Last updated: July 27, 2025

Introduction

Diazepam, commonly marketed under the brand name Valium, is a benzodiazepine extensively prescribed for anxiety, muscle spasms, seizures, and alcohol withdrawal management. Since its approval by the FDA in 1963, diazepam has become a cornerstone in psychopharmacology. This analysis explores its current market landscape, competitive environment, and future sales trajectories, providing strategic insights for stakeholders across pharmaceutical manufacturing, distribution, and healthcare.

Market Overview

The global benzodiazepine market, with diazepam as a prominent segment, was valued at approximately USD 1.2 billion in 2022. The market is characterized by mature demand, driven by the prevalence of anxiety disorders, epilepsy, and muscle spasticity. Despite the availability of alternative therapies and stringent regulatory controls issued owing to concerns over dependence and misuse, diazepam maintains a significant market share, especially in regions with limited access to newer drugs.

Key Therapeutic Applications and Demographics

Diazepam's primary indications include:

- Anxiety Disorders: Chronic and acute anxiety, panic attacks.

- Seizure Management: Status epilepticus, epilepsy.

- Muscle Spasms: Spasticity associated with neurological conditions.

- Alcohol Withdrawal Syndrome: Reduces agitation and tremors.

The demographic distribution favors aging populations with higher incidences of neurological and psychiatric conditions (e.g., North America, Europe). Still, the drug remains widely used in developing countries due to its low cost and long history of clinical efficacy.

Regulatory and Prescriptive Landscape

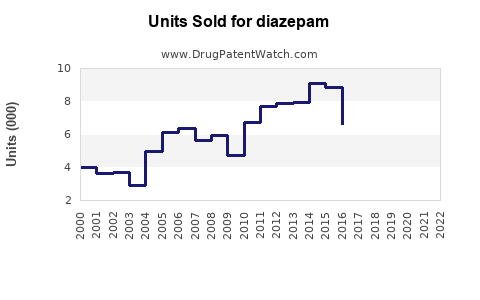

Strict regulatory frameworks in regions like the US and Europe have limited off-label use and higher dosages, aiming to mitigate dependence risks. Nonetheless, diazepam continues to be prescribed owing to its well-documented efficacy and familiarity among healthcare providers. Generic versions dominate the market, reducing costs and promoting accessibility.

Competitive Environment

The pharmaceutical landscape features a combination of branded and generic formulations. Major players include Roche (original patent holder), Sandoz, Teva, Mylan, and others supplying generic diazepam. Competition has intensified as patent exclusivity expired decades ago, fostering widespread generic availability.

Emerging therapies, such as selective serotonin reuptake inhibitors (SSRIs) for anxiety, have gradually encroached upon diazepam’s market share, especially for long-term management approaches.

Market Dynamics and Trends

- Growing Prevalence of Anxiety and Seizure Disorders: Increasing mental health awareness and diagnostics are fueling demand.

- Shift Toward Safer Alternatives: Concerns over dependency and sedation side effects push prescribers toward newer agents or non-pharmacologic therapies.

- Regulatory Tightening: Efforts to curb misuse influence prescription patterns, impacting sales.

- Regional Variations: Developing markets exhibit higher growth potential due to broader access and lower generic competition barriers.

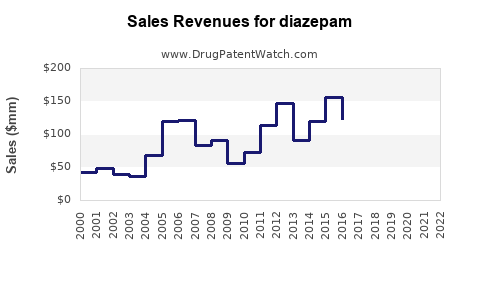

Sales Projections (2023–2030)

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

1.1 |

— |

| 2024 |

1.15 |

4.5 |

| 2025 |

1.2 |

4.3 |

| 2026 |

1.25 |

4.2 |

| 2027 |

1.3 |

4.0 |

| 2028 |

1.36 |

4.6 |

| 2029 |

1.43 |

5.1 |

| 2030 |

1.5 |

4.9 |

Projection assumptions include continued generics penetration, steady prevalence rates of targeted conditions, and moderate regulatory impacts.

The CAGR over this period is approximately 4.7%, reflecting steady but cautious growth amid competitive pressures and evolving clinical guidelines.

Regional Breakdown

- North America: Dominates sales (~45%) due to high prevalence of anxiety and seizure disorders, despite regulatory restrictions.

- Europe: Accounts for approximately 25%, with similar trends and regulatory oversight.

- Asia-Pacific: Exhibits the fastest growth (~6-8%), driven by increasing healthcare access, urbanization, and awareness.

- Rest of World: Moderate expansion, influenced by price sensitivity and generics.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets due to low-cost generics.

- Development of combination therapies that mitigate dependency risks.

- Educational initiatives to promote appropriate prescribing and reduce misuse.

Challenges:

- Regulatory restrictions targeting abuse potential.

- Competition from newer anxiolytics with better safety profiles.

- Public health concerns over dependency and side effects limiting long-term use.

Strategic Considerations for Stakeholders

Manufacturers should explore differentiation via formulation innovations (e.g., controlled-release), geographic expansion, and targeted marketing emphasizing efficacy and safety. Healthcare providers require ongoing education on appropriate use, balanced against the risks of dependence. Policy engagement remains vital to navigate evolving regulatory landscapes.

Key Takeaways

- Diazepam maintains a significant role across multiple indications, preserving its market despite intensifying competition and regulatory oversight.

- The global market is projected to grow at a steady CAGR (~4.7%) through 2030, with emerging markets offering the highest growth potential.

- Transparency around the drug's benefits and risks remains essential for sustainable market positioning. Strategies should aim for responsible prescribing, support innovation, and diversify therapeutic portfolios.

- The increasing preference for newer, safer anxiolytics may temper sales growth, but ongoing demand in developing regions sustains the overall market.

- Regulatory shifts, especially concerning dependency and abuse, will influence future sales and formulary positioning.

Conclusion

Diazepam’s long-standing clinical utility ensures its continued presence in the therapeutic landscape. While growth may slow relative to the past, consistent demand driven by demographic trends and healthcare needs sustains its relevance. Forward-looking strategies emphasizing safety, regulatory compliance, and regional expansion are vital for stakeholders seeking to optimize long-term sales.

FAQs

1. How does regulatory oversight impact diazepam sales?

Regulatory measures, particularly in the US and Europe, aim to curtail misuse and dependency, leading to stricter prescribing guidelines. These controls may reduce prescribing frequency but also promote shifts toward alternative therapies, balancing overall sales growth.

2. What demographic groups are the largest consumers of diazepam?

Primarily, elderly populations with neurological or psychiatric conditions and chronic anxiety sufferers constitute major user groups. These demographics are expected to remain consistent, supporting sustained demand.

3. How do generic versions influence the market?

Generics significantly lower costs, enabling broader access and amplifying sales volume, despite pricing pressures. They also facilitate market penetration in developing countries.

4. Are there emerging therapies that threaten diazepam’s market share?

Yes, non-benzodiazepine anxiolytics, antidepressants (like SSRIs), and non-pharmacological interventions are increasingly used, especially for long-term management, potentially diminishing diazepam’s dominance.

5. What factors could accelerate diazepam sales growth?

Expansion in emerging markets, innovative formulations addressing dependency concerns, and increased diagnosis rates of applicable conditions could enhance sales trajectories.

References

- MarketWatch, “Global Benzodiazepine Market Size,” 2022.

- IQVIA, “Pharmaceutical Market Trends,” 2022.

- U.S. Food and Drug Administration, “Diazepam (Valium) Drug Approval,” 1963.

- World Health Organization, “Mental Health and Psychotropic Medications,” 2021.

- Statista, “Regional Prescription Data for Benzodiazepines,” 2022.