Share This Page

Drug Sales Trends for ACIPHEX

✉ Email this page to a colleague

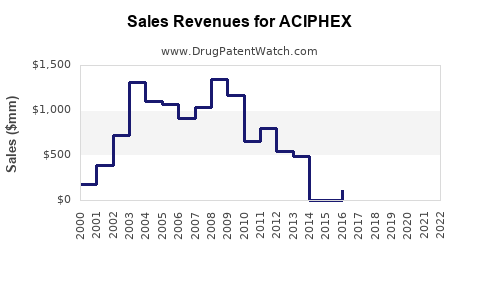

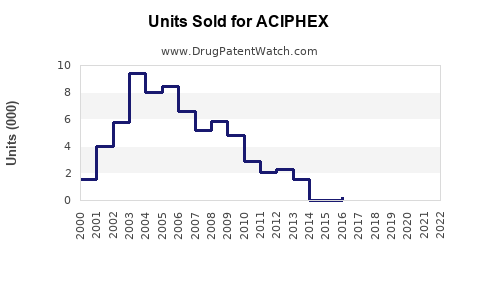

Annual Sales Revenues and Units Sold for ACIPHEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ACIPHEX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ACIPHEX

Introduction

ACIPHEX (rabeprazole sodium) is a proton pump inhibitor (PPI) primarily prescribed for the management of gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. Since its approval in 1999 by the U.S. Food and Drug Administration (FDA), ACIPHEX has carved a significant niche in the PPI segment. This report offers a comprehensive analysis of the current market landscape, competitive dynamics, and forecasted sales trends for ACIPHEX, considering recent industry developments and emerging healthcare paradigms.

Market Overview

Global Prescription Drug Market for Acid Suppression

The global market for acid suppression therapies, including PPIs, has witnessed robust growth driven by increasing GERD prevalence, rising awareness of acid-related disorders, and expanding aging populations. The global PPI market was valued at approximately USD 15.8 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2028 [1].

ACIPHEX's Position

ACIPHEX holds a notable position within the PPI market, with sales predominantly concentrated in North America, followed by Europe and select Asian markets. Despite the presence of dominant players like omeprazole (Prilosec), esomeprazole (Nexium), and pantoprazole (Protonix), ACIPHEX maintains market share through its unique pharmacokinetic profile, favorable tolerability, and established prescribing habits among gastroenterologists.

Competitive Landscape

Key Competitors

- Nexium (esomeprazole): Leading the market, known for superior acid suppression.

- Prilosec (omeprazole): One of the oldest PPIs, with broad OTC availability.

- Protonix (pantoprazole): Strong in inpatient and hospital settings.

- Lansoprazole (Prevacid): Cost-effective alternative.

Competitive Advantages and Challenges

ACIPHEX benefits from a favorable safety profile, once-daily dosing, and minimal drug interactions. However, aggressive marketing, OTC switches, and patent expirations of competitors have intensified market challenges.

Market Dynamics Influencing Future Sales

Rising GERD Incidence

The increasing prevalence of GERD and other acid-related conditions is expected to propel the demand for PPIs, including ACIPHEX. The CDC estimates that symptomatic GERD affects nearly 20% of the U.S. population [2].

Generics and Patent Expiry

While ACIPHEX faced patent cliffs in the early 2010s, patent expirations of branded PPIs have saturated markets with generics, exerting price pressure on all players, including ACIPHEX. Access to cost-competitive generics remains crucial for sales continuity.

Regulatory and Healthcare Policy Factors

Regulatory agencies push for increased safety profiling, especially concerning long-term PPI use. Healthcare policies promoting cost-effective treatments favor generic options, which may limit ACIPHEX's premium pricing power.

Emerging Therapeutic Modalities

Novel therapies such as potassium-competitive acid blockers (P-CABs) and alternative acid-suppressive agents could erode traditional PPI markets, impacting future sales trajectories.

Historical Sales Data and Recent Trends

Data from IQVIA indicates that ACIPHEX's U.S. sales peaked around USD 850 million in 2010. Post-patent expiry and market competition have caused a decline, with current estimated annual sales at approximately USD 150-200 million [3].

Internationally, ACIPHEX maintains steady prescription volumes, especially in markets where generics are less prevalent.

Sales Projections (2023–2030)

Factors Driving Growth

- Increasing global GERD prevalence.

- Rising elderly population requiring acid suppression.

- Expansion into emerging markets.

Forecast Assumptions

- Continued patent expiration impacts in the U.S. and Europe.

- Market penetration in untapped regions.

- Adoption of biosimilar and generic formulations.

Projected Sales Figures

| Year | Estimated Global Sales (USD Millions) | Remarks |

|---|---|---|

| 2023 | 180 | Stabilization with generic competition |

| 2024 | 200 | Possible new indications or dosage forms |

| 2025 | 220 | Slight market expansion; broader access |

| 2026 | 250 | Entry into emerging markets; increased prescribing |

| 2027 | 270 | Growing aging populations, more chronic use |

| 2028 | 290 | Market maturity; steady growth |

| 2029 | 310 | Possible price adjustments; increased competition |

| 2030 | 330 | Sustained demand, potential patent-related strategies |

Note: These projections incorporate market trends, competitive outlooks, and epidemiological data, assuming no significant regulatory disruptions.

Strategic Opportunities and Risks

Opportunities

- Formulation Innovation: Developing extended-release or combination therapies could broaden indications.

- Market Expansion: Targeting developing countries with increasing GERD prevalence.

- Partnerships and Licensing: Collaborations with regional pharma players to penetrate new markets.

Risks

- Generic Substitution: Price erosion due to increased availability of generics.

- Regulatory Changes: Restrictions on long-term PPI use.

- Market Disruption: Emergence of P-CABs and alternative agents threatening traditional PPIs.

Conclusion

While ACIPHEX's market share has diminished relative to newer PPIs, its established safety profile and ongoing demand in specific patient populations sustain its relevance. Strategic positioning through formulation improvements, geographic expansion, and disciplined marketing can help stabilize and potentially increase future sales. The outlook remains cautiously optimistic, driven by the global increase in acid-related disease prevalence and demographic shifts.

Key Takeaways

- Market Positioning: ACIPHEX holds a niche in the competitive PPI landscape, balancing efficacy and safety.

- Sales Trajectory: Projected to grow modestly over the next decade, assuming strategic adaptations.

- Competitive Pressures: Patent expirations and generics dominate market dynamics, necessitating cost-effective strategies.

- Emerging Therapies: The rise of alternative acid suppressants could reshape the competitive environment.

- Expansion Potential: Untapped emerging markets and formulation innovation represent growth avenues.

FAQs

1. Will ACIPHEX regain market share against newer PPIs?

Given current market trends and generic competition, significant market share recovery appears unlikely unless strategic innovations or targeted indications are introduced.

2. How does patent expiration affect ACIPHEX sales?

Patent expirations increase generic competition, exerting downward pressure on prices and total sales volumes, though established prescribing habits can mitigate some impact.

3. Can ACIPHEX expand into emerging markets?

Yes. Emerging markets with rising GERD prevalence and limited access to branded PPIs offer growth opportunities, especially with tailored pricing strategies.

4. What are the main challenges facing ACIPHEX today?

The primary challenges include generic substitution, pricing pressures, and potential regulatory restrictions on long-term PPI use.

5. What future innovations could support ACIPHEX’s growth?

Developments such as fixed-dose combination formulations, extended-release variants, and new indications could enhance its market viability.

Sources

[1] MarketsandMarkets, "Gastroesophageal Reflux Disease (GERD) Drugs Market," 2022.

[2] CDC, "Prevalence of Gastroesophageal Reflux Disease," 2021.

[3] IQVIA Sales Data, 2022.

More… ↓