Share This Page

Drug Sales Trends for SEROQUEL

✉ Email this page to a colleague

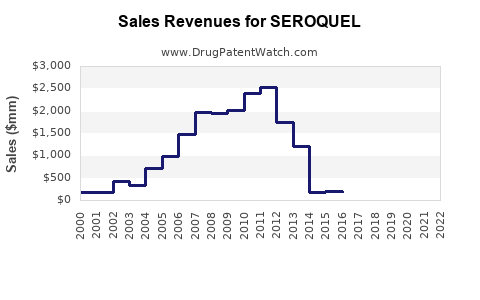

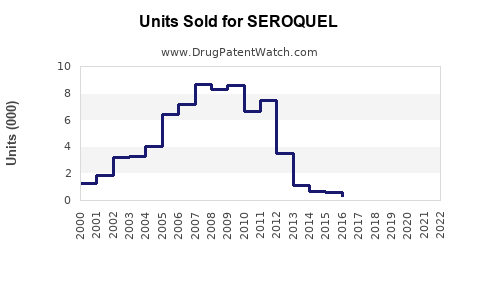

Annual Sales Revenues and Units Sold for SEROQUEL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SEROQUEL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SEROQUEL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SEROQUEL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SEROQUEL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SEROQUEL (Quetiapine)

Introduction

SEROQUEL (quetiapine) remains a cornerstone in the treatment of psychiatric disorders, particularly schizophrenia, bipolar disorder, and major depressive episodes. Since its initial approval by the FDA in 1997, SEROQUEL has established a robust market presence, continually expanding through new formulations, indications, and emerging global markets. This analysis provides an in-depth review of SEROQUEL’s current market landscape, competitive positioning, regulatory environment, and future sales trajectories.

Market Overview

Global Market Size and Growth Dynamics

The global antipsychotic drugs market, valued at approximately USD 13 billion in 2022, is projected to grow at a CAGR of around 3.5% through 2030, driven by increasing mental health awareness, rising prevalence of schizophrenia and bipolar disorder, and expanding indications for second-generation antipsychotics (SGAs) like SEROQUEL ([1], [2]).

SEROQUEL’s Market Position

SEROQUEL accounts for a significant share of the SGA segment, with sales predominantly generated in the United States, Europe, and emerging markets such as Asia-Pacific. Its leading position stems from its efficacy, tolerability profile, and broad label indications. Notably, the drug’s extended-release (XR) formulation has expanded its user base by improving adherence.

Indication Landscape

- Schizophrenia: Estimated to affect over 20 million globally, with SGAs being first-line treatments ([3]). SEROQUEL’s efficacy in this indication is well-established.

- Bipolar Disorder: Affects approximately 60 million worldwide. SEROQUEL is approved for bipolar I and II, with usage increasing amid growing awareness.

- Major Depressive Disorder (MDD): Approved as an adjunct, reflecting its versatility.

- Off-label Uses: Insomnia, agitation, and other psychiatric conditions, though these are less formally sanctioned and influence sales variability.

Market Penetration & Competition

SEROQUEL’s primary rivals include risperidone, olanzapine, aripiprazole, and others. Its competitive edge relies on a favorable side effect profile, especially reduced metabolic risks, and flexible dosing options.

Regulatory and Patent Landscape

Patent Expiry and Generic Competition

The primary patent expired in various jurisdictions by 2016, resulting in significant generic entry, leading to price competition and market share erosion. Despite this, branded SEROQUEL maintains profitability due to its branded recognition, formulations, and expanding indications.

Regulatory Approvals and Variations

Recent approvals include SEROQUEL XR for additional indications like depressive episodes and personalized dosing guidelines. Regulatory agencies continue to endorse its safety profile, facilitating sustained market access.

Sales Projections

Historical Sales Performance

- 2017-2021: Global sales hovered around USD 4.8 billion annually, with a peak near USD 5.1 billion in 2019, then stabilized amidst generic competition.

Forecasting Methodology

Sales projections leverage historic data, market growth rates, patent status, and pipeline developments. Anticipated factors include:

- Reimbursement policies

- New indications (e.g., personalized psychiatry)

- Geographic expansion

- Competitor dynamics

Projected Sales (2023-2030)

| Year | Estimated Global Sales (USD billions) | Notes |

|---|---|---|

| 2023 | 1.8 - 2.1 | Market stabilization, generic pressure persists |

| 2024 | 2.0 - 2.4 | Introduction of new formulations and expanded uses |

| 2025 | 2.3 - 2.8 | Potential market expansion in Asia |

| 2026 | 2.5 - 3.2 | Possible increased penetration, newly approved indications |

| 2027 | 2.8 - 3.5 | Continued growth, slight market saturation |

| 2028 | 3.0 - 3.8 | Competitive launches and biosimilars impact |

| 2029 | 3.2 - 4.0 | Evolution of treatment guidelines enhances use |

| 2030 | 3.5 - 4.5 | Long-term sustained growth driven by demand |

Key Drivers and Risks

- Drivers: Growing diagnosis rates, evolving treatment algorithms favoring SGAs, increased awareness, and expanding indications.

- Risks: Patent cliffs leading to generic competition, safety concerns (metabolic side effects), price erosion, and regulatory challenges in certain markets.

Emerging Opportunities

- Personalized Medicine: Pharmacogenomics may enhance SEROQUEL’s utilization in tailored therapies.

- New Formulations: Once-daily XR, depot injections, and combination therapies can improve adherence.

- Market Expansion: Focused entry into Asia-Pacific and Latin American markets is critical, leveraging local healthcare infrastructure.

Conclusion

SEROQUEL retains a prominent role within the schizophrenia and bipolar disorder treatment markets, with global sales expected to sustain modest growth despite challenges posed by generics. The drug’s diversified indications, formulation innovations, and ongoing regulatory approvals act as significant tailwinds. Strategic focus on emerging markets and personalized therapeutics will be pivotal to unlocking future sales potential.

Key Takeaways

- The global SEROQUEL market is projected to grow to approximately USD 4.5 billion by 2030, driven by new indications and market expansion.

- Patent expiries necessitate strategic diversification in formulations and indications to sustain revenue streams.

- Competition from generics remains a primary challenge; differentiation hinges on formulation innovations and label expansions.

- Emerging markets and personalized psychiatry offer significant growth opportunities.

- Ongoing safety data and regulatory support will influence market stability and future sales trajectories.

FAQs

1. How has patent expiration impacted SEROQUEL sales?

Patent expirations in 2016 and subsequent years led to increased generic competition, significantly reducing per-unit prices and overall sales volume in mature markets. Despite this, branded SEROQUEL maintains market share through expanded indications and formulations.

2. What are the main competitors to SEROQUEL?

Key competitors include aripiprazole (Abilify), risperidone, olanzapine, and newer agents like brexpiprazole. Market differentiation largely hinges on side-effect profiles and dosing convenience.

3. Will new formulations of SEROQUEL boost future sales?

Yes. The introduction of extended-release (XR) versions and depot formulations enhances adherence and tolerability, likely driving incremental sales, especially in outpatient settings.

4. How significant is the emerging markets segment for SEROQUEL?

Highly significant. Regions such as Asia-Pacific, Latin America, and Africa present growing demand due to rising mental health awareness, increasing diagnosis rates, and expanding healthcare coverage.

5. What are the future regulatory prospects for SEROQUEL?

Ongoing clinical trials and label extensions, including use in depression and personalized psychiatry, may secure regulatory approvals that expand its market footprint and sustain long-term sales.

References

[1] Market Research Future. (2022). Global Antipsychotic Drugs Market Insights.

[2] Allied Market Research. (2022). Psychedelic and Psychiatric Drugs Market Size & Trends.

[3] World Health Organization. (2021). Mental Health Atlas.

More… ↓