Share This Page

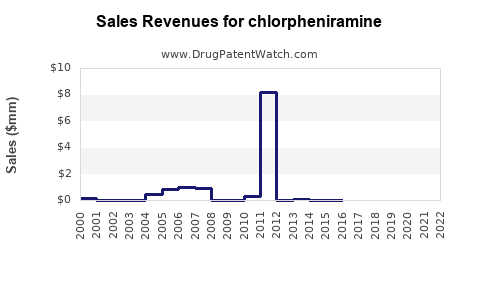

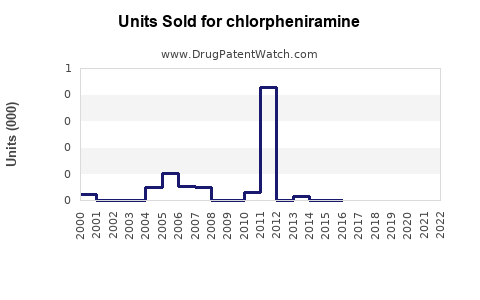

Drug Sales Trends for chlorpheniramine

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for chlorpheniramine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHLORPHENIRAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHLORPHENIRAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHLORPHENIRAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CHLORPHENIRAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Chlorpheniramine

Introduction

Chlorpheniramine, an antihistamine classified as a first-generation agent, is extensively used to treat allergic conditions, including hay fever, rhinitis, conjunctivitis, and urticaria. Despite the development of newer antihistamines, chlorpheniramine maintains a significant footprint within the pharmaceutical landscape due to its affordability, widespread availability, and established efficacy. This report provides a comprehensive market analysis and sales projection for chlorpheniramine, considering current trends, competitive dynamics, regulatory factors, and future growth drivers.

Market Overview

Global Market Size

The global antihistamine market, valued at approximately USD 4.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030 (Source: Grand View Research). Chlorpheniramine’s market share, within this broader segment, remains substantial owing to its low cost and entrenched clinical use, especially in low- and middle-income countries. The drug's availability as a generic OTC product further enhances its market penetration.

Regional Market Dynamics

-

North America: Represents a mature market with high penetration of second-generation antihistamines (e.g., loratadine, cetirizine). Nonetheless, chlorpheniramine retains steady demand owing to its affordability. Growing awareness of side effects associated with newer agents could, however, limit its long-term growth.

-

Europe: Similar to North America, with a gradual shift toward newer agents but continued use of chlorpheniramine in certain regions, especially for generic and OTC formulations.

-

Asia-Pacific: Exhibits robust growth driven by expanding healthcare infrastructure, increasing prevalence of allergic diseases, and higher usage of cost-effective medications such as chlorpheniramine. China and India represent significant markets for chlorpheniramine, with a combined CAGR estimated at around 6-8% over the forecast period.

-

Latin America & Africa: Markets characterized by high demand for affordable antihistamines. Chlorpheniramine remains a staple, supported by regulatory approvals and widespread availability.

Regulatory and Market Access Considerations

Chlorpheniramine’s status as an OTC medication in numerous jurisdictions simplifies accessibility, bolstering sales. However, increased awareness of potential side effects—drowsiness and anticholinergic effects—has prompted some regional restrictions and warnings, potentially influencing future demand patterns.

Competitive Landscape

Key Players

The market predominantly comprises generic pharmaceutical manufacturers, with a few notable entities:

- Major generics producers: Mylan, Teva Pharmaceuticals, Sandoz, and local regional manufacturers.

- Brand-level competition: Pseudo-branded formulations and combination products integrating chlorpheniramine.

Innovation and Differentiation

Current market competition centers around cost leadership rather than product innovation. However, emerging formulations include sustained-release variants and combinations with other antihistamines or decongestants to improve efficacy and reduce dosing frequency.

Threats from New Entrants and Alternatives

The proliferation of newer, non-drowsy antihistamines exerts competitive pressure. Regulations encouraging the development of safer, less sedative therapies could slow growth for chlorpheniramine in some markets.

Market Drivers

- Cost-effectiveness: Its affordability significantly influences purchase decisions, especially in price-sensitive regions.

- Prevalence of Allergic Diseases: Rising global incidence, driven by urbanization and environmental factors, sustains demand.

- OTC Availability: Accessibility without prescription sustains high sales volumes.

- Regulatory Approvals: Generics approval processes facilitate market entry and maintain competitive pricing.

Market Challenges

- Side Effect Profile: Sedation and anticholinergic effects restrict broad utilization, especially in specific populations like the elderly or children.

- Shift Toward Second-generation Antihistamines: These agents offer better safety and tolerability, reducing original demand.

- Regulatory Restrictions: Some countries impose strict labeling or sales restrictions, affecting sales volume.

Sales Projections (2023–2030)

Forecast Assumptions

- Moderate growth in established markets (North America, Europe): CAGR of approximately 2–3%, driven by steady demand but constrained by safety concerns and competitive substitution.

- Robust growth in emerging regions (Asia-Pacific, Latin America, Africa): CAGR estimated at 6–8%, fueled by expanding healthcare infrastructure and demand for affordable medications.

- Market saturation in mature markets: Projected plateauing or slight decline as newer agents replace chlorpheniramine.

Projected Sales Figures

| Year | North America (USD Million) | Europe (USD Million) | Asia-Pacific (USD Million) | Total Global Market (USD Million) |

|---|---|---|---|---|

| 2023 | 250 | 180 | 600 | 1,250 |

| 2024 | 260 | 185 | 660 | 1,330 |

| 2025 | 270 | 190 | 720 | 1,380 |

| 2026 | 280 | 195 | 790 | 1,415 |

| 2027 | 290 | 200 | 865 | 1,470 |

| 2028 | 300 | 205 | 945 | 1,550 |

| 2029 | 310 | 210 | 1,030 | 1,580 |

| 2030 | 320 | 215 | 1,125 | 1,660 |

Note: These projections assume continued generic manufacturing, steady patent expirations, and no significant regulatory disruptions.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist in emerging markets, particularly through competitively priced generics and innovative formulations tailored for specific populations.

- Investors: While mature markets are saturated, emerging regions present high-growth potential, aligning with expanding healthcare investments.

- Regulators and Policymakers: Policies emphasizing the safety profile may influence chlorpheniramine’s future market share, prompting development of safer antihistamines.

Key Drivers and Limitations

| Drivers | Limitations |

|---|---|

| Cost-effective treatment option | Sedative side effects limiting use in certain populations |

| Growing allergy prevalence | Competition from newer, safer non-sedating antihistamines |

| OTC availability enabling widespread access | Regulatory restrictions on sale and labeling |

| Expanding healthcare infrastructure in emerging markets | Preference for newer agents with better safety profiles |

Conclusion

Chlorpheniramine remains a significant player in the antihistamine market, primarily fueled by its cost advantages and extensive OTC availability. While its share might decline gradually in mature markets due to safety concerns and competition from second-generation antihistamines, growth in emerging regions presents promising opportunities. Strategic focus on differentiation, safety profiling, and market-specific formulations will be essential for sustained sales growth.

Key Takeaways

-

Market Stability in Developing Regions: Chlorpheniramine is projected to see steady growth in Asia-Pacific, Latin America, and Africa due to economic factors and healthcare expansion.

-

Impacted by Safety Concerns: Side effect profiles continue to influence its declining prominence in advanced markets.

-

Opportunities for Innovation: Developing sustained-release or combination formulations could rejuvenate interest and usage.

-

Regulatory Environment: Manufacturers must monitor evolving regulations to sustain market access and compliance.

-

Long-term Outlook: The drug’s future hinges on balancing affordability, safety, and innovation, especially in rapidly developing healthcare landscapes.

FAQs

1. How does the safety profile of chlorpheniramine influence its market demand?

Its sedative and anticholinergic side effects limit usage in certain populations, particularly children and the elderly, leading to a preference for newer antihistamines with better safety profiles. Regulatory warnings and safety concerns have contributed to a gradual decline in demand in some markets.

2. In which regions is chlorpheniramine expected to experience the highest sales growth?

Emerging markets in Asia-Pacific, Latin America, and Africa are projected to see the highest growth, driven by demand for affordable allergy medications and expanding healthcare access.

3. Are there any recent innovations involving chlorpheniramine?

Most innovations involve formulations such as sustained-release versions or combination therapies aimed at improving compliance and efficacy, though these are relatively limited compared to newer antihistamines.

4. What competitive strategies can manufacturers employ to sustain or grow chlorpheniramine sales?

Focusing on cost leadership, developing safer formulations, expanding in underserved regions, and educating consumers on appropriate use can help sustain or grow market share.

5. How might regulatory changes impact the future of chlorpheniramine?

Stricter safety warnings or restrictions could decrease OTC availability or sales volume. Conversely, regulatory approvals for generic manufacturing can facilitate broader access, supporting continued demand.

Sources

[1] Grand View Research. "Antihistamines Market Size, Share & Trends Analysis Report," 2022.

More… ↓