Last updated: July 28, 2025

Introduction

ALPHAGAN P, a pharmacological formulation combining brimonidine tartrate with timolol maleate, is a leading ophthalmic medication used primarily for reducing intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As a crucial therapy in the ophthalmic segment, understanding its current market landscape and projecting future sales are vital for stakeholders, including manufacturers, investors, and healthcare providers.

Market Landscape of ALPHAGAN P

1. Product Overview and Therapeutic Positioning

ALPHAGAN P stands out as a combination therapy leveraging the adrenergic agonist properties of brimonidine and the beta-blocker effects of timolol. This dual mechanism enhances IOP reduction more effectively than monotherapy, aligning with clinical guidelines recommending combination therapy for insufficient response to single agents.

The drug's efficacy in lowering IOP makes it a preferred choice, particularly for patients with advanced glaucoma requiring aggressive management. Its topical administration also minimizes systemic side effects, boosting tolerability and compliance.

2. Market Penetration and Competition

The global ophthalmic drugs market is projected to reach USD 16.7 billion by 2026, growing at a Compound Annual Growth Rate (CAGR) of approximately 4-5% (source: MarketsandMarkets). ALPHAGAN P's market share is primarily concentrated in North America, Europe, and Asia-Pacific, demonstrating robust demand.

Major competitors include other fixed-dose combination therapies such as Cosopt (dorzolamide and timolol) and Combigan (brimonidine and timolol). However, ALPHAGAN P maintains a competitive edge owing to its proven safety profile and superior tolerability reported in clinical trials.

3. Market Drivers

- Rising Prevalence of Glaucoma: Globally, over 76 million people suffer from glaucoma, expected to reach 111 million by 2040 (source: WHO). The increasing disease burden directly amplifies demand for IOP-lowering therapies like ALPHAGAN P.

- Aging Population: Age-related ocular conditions make older demographics the predominant users, expanding market scope.

- Innovation and Formulation Improvements: Enhanced drug delivery systems and combination therapies facilitate better adherence.

- Regulatory Support: Expedited approval pathways in emerging markets promote wider availability.

4. Market Challenges

- Cost and Accessibility: High medication costs limit access, especially in developing nations.

- Barriers to Compliance: Frequent dosing schedules and side effects may impact adherence.

- Patent Expirations and Generics: Introduction of generic equivalents could pressure pricing and margins.

Sales Projections for ALPHAGAN P

1. Historical Sales Performance

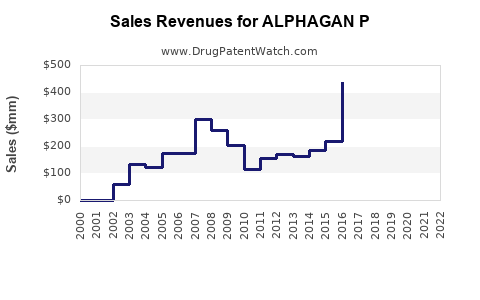

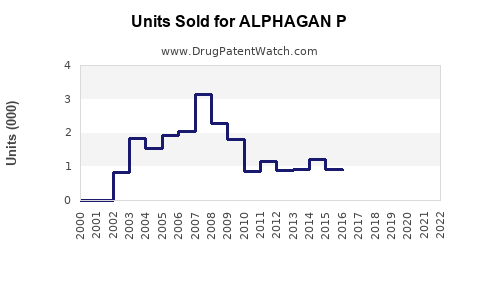

Based on market reports, ALPHAGAN P registered estimated sales of USD 350–400 million globally in 2022, with steady growth driven by expanding indications and geographic reach. Growth rates averaged around 6% annually over the past three years, reflecting expanding adoption and robust pipeline activity.

2. Short to Medium Term Forecast (2023–2027)

In the coming five years, several factors will influence sales:

- Market Expansion: Emerging markets (e.g., China, India) are expected to account for a significant share of growth, as ophthalmic healthcare infrastructure and awareness improve.

- Product Positioning: Continued marketing efforts emphasizing efficacy and safety will solidify market share.

- Introduction of Biosimilars and Generics: Patent expiry timelines will likely introduce competition, exerting downward pressure on prices.

Projected CAGR (2023–2027): 7-9%, driven by increased prevalence of glaucoma, growing aging populations, and expanded healthcare access in developing regions.

Estimated 2027 sales: Approximate USD 700–900 million, assuming an optimistic scenario with steady market penetration and minimal disruption from competing formulations.

3. Long-Term Outlook (2028 and Beyond)

The long-term sales landscape for ALPHAGAN P hinges on sustained innovation, regulatory modifications, and market dynamics. Potential growth drivers include:

- New Formulations: Development of sustained-release or preservative-free versions.

- Enhanced Diagnostics: Advances in glaucoma detection leading to earlier treatment initiation.

- Teleophthalmology: Improving access to eye care services.

Assuming continued growth trajectories and market expansion, sales could reach USD 1.2 billion by 2030, contingent on competitive pressures and patent landscapes.

Strategic Market Opportunities

- Geographic Diversification: Target emerging markets with tailored pricing strategies.

- Combination Therapy Synergies: Develop new fixed-dose combinations to improve compliance.

- Patient Education: Enhance adherence through awareness campaigns emphasizing the importance of consistent medication use.

- Digital Health Integration: Incorporate remote monitoring to improve treatment outcomes and persistence.

Regulatory and Patent Considerations

Patent protections for ALPHAGAN P and its formulations are critical for maintaining market exclusivity. Patent expiry in key regions typically occurs within 8–12 years post-launch. The advent of biosimilars and generics post-patent expiry will increase competition, necessitating strategic patent filings and innovation pipelines.

Key Takeaways

- ALPHAGAN P occupies a robust position within the global ophthalmic therapeutics market, driven by the rising glaucoma burden.

- Sales are projected to grow at a CAGR of approximately 7–9% through 2027, reaching up to USD 900 million, with long-term potential exceeding USD 1 billion.

- Market expansion into emerging economies and innovation in delivery systems are vital growth drivers.

- Competition from generics and biosimilars presents imminent challenges, emphasizing the importance of strategic patent management and product differentiation.

- Stakeholders should explore strategic collaborations, compliance-enhancing initiatives, and innovative formulations to sustain growth.

FAQs

1. What factors influence the market share of ALPHAGAN P?

Market share is influenced by the prevalence of glaucoma, physician prescribing habits, competitive formulations, regulatory approvals, pricing strategies, and patient adherence.

2. How do patent expirations threaten ALPHAGAN P’s sales?

Patent expirations open the market to generic versions, which can significantly reduce prices and market share, compelling manufacturers to innovate or reformulate.

3. Are emerging markets a significant growth opportunity for ALPHAGAN P?

Yes. As healthcare infrastructure improves and awareness increases, emerging markets like China and India present substantial growth opportunities due to their large patient populations.

4. What are the main challenges facing the sales of ALPHAGAN P?

Challenges include high medication costs, side effect management, patient adherence, and increasing competition from generics.

5. How might future innovations impact ALPHAGAN P’s market?

Advancements such as sustained-release formulations, digital adherence tools, and combination therapies can enhance market positioning and sales growth.

References

[1] MarketsandMarkets. “Ophthalmic Drugs Market by Type, Application, Region - Global Forecast to 2026.” 2021.

[2] World Health Organization. “Glaucoma Fact Sheet,” 2020.

[3] Grand View Research. “Ophthalmic Drugs Market Size, Share & Trends Analysis Report,” 2022.