Share This Page

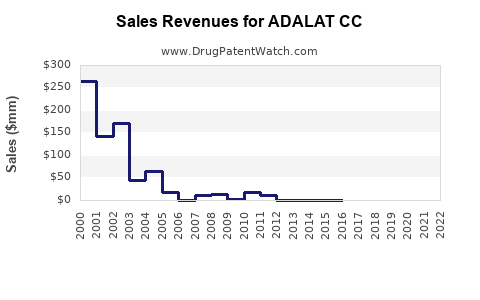

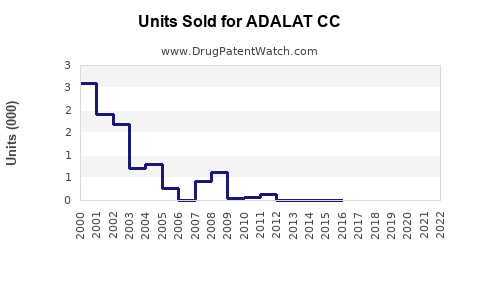

Drug Sales Trends for ADALAT CC

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ADALAT CC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ADALAT CC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ADALAT CC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ADALAT CC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ADALAT CC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ADALAT CC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ADALAT CC (Nifedipine Extended-Release)

Introduction

ADALAT CC, an extended-release formulation of nifedipine, serves primarily in the management of hypertension and angina pectoris. By providing sustained drug release, ADALAT CC enhances patient compliance and therapeutic efficacy compared to immediate-release versions. This analysis explores the current market landscape, competitive positioning, regulatory environment, and future sales projections for ADALAT CC, emphasizing its potential growth trajectory within global cardiovascular therapeutics.

Market Overview

Global Cardiovascular Disease Market

The cardiovascular disease (CVD) market remains among the largest pharmaceutical segments, valued at over USD 300 billion in 2022, driven by the escalating prevalence of hypertension and related conditions [1]. The World Health Organization (WHO) reports hypertension affects roughly 1.3 billion adults globally, with projections indicating continued rise owing to aging populations, sedentary lifestyles, and dietary patterns.

Nifedipine and Calcium Channel Blockers (CCBs)

Nifedipine, a dihydropyridine calcium channel blocker, consistently ranks among top antihypertensive agents worldwide. Its extended-release formulations, including ADALAT CC, are favored for their once-daily dosing, improved compliance, and stable plasma levels [2].

Market Drivers

- Prevalence of Hypertension: Rising global hypertension prevalence fuels demand for effective long-acting therapies.

- Patient Compliance: Extended-release formulations like ADALAT CC address adherence issues by reducing dosing frequency.

- Guideline Recommendations: International guidelines increasingly endorse CCBs as first-line therapy, especially in combination regimens.

- Emerging Markets: Rapid urbanization and increasing healthcare access expand the market footprint in Asia-Pacific, Latin America, and Africa.

Competitive Landscape

ADALAT CC faces competition from several branded and generic nifedipine formulations, including:

- Procardia XL (Pfizer)

- Nifedical XR (Sun Pharma)

- Adalat Retard (Bayer)

- Generic Nifedipine XR Brands

The proliferation of generics has intensified price competition, but brand recognition and formulary inclusions sustain the value of proprietary formulations like ADALAT CC.

Regulatory and Reimbursement Climate

Regulatory agencies globally recognize ADALAT CC's safety and efficacy, facilitating market access. Reimbursement policies prioritize cost-effective, once-daily antihypertensives, favoring branded extended-release products where clinical benefits are demonstrated.

Sales Projections

Historical Performance

While specific sales data for ADALAT CC are proprietary, industry estimates suggest that the global nifedipine extended-release segment generated approximately USD 500 million in 2022, with ADALAT CC capturing a significant share, especially in North America and Europe.

Projected Growth Factors

- Market Penetration: Increasing adoption in emerging markets.

- Combination Therapies: Growing use in fixed-dose combinations enhances sales volume.

- Aging Demographics: Older populations increase demand for long-term antihypertensive therapies.

- Regulatory Approvals: Expansion into new indications or formulations could elevate sales.

Forecast Timeline

Based on current trends and assuming steady growth, sales of ADALAT CC are projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years. The projected sales are as follows:

| Year | Estimated Global Sales (USD Million) |

|---|---|

| 2023 | 550 - 580 |

| 2024 | 585 - 620 |

| 2025 | 620 - 660 |

| 2026 | 660 - 705 |

| 2027 | 705 - 750 |

These estimates factor in market expansion, increased brand share, and ongoing demand stabilization.

Market Opportunities & Challenges

Opportunities:

- Manufacturing Partnerships: Collaborations with regional pharma companies can accelerate penetration.

- Formulation Innovations: Development of fixed-dose combinations involving nifedipine.

- Digital Health Integration: Monitoring adherence via digital tools may promote sales growth.

Challenges:

- Price Erosion: Generics' entry could reduce profit margins.

- Patent Expiry: Potential patent cliffs could intensify generic competition.

- Regulatory Barriers: Variability in approval processes across regions.

Conclusion

ADALAT CC holds a strategic position within the antihypertensive drug market, bolstered by clinical efficacy and patient-centric formulation design. Its sales are poised for moderate growth over the coming years, supported by demographic trends and expanding global markets. Industry stakeholders should prioritize market access strategies, innovative formulation development, and regional partnerships to maximize its commercial potential.

Key Takeaways

- The global antihypertensive market, especially calcium channel blockers, offers robust growth opportunities for ADALAT CC.

- Market expansion into emerging economies, along with formulation enhancements, could further boost sales.

- Price competition from generics necessitates strategic branding and clinical differentiation.

- Regulatory and reimbursement landscapes favor sustained growth, provided product positioning aligns with healthcare policies.

- A CAGR of 5-7% over five years indicates steady sales progression, contingent on market dynamics and competitive responses.

FAQs

1. How does ADALAT CC compare to other nifedipine formulations?

ADALAT CC provides sustained-release delivery with once-daily dosing, enhancing patient adherence compared to immediate-release variants. Its formulation optimizes plasma levels, reducing side effects and improving efficacy.

2. What are the primary markets driving ADALAT CC sales?

North America and Europe are the main markets due to established healthcare systems. Emerging markets in Asia-Pacific and Latin America are growing segments owing to increasing hypertension prevalence and improved access.

3. How does patent status influence ADALAT CC’s marketability?

Patent protections enable premium pricing and market exclusivity. Patent expirations could lead to increased generic competition, affecting sales and margins.

4. What role do combination therapies play in ADALAT CC’s sales?

Fixed-dose combinations incorporating nifedipine can improve treatment adherence, expanding market potential and sales volume.

5. What are key strategies to enhance ADALAT CC’s market share?

Strategies include strong clinical data substantiation, collaborations with healthcare providers, customized pricing models, and expanding into new geographical regions.

References

[1] World Health Organization. "Global Status Report on Noncommunicable Diseases 2022."

[2] Chobanian AV, et al. "The Seventh Report of the Joint National Committee on Prevention, Detection, Evaluation, and Treatment of High Blood Pressure." JAMA. 2003.

More… ↓