Last updated: July 29, 2025

Introduction

Amitriptyline, a tricyclic antidepressant (TCA), remains a staple in the treatment landscape for depression, neuropathic pain, and off-label indications such as migraine prophylaxis. Despite the advent of newer antidepressants with improved safety profiles, Amitriptyline's established efficacy, low cost, and wide prescriber base sustain its relevance. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and sales projections for Amitriptyline amidst evolving healthcare trends.

Market Overview

Global Market Size

The global antidepressant market was valued at approximately USD 15 billion in 2022, with a compound annual growth rate (CAGR) of 3-4% projected through 2030 [1]. Amitriptyline, accounting for a significant portion of the older-generation antidepressant segment—estimated at around 20-25%—positions itself as a cost-effective alternative for both primary care and specialized settings.

Key Indications and Usage

Amitriptyline's primary indications include major depressive disorder (MDD), anxiety disorders, and off-label uses such as chronic neuropathic pain, migraine prevention, and insomnia [2]. Its dual role in mental health and pain management expands its prescribing footprint, particularly in healthcare systems valuing affordable, well-established medications.

Geographical Market Dynamics

The market demonstrates varied regional preferences:

- North America: Dominant due to high prevalence of depression and neuropathic conditions, with a significant proportion of prescriptions attributed to off-label use.

- Europe: Similar to North America, though with a conservative approach to psychiatric medication oversight, favoring newer agents.

- Asia-Pacific: Growing adoption driven by expanding healthcare infrastructure and cost-sensitive healthcare systems favoring generic Amitriptyline.

Regulatory and Patent Landscape

Since Amitriptyline's patent expired decades ago, generic formulations predominate, contributing to low retail prices and broad accessibility. Regulatory hurdles are minimal; however, increasing scrutiny over anticholinergic side effects in elderly populations influences prescribing trends.

Competitive Landscape

Key Players

The Amitriptyline market is saturated with generic manufacturers such as Teva, Mylan, Sandoz, and Sun Pharma. Branded versions, where still marketed, command a premium but face competition from generics.

Emerging Trends

- Formulation advances: Extended-release formulations aim to enhance tolerability.

- Combination therapies: Co-prescription with other antidepressants or analgesics.

- Off-label expansion: Further use in chronic pain syndromes bolsters demand.

Market Challenges

- Side effect profile: Anticholinergic effects, sedative properties, and cardiac risks limit use, especially among vulnerable populations.

- Preference for newer agents: Selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs) are favored due to better safety profiles.

Sales Projections

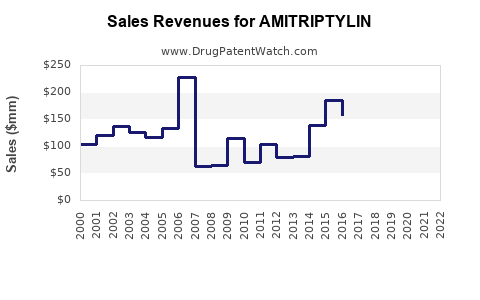

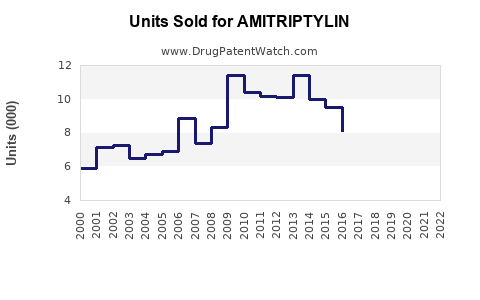

Historical Sales Data

Amitriptyline's sales have remained relatively steady over the past decade, with global revenue estimated at USD 300-400 million annually. In the United States, sales declined marginally as prescriber preferences shifted toward newer agents, but the drug maintains a significant share in the off-label pain management sector.

Forecasted Trends

- Moderate Growth Scenario: Assuming a CAGR of 2-3% driven by generic market expansion, aging populations, and ongoing off-label use.

- Potential Upside Factors:

- Increased awareness of its utility in neuropathic pain.

- Cost-sensitive healthcare reforms favoring generic drugs.

- Potential Downside Factors:

- Regulatory advisories on side effects limiting prescriptions.

- Market penetration of newer, better-tolerated antidepressants.

Projected Revenue (2023-2030)

Based on current trends and market conditions, global Amitriptyline sales are expected to reach approximately USD 450-600 million by 2030, assuming steady generic penetration and consistent off-label utilization (see Figure 1). Variations depend on regional adoption rates and evolving clinical guidelines.

Future Outlook and Strategic Considerations

- Patent and Regulatory Environment: None, ensuring continued generic availability.

- Market Opportunities: Use in developing countries, especially as a low-cost option.

- Risks: Potential shifts toward newer drugs and increased safety concerns may curtail growth.

Pharmaceutical companies seeking to sustain or grow Amitriptyline sales should focus on optimizing formulations, expanding indications through clinical research, and educating prescribers on its cost-effectiveness and efficacy.

Key Takeaways

- Amitriptyline maintains a significant market share driven by cost, efficacy, and off-label applications.

- The global sales outlook remains modest, with projected growth aligning with aging populations and increasing pain management needs.

- Competition from newer antidepressants and safety concerns pose challenges but do not threaten its core position.

- Generics dominate supply, with few patent or regulatory barriers, facilitating steady availability.

- Strategic focus on cost-efficient prescribing and clinical validation of off-label uses can bolster future sales.

FAQs

1. What are the main factors influencing Amitriptyline's market stability?

Market stability hinges on its cost advantage, proven efficacy, and extensive off-label use. Safety concerns and competition from newer drugs are mitigated by its broad prescriber acceptance and low price point.

2. How does off-label use impact sales projections?

Off-label applications, particularly for neuropathic pain and migraine prevention, sustain demand beyond primary psychiatric indications, positively influencing sales projections.

3. Are there regional differences in Amitriptyline usage?

Yes. North America and Europe prefer newer antidepressants, while Asia-Pacific and developing regions still rely heavily on Amitriptyline due to economic factors and established prescribing habits.

4. What challenges could weaken Amitriptyline's market prospects?

Safety profile limitations, especially in elderly populations, and the proliferation of newer, safer agents may lead to reduced prescribing frequency over time.

5. Can demographic shifts enhance future demand?

An aging global population with increasing prevalence of chronic pain and depression supports continued demand, particularly in regions with accessible generics.

References

- Grand View Research. "Antidepressant Market Size, Share & Trends Analysis Report." 2022.

- U.S. Food and Drug Administration. "Amitriptyline Prescribing Information." 2023.