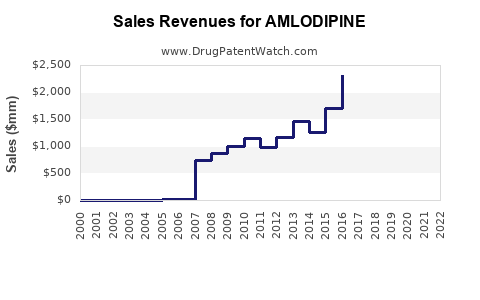

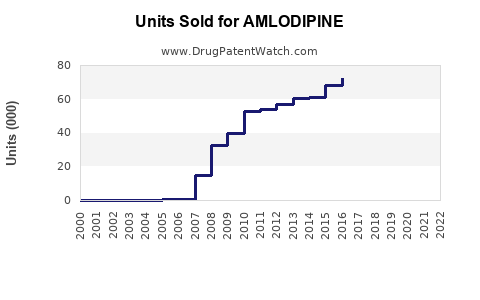

Drug Sales Trends for AMLODIPINE

✉ Email this page to a colleague

Payment Methods and Pharmacy Types for AMLODIPINE (2021)

Revenues by Pharmacy Type

Units Sold by Pharmacy Type

You're using a free limited version of DrugPatentWatch: Upgrade for Complete Access

Last Updated: December 11, 2024

✉ Email this page to a colleague

Revenues by Pharmacy Type

Units Sold by Pharmacy Type

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.