Share This Page

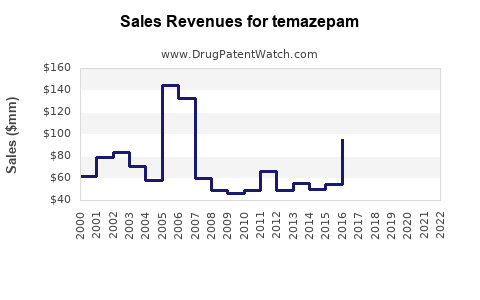

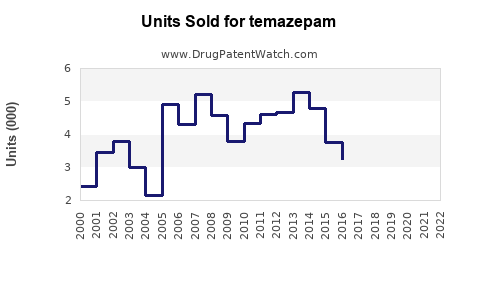

Drug Sales Trends for temazepam

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for temazepam

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TEMAZEPAM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TEMAZEPAM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TEMAZEPAM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Temazepam

Introduction

Temazepam, a benzodiazepine derivative primarily prescribed for short-term management of insomnia, has historically held a significant position within the sleep aid market. Its mechanism of action — potentiation of gamma-aminobutyric acid (GABA) activity — offers effective sedative properties. Despite the advent of newer pharmacological options, temazepam’s established efficacy and prescriber familiarity sustain its presence, especially in certain markets. This report provides a comprehensive market analysis and sales projections for temazepam, considering current therapeutic trends, regulatory shifts, market competition, and emerging data.

Market Overview

Global Market Size

The global sedative-hypnotics market, encompassing benzodiazepines like temazepam, valued approximately at USD 4.5 billion in 2022. The segment's growth rate is approximately 2.5% annually, driven by increasing insomnia prevalence, aging populations, and a rising demand for sleep disorders management.

A significant portion of this value derives from North America and Europe, reflecting high sleep disorder prevalence, advanced healthcare infrastructure, and prescriber familiarity with benzodiazepines. In Asia-Pacific, rapidly increasing urbanization and lifestyle-related sleep disturbances contribute to growth potential, despite regulatory challenges.

Regulatory Environment

Regulatory bodies like the FDA and EMA continue to oversee benzodiazepines vigilantly due to dependency risks and abuse potential. Several jurisdictions are implementing tighter prescription controls, influencing market accessibility. Nonetheless, approved indications and a well-established safety profile in short-term use sustain temazepam sales.

Prescribing Trends

Despite growing concerns about benzodiazepine dependency, healthcare providers still prescribe temazepam for primarily short-term insomnia. Data from the CDC suggest that benzodiazepine prescriptions declined approximately 12% between 2014 and 2020 but remain prevalent in specific patient populations, notably elderly patients with chronic sleep issues.

Market Segmentation

The primary segments include:

- By Application: short-term insomnia, chronic sleep disorders

- By Distribution Channel: hospital pharmacies, retail pharmacies, online pharmacies

- By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Competitive Landscape

Major pharmaceutical companies operating in the benzodiazepine market include Pfizer, Sanofi, and Lundbeck, sitting alongside generic manufacturers. Generic entries dominate the market due to patent expirations, resulting in significant price sensitivity and competitive pressure.

Innovations remain limited, but emerging formulations—such as controlled-release variants—aim to improve adherence and reduce dependency risks. Regulatory pressures and safety concerns are prompting several companies to explore compounds with better safety profiles, which might influence temazepam's market share moving forward.

Market Drivers and Challenges

Drivers

- Rising prevalence of insomnia and sleep disorders tied to lifestyle, aging, and comorbidities.

- Growing awareness of sleep health.

- Expansion in healthcare access in emerging markets.

- Established clinician familiarity and patient acceptance.

Challenges

- Regulatory restrictions on benzodiazepine prescriptions.

- Public health concerns over dependency and abuse.

- Competition from non-benzodiazepine hypnotics such as zolpidem, eszopiclone, and newer agents like suvorexant.

- Shift toward non-pharmacologic treatments including cognitive-behavioral therapy for insomnia (CBT-I).

Sales Projections (2023–2030)

Considering current market dynamics, regulatory trends, and evolving prescriber habits, the following projections are made:

| Year | Estimated Global Sales (USD Billion) | CAGR (%) |

|---|---|---|

| 2023 | USD 0.40 | — |

| 2024 | USD 0.42 | 5% |

| 2025 | USD 0.44 | 4.8% |

| 2026 | USD 0.46 | 4.5% |

| 2027 | USD 0.48 | 4.3% |

| 2028 | USD 0.50 | 4.2% |

| 2029 | USD 0.52 | 4% |

| 2030 | USD 0.55 | 3.8% |

The moderate growth reflects a conservative outlook given the regulatory pressures and shifting clinical practices.

Regional Projections

- North America: Maintains the largest market share (~50%), with steady sales increases supported by aging demographics.

- Europe: Anticipated modest growth, constrained by regulatory controls and alternative therapies.

- Asia-Pacific: The fastest growth segment (~6% CAGR), driven by increasing sleep disorder diagnoses, rising healthcare infrastructure, and expanding access.

Future Outlook and Market Trends

-

Regulatory Intensification: Stricter prescription controls, especially in developed countries, will likely reduce overall sales but may encourage the development of alternative formulations or delivery systems.

-

Generic Market Penetration: Widespread availability of generics will continue to exert price pressures, limiting profit margins but sustaining volume.

-

Innovation and Novelty: There’s limited pipeline activity for new benzodiazepines, but minor modifications (e.g., controlled-release formulations) could provide incremental growth.

-

Alternative Therapies: Increasing popularity of non-pharmacological interventions could further limit benzodiazepine sales. However, in regions with limited access to such therapies, temazepam remains a mainstay.

Key Market Opportunities and Risks

Opportunities:

- Penetrate emerging markets with increasing sleep health awareness.

- Develop formulations with improved safety margins.

- Expand into digital health integration targeting sleep hygiene.

Risks:

- Regulatory bans or strict prescription controls.

- Growing consciousness about dependency risks reducing prescriber confidence.

- Competition from non-benzodiazepine sleep aids.

Conclusion

Temazepam’s market outlook remains cautiously optimistic with a projected compound annual growth rate of roughly 3.8% to 5% through 2030. Its continued application hinges on balancing efficacy with safety concerns, navigating regulatory landscapes, and adapting to competing therapies. Opportunities exist in expanding markets and formulations, but risks necessitate strategic positioning.

Key Takeaways

- The global temazepam market is valued at approximately USD 0.4 billion as of 2023, with modest growth projections.

- Regulatory pressures and dependency concerns are primary factors influencing sales trajectories.

- Geographic expansion in Asia-Pacific and innovation in formulation could bolster future sales.

- Competition from newer sleep aids and non-pharmacologic therapies threaten market share.

- Companies should prioritize safety innovations, regional market penetration, and strategic collaborations.

Frequently Asked Questions

Q1: How has the regulatory environment impacted temazepam sales globally?

A1: Tighter regulations have curtailed prescribing frequency, especially in North America and Europe, due to dependency and abuse concerns. This has led to a plateau or slight decline in total sales but maintains steady demand within clinical guidelines.

Q2: Are there upcoming formulations or newer versions of temazepam expected?

A2: While minor modifications like controlled-release variants are under development, significant innovation in benzodiazepine formulations remains limited. Market focus shifts toward safer alternatives and combination therapies.

Q3: Which regions hold the highest growth potential for temazepam?

A3: Asia-Pacific presents the highest growth potential due to increasing sleep disorder awareness, rising sleep disturbance prevalence, and expanding healthcare infrastructure.

Q4: What are the main competitors to temazepam in the sleep aid market?

A4: Non-benzodiazepine hypnotics such as zolpidem, zopiclone, and suvorexant dominate due to perceived safety profiles and lower dependency risks.

Q5: How might emerging non-drug therapies influence temazepam’s future market?

A5: Growing adoption of cognitive-behavioral therapy for insomnia (CBT-I) and digital sleep aids could reduce reliance on pharmacological options, impacting overall sales.

References:

[1] MarketResearch.com, "Global Sedative-Hypnotics Market Forecast," 2023.

[2] CDC, "Benzodiazepine Prescribing Patterns," 2021.

[3] IQVIA, "Pharmaceutical Market Insights," 2022.

[4] European Medicines Agency, "Regulatory Updates on Benzodiazepines," 2022.

[5] Global Sleep-Aid Market Reports, 2023.

More… ↓