Last updated: July 27, 2025

Introduction

ABILIFY MAIN (generic name: aripiprazole) is a widely prescribed antipsychotic medication primarily used for the treatment of schizophrenia, bipolar disorder, and irritability associated with autism. With a robust patent portfolio and extensive clinical validation, ABILIFY MAIN has cemented its position in the global psychiatric drug market. This analysis evaluates current market dynamics and projects sales trajectories amid evolving regulatory, competitive, and healthcare landscape conditions.

Market Overview

The global market for antipsychotics is experiencing steady growth, driven by increasing prevalence of schizophrenia and bipolar disorder, rising mental health awareness, and expanding access to healthcare services. According to IQVIA, the global psychiatric medication market was valued at approximately USD 25 billion in 2022, with antipsychotics constituting a significant share [1].

Key Drivers

- Epidemiological Trends: Schizophrenia affects roughly 20 million people worldwide, with bipolar disorder impacting an estimated 45 million—driving sustained demand for effective antipsychotics [2].

- Growing Mental Health Awareness: Increased recognition and destigmatization promote higher diagnosis rates.

- Healthcare Infrastructure Expansion: Emerging markets expand access to mental health services, offering new sales opportunities.

- Patent and Market Exclusivity: ABILIFY MAIN benefits from patent protections in several key territories, delaying generic competition.

Market Challenges

- Generic Entry: The expiration of ABILIFY’s primary patents in multiple regions tumbling into generic markets suppresses pricing power.

- Regulatory Scrutiny: Ongoing investigations and stringent approvals impact market access.

- Competitive Landscape: Multiple first-line antipsychotics (e.g., risperidone, olanzapine, quetiapine) offer alternatives, intensifying competition.

Product Position and Strategic Advantages

ABILIFY MAIN distinguishes itself through its unique pharmacological profile, notably its partial dopamine agonist activity, which potentially reduces side effects like weight gain and metabolic disturbances associated with other antipsychotics. Its broad indication spectrum and favorable tolerability have fostered strong prescriber loyalty, especially in developed markets.

Market Segmentation & Geographic Outlook

Regional Dynamics

- North America: Largest market, driven by high prevalence of mental health disorders, advanced healthcare infrastructure, and high medication adherence.

- Europe: Similar to North America with rigorous regulatory standards but higher generic penetration.

- Asia-Pacific (APAC): Fastest-growing due to rising mental health awareness, increasing healthcare expenditure, and demographic shifts.

- Rest of the World (RoW): Emerging markets are experiencing increasing adoption, despite price sensitivity and regulatory hurdles.

Therapeutic Segments

- Schizophrenia: Accounts for over 50% of ABILIFY MAIN's sales—primary driver.

- Bipolar Disorder: Growing segment owing to shifts in clinical practice favoring oral and long-acting injectable formulations.

- Autism: Off-label but significant segment, with increasing evidence supporting efficacy for irritability.

Sales Projections (2023–2028)

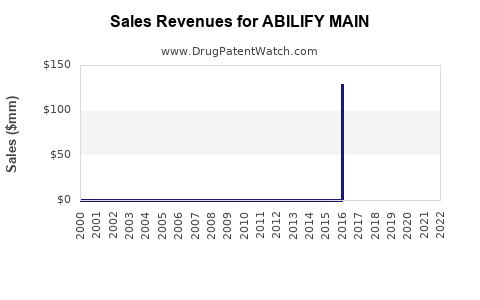

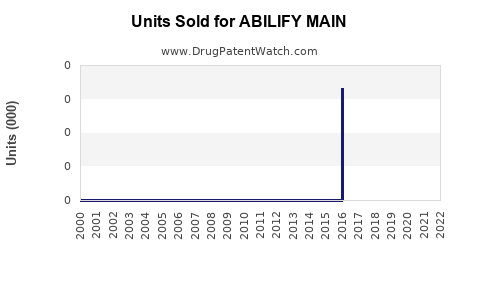

Historical Performance

In 2022, ABILIFY MAIN generated approximately USD 3.2 billion globally, with North America contributing approx. USD 2 billion—leading and indicative of its dominant market position (Sources: IQVIA, 2022). The patent expiry in major markets in 2015 led to a decline in revenue, but strategic marketing and expanded indications mitigated losses.

Projected Trends

- 2023–2024: Stabilization with minor declines in some markets due to generic competition. However, brand stability maintained through current formulations and new indications.

- 2025–2026: Sales stabilizing at USD 2.5–2.8 billion, bolstered by growth in APAC, especially China and India, where mental health services expand.

- 2027–2028: Potential rebound to USD 3 billion+ owing to lifecycle management initiatives, including new delivery systems and expanded indications such as treatment-resistant depression (via combination therapies).

Influence of Generic Competition

Post-patent expiry, generic aripiprazole entered markets, leading to price erosion of up to 60% but allowing for volume-driven growth. Brand sales are expected to stabilize as a result of strategic brand repositioning and the introduction of novel formulations.

Impact of New Formulations and Indications

The launch of long-acting injectable formulations and fixed-dose combinations, particularly targeting adherence—considered Achilles' heel for antipsychotics—may contribute an incremental USD 300–500 million annually by 2028.

Market Share Dynamics

Despite challenges, ABILIFY MAIN's global market share is projected to remain above 20% in the antipsychotic segment, with stronger footholds in North America (~25%) due to prescriber familiarity and established formulary positioning.

Regulatory and Patent Outlook

Pending patent cliffs are expected for 2025-2026 in the U.S. and Europe, opening markets for generic competition. However, strategic pipeline investments—such as biosimilars or long-acting formulations—aim to sustain revenue streams.

Competitive Landscape

Major competitors include risperidone, olanzapine, quetiapine, and newer atypical antipsychotics like lurasidone and brexiprazole. The competitive edge of ABILIFY MAIN lies in its tolerability profile and broad indication spectrum.

Key Opportunities

- Expansion of Indications: Novel approvals in depression and treatment-resistant cases.

- Market Penetration in APAC: Rising healthcare access and policy shifts to include mental health treatments.

- Enhanced Formulations: Development of injectable or depot administrations improving adherence.

Key Challenges

- Pricing pressures from generics.

- Regulatory delays or rejections for new formulations.

- Market saturation in mature markets.

Conclusion

ABILIFY MAIN's future sales trajectory hinges on strategic lifecycle management amidst patent expirations and intense competition. While near-term challenges pose risks, long-term growth prospects remain favorable driven by expanding global mental health awareness, demographic shifts, and pipeline innovations.

Key Takeaways

- Market position remains strong despite patent expirations, owing to brand recognition, product differentiation, and expanding indications.

- Sales are projected to stabilize around USD 2.5–3 billion annually from 2025 onward, contingent upon successful lifecycle strategies.

- Emerging markets, especially in APAC, offer substantial growth opportunities driven by increasing mental health awareness and healthcare infrastructure improvements.

- Generic competition will exert downward pressure on prices, but innovative formulations and new indications can offset volume declines.

- Strategic investments in long-acting injectable formulations and expanded indications will be crucial for sustaining future revenue streams.

FAQs

-

What is the primary factor affecting ABILIFY MAIN’s sales after patent expiry?

The expiration of patents in key markets introduces generic competition, leading to significant price erosion but also offering volume-based growth opportunities.

-

Which regions present the greatest growth potential for ABILIFY MAIN?

The Asia-Pacific markets, notably China and India, demonstrate high growth potential driven by demographic shifts and increased mental health awareness.

-

How do new formulations impact ABILIFY MAIN’s competitive position?

Long-acting injectables and fixed-dose combinations can enhance adherence, differentiate the product, and bolster sales despite generic entry.

-

What are the main competitive threats facing ABILIFY MAIN?

Competing antipsychotics with similar efficacy but potentially better tolerability profiles, pricing pressures from generics, and regulatory hurdles for new formulations.

-

What strategic moves could sustain ABILIFY MAIN’s market share in the coming years?

Expanding indications, launching innovative formulations, strengthening market presence in emerging regions, and leveraging lifecycle management initiatives.

References

[1] IQVIA, "Global Psychiatric Medication Market Report," 2022.

[2] World Health Organization, "Mental Health: Strengthening Our Response," 2021.