Last updated: July 27, 2025

Introduction

Adapalene, a third-generation topical retinoid primarily used for the treatment of acne vulgaris, has established itself as a staple in dermatological therapy. Developed by Galderma, adapalene gained FDA approval in 1996 and has since been integrated into various formulations. Its unique mechanism as a selective retinoic acid receptor agonist offers advantages over earlier retinoids, including reduced irritation and improved tolerability. Given the ongoing dermatology market expansion, assessing adapalene's market trajectory and sales potential is crucial for stakeholders. This analysis synthesizes current market dynamics, competitive landscape, regulatory environment, and future growth drivers.

Market Overview

Global Dermatology Market Context

The broader dermatology market is projected to reach approximately $28 billion by 2027, driven by rising incidence of skin conditions, increased awareness, and advances in pharmacotherapy [1]. Acne vulgaris is among the most prevalent dermatological disorders, affecting approximately 85% of adolescents and young adults globally [2].

Adapalene in Acne Treatment

Adapalene's efficacy, safety profile, and OTC availability in formulations like Differin have expanded its reach. Its specificity for retinoic acid receptors and lower irritancy profile, relative to tretinoin, have made it suitable for continuous lifelong management in acne patients. The global adapalene market, particularly for topical formulations, is driven by the high prevalence of acne, the convenience of OTC sales, and favorable reimbursement policies in various regions.

Market Dynamics

Key Drivers

- High prevalence of acne vulgaris: Increasing awareness and cosmetics-driven demand bolster the adoption of adaptive therapies.

- Regulatory approvals and formulations: The availability of adapalene in various strengths, gels, creams, and OTC options enhances accessibility.

- COVID-19 pandemic effects: The pandemic accelerated teledermatology and self-medication trends, expanding OTC sales of adapalene.

- Competitive advantages over older retinoids: Improved tolerability supports compliance, especially in sensitive skin populations.

Key Challenges

- Market saturation: Many generic versions reduce profit margins.

- Limited indications: Currently restricted primarily to acne, limiting diversification opportunities.

- Emerging competitors: Novel agents such as topical antibiotics, combination therapies, and alternative acne drugs challenge market share.

- Patent expirations: Generic entries diminish exclusivity, affecting revenue streams.

Regulatory and Patent Landscape

- Patent status: As a drug discovered in the 1980s and marketed since the 1990s, adapalene's original patent is expired in many jurisdictions, leading to a proliferation of generics.

- Regulatory approvals: FDA approval for OTC and prescription formulations in the U.S., along with approvals in Europe, Asia, and emerging markets, broadens its utilization scope.

- Pipeline developments: No significant pipeline drugs directly targeting adapalene's mechanism reported; however, combination therapies are under investigation.

Sales Projections

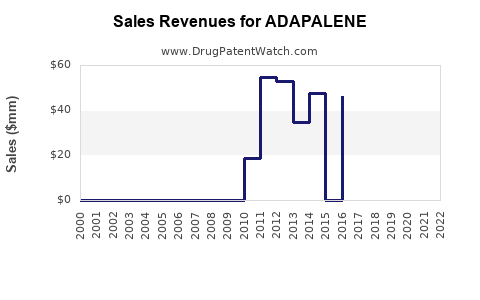

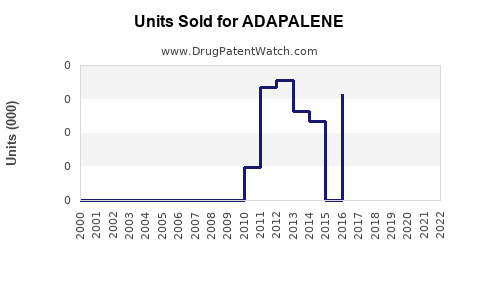

Historical Sales Data

From inception, adapalene’s sales experienced steady growth, with significant upticks following OTC availability. In 2020, global revenues were estimated at approximately $520 million, primarily driven by OTC sales in North America and Europe [3].

Forecast Methodology

Sales forecasts are based on:

- Epidemiological data for acne prevalence.

- Market penetration rates.

- Competitive landscape.

- Pricing trends.

- Regulatory environment projections.

Projected Market Growth

Between 2023 and 2028, the adapalene market is expected to grow at a CAGR of approximately 4%, reaching an estimated $680 million by 2028. Key regional contributions include:

- North America: Maintains dominant position due to high acne prevalence and OTC sales.

- Europe: Steady growth driven by increased awareness and expanded OTC access.

- Asia-Pacific: Rapid growth potential, fueled by rising skincare awareness, urbanization, and emerging middle-class consumers.

Influencing Factors

- The advent of novel formulation technologies (e.g., liposomal, foam formulations) enhances patient adherence.

- Increasing integration into combination therapies (e.g., adapalene with benzoyl peroxide) may drive incremental sales.

- Expansion into emerging markets, especially in Asia, will substantially contribute to growth projections.

Competitive Landscape

Major players include Galderma (original developer), Perrigo, Almirall, and generic pharmaceutical companies. The proliferation of generics has resulted in reduced drug prices, stimulating broad availability but constraining profit margins. Innovators investing in delivery system improvements and combination therapies could gain competitive advantages.

Future Outlook

Adapalene's market is poised for moderate growth, constrained by patent expirations but buoyed by ongoing consumer demand for effective, tolerable acne treatments. Regulatory trends favor OTC availability in key markets, further amplifying sales. Strategic focus on formulation innovation, geographic expansion, and combination therapies will be critical to maximize revenue potential.

Key Region-Specific Considerations

- United States: Robust OTC market, with mature competition and declining margins but sustained volume growth.

- Europe: Favorable regulatory environment aiding OTC access, with increasing market penetration.

- Asia-Pacific: Significant expansion opportunities due to rising dermatology awareness and affordability.

Key Takeaways

- Adapalene’s global market is expected to grow modestly, with a CAGR of approximately 4% over the next five years.

- The saturation of generic formulations will pressure prices but also expand market volume.

- Innovation in formulation and combination therapy will be essential to counteract competitive pressures.

- Expansion efforts into emerging markets and OTC channels will be vital growth drivers.

- Regulatory landscapes and patent expirations will continue to influence market dynamics.

FAQs

-

What is the primary therapeutic application of adapalene?

Adapalene is mainly used for the topical treatment of acne vulgaris due to its comedolytic and anti-inflammatory properties.

-

How does adapalene differentiate from other retinoids?

It is a third-generation retinoid with higher receptor selectivity, offering comparable efficacy with fewer side effects, particularly less irritation.

-

What factors are driving adapalene sales growth?

Rising acne prevalence, OTC product availability, formulation innovations, and expansion into emerging markets.

-

What challenges does the adapalene market face?

Increased generic competition, patent expirations, limited indications, and competition from novel acne therapies.

-

Are there new formulations or combination therapies for adapalene?

Yes, combination products such as adapalene with benzoyl peroxide and reformulated delivery systems are under development and commercialization to enhance efficacy and patient adherence.

Sources

[1] MarketWatch. Dermatology Market Size & Trends. 2022.

[2] Global Burden of Disease Study. U.S. skin disease prevalence. 2020.

[3] IQVIA. Topical Acne Treatments Sales Report. 2021.