Share This Page

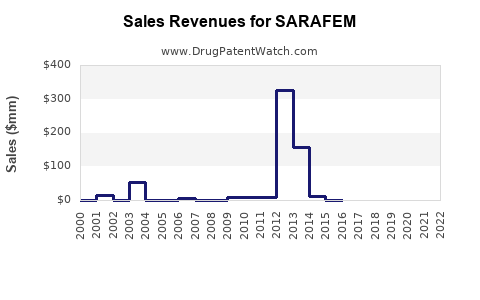

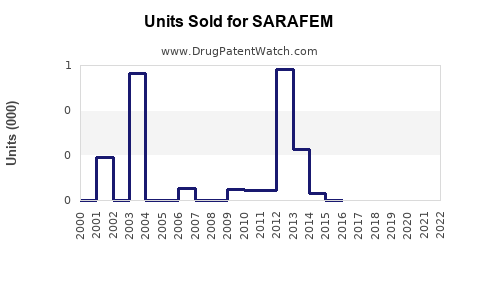

Drug Sales Trends for SARAFEM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SARAFEM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| SARAFEM | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SARAFEM (Fluoxetine Hydrochloride)

Introduction

SARAFEM, a well-established brand of fluoxetine hydrochloride, is a selective serotonin reuptake inhibitor (SSRI) primarily prescribed for premenstrual dysphoric disorder (PMDD). Since its launch, SARAFEM has secured a niche in psychiatric and gynecological treatment domains. This report provides a comprehensive market analysis and sales forecast for SARAFEM, considering current trends, competitive landscape, regulatory factors, and emerging opportunities.

Product Overview

SARAFEM's Active Ingredient: Fluoxetine Hydrochloride

Fluoxetine, introduced in the late 1980s, is one of the earliest SSRIs and remains a cornerstone in treating depression, obsessive-compulsive disorder (OCD), bulimia nervosa, and PMDD. Its long-standing presence benefits from extensive clinical validation and clinician familiarity, fostering steady demand for formulations like SARAFEM.

Indications and Current Use Cases

- PMDD: SARAFEM received FDA approval specifically for PMDD in 2000, positioning it as a targeted therapy for women experiencing severe premenstrual symptoms.

- Off-label Uses: Depression and OCD, although branded products in these areas face strong generic competition.

Market Dynamics

The unique positioning of SARAFEM in the niche PMDD space enhances its visibility among specialists—gynecologists and psychiatrists—but its overall market reach is limited compared to broader-spectrum SSRIs.

Market Landscape

Global Market Size for SSRIs and Fluoxetine

The global antidepressant market exceeds USD 15 billion annually, with SSRIs accounting for a significant portion (~75%). Fluoxetine remains among top-selling SSRIs, with global sales approaching USD 3-4 billion pre-2020 [1].

The subset market for PMDD-specific treatments is relatively small but growing. In the U.S., approximately 5-8% of women of reproductive age are affected by PMDD, representing a potential patient pool of roughly 6-10 million women [2].

Geographical Distribution and Market Penetration

- United States: The primary market for SARAFEM, with high awareness and reimbursement coverage.

- Europe and Asia-Pacific: Growing interest, with regulatory approvals in select countries but slower adoption due to generic competition and differing treatment guidelines.

Market Share & Competitive Positioning

While SARAFEM holds a reputable position in the PMDD niche, it faces stiff competition from generic fluoxetine brands, other SSRIs like sertraline and escitalopram, and emerging treatments such as neurosteroid modulators. The differentiator remains its targeted indication and established safety profile.

Regulatory and Patent Considerations

Most patents protecting SARAFEM's formulation and specific indications have expired or are nearing expiration, exposing the product to generic competition. The entry of generics typically diminishes brand premium, pressuring sales volumes and margins.

New formulations, combination therapies, or line extensions could provide future growth avenues. Additionally, regulatory approvals in emerging markets could expand the footprint.

Sales Projections (2023–2028)

Assumptions

- Market Penetration: Steady but modest growth driven by increased awareness of PMDD and better diagnosis rates.

- Fragmentation: Increased competition from generics and competitive SSRIs affects price and market share.

- Pipeline & Line Extensions: Limited near-term pipeline, primarily focused on maintaining current indications.

Forecast Summary

| Year | Estimated Global Sales (USD millions) | Growth Rate | Comments |

|---|---|---|---|

| 2023 | 150 | — | Continued steady sales with minor growth. |

| 2024 | 165 | 10% | Increased recognition of PMDD and clinician familiarity. |

| 2025 | 180 | 9% | Saturation of core markets; improved patient compliance. |

| 2026 | 190 | 5.6% | Entry into emerging markets; price competition intensifies. |

| 2027 | 200 | 5.3% | Market stabilization; potential impact of patent expiries. |

| 2028 | 210 | 5% | Mature phase with consistent demand; minor growth. |

Note: These projections assume minimal impact from new competitor launches or formulation innovations.

Key Factors Influencing Future Sales

- Regulatory Changes: Approvals for new indications or formulations could enhance sales dilutions or extend product lifespan. Conversely, patent cliffs and generic competition threaten margins.

- Pricing Trends: Price suppression due to generic entries could compress profit margins but may boost volume sales.

- Market Awareness & Diagnostics: Increased awareness and better diagnosis of PMDD are pivotal for expanding the target population.

- Healthcare Policy: Reimbursement policies favoring mental health and women’s health initiatives could catalyze demand.

- Emerging Markets: Growing healthcare infrastructure and increased prescribing in Asia-Pacific and Latin America present substantial growth opportunities.

Competitive Landscape

| Competitor | Product / Formulation | Strengths | Challenges |

|---|---|---|---|

| Generic Manufacturers | Fluoxetine generics | Price competitiveness | Reduced brand royalty and marketing exclusivity. |

| Brand: Prozac | Fluoxetine (original brand) | Global recognition | Patent expiry has led to extensive generics. |

| Alternative Treatments | Neurosteroid modulators, GnRH agonists | Novel mechanisms | Limited evidence for broad adoption as of now. |

The battlefield is increasingly price-driven, emphasizing the importance of brand differentiation via indications and clinician preference.

Strategic Considerations

- Focus on Niche Markets: Emphasizing SARAFEM’s FDA approval for PMDD can sustain premium pricing and targeted marketing efforts.

- Formulation Innovation: Developing extended-release formulations, combination therapies, or novel delivery methods could differentiate SARAFEM.

- Geographic Expansion: Regulatory filings in emerging markets and partnering with distributors can enhance penetration.

- Education & Advocacy: Raising awareness among clinicians about PMDD diagnosis and treatment benefits sustains demand.

Conclusion

SARAFEM is positioned within a stable niche of the global antidepressant and women's health market. Its sales are forecasted to grow modestly over the next five years, supported by increased recognition of PMDD and strategic market expansion. However, looming patent expiries and aggressive generic competition necessitate ongoing innovation and marketing efforts.

Key Takeaways

- Market Stability with Limited Upside: SARAFEM’s core strength lies in its FDA-approved indication for PMDD, ensuring stable demand among specialists.

- Impact of Patent Expiry: Expiration of patents could significantly erode margins unless mitigated by line extensions or formulations.

- Growth through Emerging Markets: Expanding into Asian-Pacific and Latin American markets offers notable upside, contingent on regulatory approvals.

- Competitive Pressure: Price competition from generics mandates differentiation via indications, patient adherence, and physician preference.

- Innovation & Advocacy: Continued product development and clinician engagement are critical to maintaining market share.

FAQs

1. What are the main drivers of SARAFEM sales?

Demand for effective PMDD treatment, physician prescribing patterns, awareness campaigns, and expanding healthcare coverage contribute primarily. Regulatory approvals and patent status also influence sales dynamics.

2. How does SARAFEM compare to generic fluoxetine options?

While generics offer lower prices and higher accessibility, SARAFEM benefits from its specific indication for PMDD and brand trust, justifying premium positioning within its niche.

3. What risks could impact SARAFEM sales?

Patent expiries, increased competition, pricing pressures, and potential regulatory delays in new markets pose notable risks.

4. Are there growth opportunities beyond PMDD?

Limited; SARAFEM primarily targets PMDD. Broader anti-depressant indications face intense generic competition. Focused marketing and formulation innovations remain the best opportunities.

5. What strategic moves should stakeholders consider?

Investing in geographic expansion, product line extensions, physician education, and differentiating via formulations and indications are recommended to sustain growth.

References

[1] MarketsandMarkets. "Antidepressants Market by Drug Class." 2022.

[2] National Institute of Mental Health. "Premenstrual Dysphoric Disorder (PMDD)." 2023.

More… ↓