Last updated: July 27, 2025

Introduction

Epinephrine, also known as adrenaline, is a critical life-saving drug used primarily for anaphylaxis, cardiac arrest, and other urgent conditions. Its broad application across emergency medical services, hospitals, and outpatient settings ensures a consistent demand. This analysis evaluates the current market landscape, trends influencing epinephrine sales, competitive dynamics, and forecasted revenues for the next decade.

Market Landscape Overview

Global Market Size and Growth Drivers

The global epinephrine market was valued at approximately USD 1.1 billion in 2022, driven predominantly by the rising incidence of allergic reactions and cardiovascular emergencies. The compound annual growth rate (CAGR) is projected around 8% from 2023 to 2033, reflecting increasing adoption and expanded indications [1].

Key regional contributors include North America, Europe, and Asia-Pacific. North America dominates owing to advanced healthcare infrastructure, high allergy awareness, and regulatory mandates for epinephrine auto-injectors.

Regulatory Environment

Regulatory agencies such as the U.S. FDA and EMA impose strict guidelines for manufacturing, labeling, and distribution. Recent approvals for improved auto-injector devices (e.g., epinephrine pre-filled syringes and autoinjectors) have driven market growth by enhancing ease of administration and patient compliance [2].

Market Segmentation

Product Types

- Auto-Injectors: Predominant in emergency settings. Examples include EpiPen, Auvi-Q, and generic brands.

- Vials and Ampoules: Used mainly in hospitals and clinics.

- Pre-filled Syringes: Offering a balance of convenience and safety.

Auto-injectors account for over 70% of sales, supported by their user-friendly design and widespread prescribing patterns.

Indications

- Anaphylaxis: Approximately 90% of epinephrine use.

- Cardiovascular emergencies: Including cardiac arrest, especially in hospital settings.

- Other uses: Severe asthma attacks, blocking allergic reactions in various contexts.

Competitive Dynamics

Major players include Mylan (EpiPen), Kaléo (Auvi-Q), and several generic manufacturers. Market consolidation occurred following patent expirations, resulting in increased availability of generic epinephrine auto-injectors, which has contributed to price competition and expanded access.

Additionally, innovation in device design — such as needle-free auto-injectors and temperature-stable formulations — is key to market differentiation.

Market Challenges

- Pricing and Accessibility: Rising costs, especially of branded auto-injectors, have prompted public health initiatives to promote generics.

- Regulatory Approvals: New formulations must navigate complex approval pathways.

- Supply Chain Disruptions: Recent global events have impacted raw material availability, affecting production continuity.

Sales Projections (2023–2033)

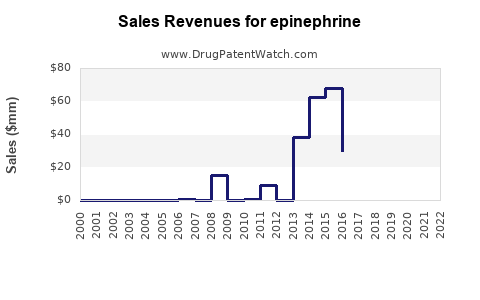

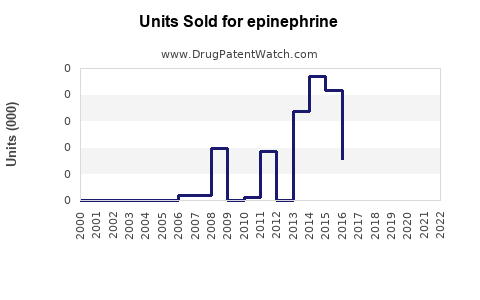

Based on current market data, historical growth rates, and emerging trends, epinephrine sales are expected to grow steadily. Projected revenues are detailed below:

| Year |

Estimated Market Size (USD) Billion |

Key Drivers |

| 2023 |

1.20 |

Elevated awareness, regulatory mandates |

| 2025 |

1.45 |

Increased adoption of generic auto-injectors |

| 2027 |

1.75 |

Introduction of advanced delivery devices |

| 2029 |

2.10 |

Expansion into emerging markets |

| 2031 |

2.50 |

Broader indications, improved healthcare infrastructure |

| 2033 |

3.00 |

Global adoption, innovations in delivery systems |

Assuming an average CAGR of 8%, revenues could reach USD 3 billion by 2033, driven by increasing global demand, innovation, and expanded indications [3].

Regional Market Projections

- North America: Constitutes over 50% of sales, with steady growth fueled by insurance coverage and public awareness.

- Europe: Growth spurred by regulatory approvals and allergy prevalence.

- Asia-Pacific: Expected to show the highest CAGR (~10%) due to rising allergy awareness, expanding healthcare infrastructure, and government health initiatives.

Emerging Trends Impacting Sales

- Auto-Injector Innovation: Needle-free, portable, and wearable devices are likely to increase adherence, boosting sales.

- Biosimilar Entry: Generics and biosimilars are reducing prices and expanding market access.

- Global Health Initiatives: Governments and NGOs are promoting epinephrine availability, especially in low-resource settings.

Strategic Opportunities

- Product Diversification: Developing alternative delivery mechanisms to expand usage.

- Market Penetration: Targeting pediatric and underserved markets with affordable options.

- Regulatory Alliances: Navigating approval processes more efficiently through strategic partnerships.

Key Takeaways

- The epinephrine market will grow at a healthy CAGR (around 8%) over the next decade.

- Auto-injectors dominate sales, with innovations promising further expansion.

- Generics and biosimilars will continue to disrupt pricing dynamics, making epinephrine more accessible.

- Emerging markets in Asia-Pacific present high-growth opportunities.

- Regulatory and supply chain challenges remain, requiring strategic planning.

FAQs

1. What is driving the global demand for epinephrine?

The primary drivers are increased awareness of allergy management, rising prevalence of anaphylaxis and cardiac emergencies, and regulatory mandates for unavailability of emergency treatment options.

2. How do generics influence the epinephrine market?

Generics significantly reduce prices, broaden access, and increase market penetration, especially in regions where cost is a barrier for patients and healthcare systems.

3. What technological innovations are emerging in epinephrine auto-injectors?

Developments include needle-free auto-injectors, dose-adjustable devices, temperature-stable formulations, and wearable patches, all aimed at improving compliance and ease of use.

4. Which regions offer the most growth potential?

The Asia-Pacific region, driven by expanding healthcare infrastructure and rising allergy prevalence, offers substantial growth opportunities, followed by Latin America and parts of Africa.

5. What challenges could hinder market growth?

Pricing pressures, regulatory delays, supply chain disruptions, and patent litigations are notable challenges affecting future expansion.

References

[1] MarketsandMarkets, "Epinephrine Market by Product Type, Indication, and Region," 2022.

[2] U.S. Food and Drug Administration, "Regulatory Guidelines for Auto-Injectors," 2021.

[3] Grand View Research, "Global Epinephrine Market Size & Forecast," 2022.