Last updated: July 30, 2025

Introduction

Albuterol sulfate, a beta-2 adrenergic agonist primarily used for the relief of bronchospasm in conditions such as asthma, chronic obstructive pulmonary disease (COPD), and other respiratory illnesses, remains a cornerstone in inhaled bronchodilator therapy. As a widely prescribed medication with several formulations—including metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizer solutions—albuterol’s market dynamics are influenced by factors such as rising respiratory disease prevalence, technological advances, and regulatory changes.

The following market analysis and sales projections provide insights into current trends, key growth drivers, competitive landscape, and future opportunities within the albuterol sulfate market.

Market Overview

Global Market Size and Current Trends

The global respiratory drugs market was valued at approximately USD 36 billion in 2022, with inhaled bronchodilators like albuterol representing a significant share due to widespread use. The compound’s versatility, patent expirations, and availability in generic forms contribute to sustained market demand.

In the United States, albuterol remains the most prescribed inhaler for asthma and COPD management. The high prevalence of these respiratory conditions—affecting over 25 million Americans annually—underpins robust sales volumes[1]. Similarly, emerging markets exhibit increasing adoption owing to rising urbanization, environmental pollution, and improved healthcare access.

Regulatory Landscape

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continually review inhalers for safety and efficacy. Recent shifts towards metered-dose inhalers with lower global warming potential (GWP) propellants are prompting reformulations, which may influence market approaches[2].

Key Market Drivers

-

Rising Prevalence of Respiratory Diseases: The increasing incidence of asthma, especially in children and in urbanized regions, sustains high demand. COPD prevalence is also climbing, particularly in aging populations[3].

-

Advancements in Drug Delivery Systems: Innovations such as soft mist inhalers and breath-actuated inhalers are improving medication adherence and efficacy, encouraging continued use of albuterol formulations.

-

Generic Competition: Patent expirations have led to a surge in generic albuterol inhalers, reducing costs and expanding access, including in lower-income regions.

-

COVID-19 Pandemic Impact: The pandemic heightened awareness and medical attention to respiratory illnesses, indirectly boosting demand for bronchodilators, including albuterol.

Competitive Landscape

Major players include AstraZeneca, Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical. The market is highly commoditized given the widespread availability of generics, leading to price competition but also opportunities for differentiation through formulations and delivery mechanisms.

Emerging biosimilar companies are exploring innovative inhaler technologies, aiming to capture market share by improving usability and efficacy.

Sales Projections (2023–2028)

Methodology

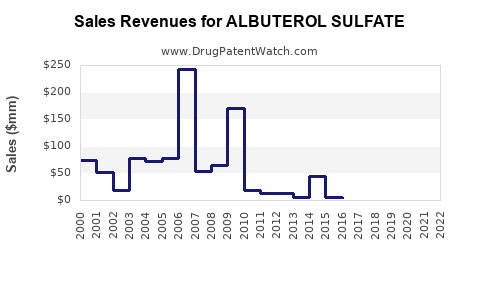

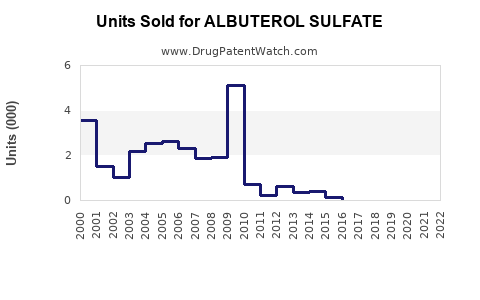

Projections are modeled based on historical sales data, prevalence rates, advancements in delivery technology, regulatory developments, and macroeconomic factors.

| Year |

Estimated Global Sales (USD Billion) |

CAGR (Compound Annual Growth Rate) |

| 2023 |

4.2 |

— |

| 2024 |

4.4 |

4.8% |

| 2025 |

4.7 |

6.8% |

| 2026 |

5.1 |

8.5% |

| 2027 |

5.6 |

9.8% |

| 2028 |

6.2 |

10.7% |

The projected CAGR of approximately 8.3% indicates healthy growth driven by global respiratory disease management needs and technological advancements.

Regional Outlook

-

North America: Dominant market maintaining around 45% of global sales, driven by high disease prevalence and healthcare expenditure.

-

Europe: Significant growth potential due to aging populations and increased awareness.

-

Asia-Pacific: Fastest growth, forecasted CAGR of approximately 12%, fueled by population size, urbanization, and expanding healthcare infrastructure.

-

Latin America and Africa: Growing markets, though sales remain constrained by affordability and healthcare access.

Opportunities and Challenges

Opportunities

-

Development of GWP-friendly inhalers: Transition to environmentally sustainable propellants could open niche markets and mandate product reformulations.

-

Combination Therapies: Combining albuterol with corticosteroids or other bronchodilators in single inhalers enhances patient compliance and varies competitive strategies.

-

Digital Health Integration: Smart inhalers with dose tracking and adherence features are poised to disrupt traditional sales channels, appealing to tech-savvy consumers and healthcare providers.

Challenges

-

Market Saturation: High penetration in mature markets limits growth; innovation becomes imperative to sustain sales.

-

Regulatory Hurdles: New formulations or delivery systems face stringent approval processes which could delay market entry.

-

Generic Price Competition: Continual proliferation of low-cost generics pressures profit margins and influences purchasing decisions, especially in price-sensitive regions.

Summary and Future Outlook

Albuterol sulfate remains a vital pharmacologic agent in respiratory therapy. Market growth hinges on demographic trends, technological development, and environmental regulatory shifts. While mature markets exhibit stable, moderate growth, emerging regions present substantial upside. Companies investing in innovation—such as eco-friendly inhalers, improved drug delivery, and digital integration—could capitalize on the projected upward trajectory.

Key Takeaways

- The global albuterol sulfate market is projected to grow at a CAGR of approximately 8.3% from 2023 to 2028, reaching USD 6.2 billion.

- Innovation in inhaler technology and environmentally sustainable formulations will be critical to differentiating products and sustaining growth.

- Demographics, urbanization, and increased respiratory disease prevalence sustain high demand, especially in Asia-Pacific.

- Regulatory changes and competitive pressures necessitate strategic focus on product development and market expansion.

- Monitoring regional trends and technological advancements offers pathways for market share optimization.

FAQs

1. What factors are driving the growth of albuterol sulfate in emerging markets?

Urbanization, increased environmental pollution, growing healthcare infrastructure, and rising awareness of respiratory diseases are expanding albuterol’s market presence in Asia-Pacific, Latin America, and Africa.

2. How are environmental regulations affecting inhaler formulations?

Stricter regulations on propellants with high GWP are prompting transition to eco-friendly alternatives, compelling companies to reformulate inhalers, which may impact production costs and regulatory timelines.

3. What role do digital health solutions play in the albuterol sulfate market?

Smart inhalers with connectivity features improve adherence and enable remote monitoring, creating new revenue streams and enhancing patient outcomes.

4. How does patent expiry influence albuterol sulfate sales?

Patent expiration facilitates the entry of cost-effective generics, increasing accessibility but intensifying price competition, which can impact profit margins.

5. What are the future prospects for biosimilar albuterol products?

Biosimilars could introduce price competition and improve access, especially in low- and middle-income countries, although regulatory pathways and acceptance may pose barriers.

References

[1] Global Initiative for Asthma (GINA), 2022 Report.

[2] Regulatory News, Environmental Impact of Inhaler Propellants, EMA, 2021.

[3] World Health Organization (WHO), Respiratory Disease Statistics, 2022.