Share This Page

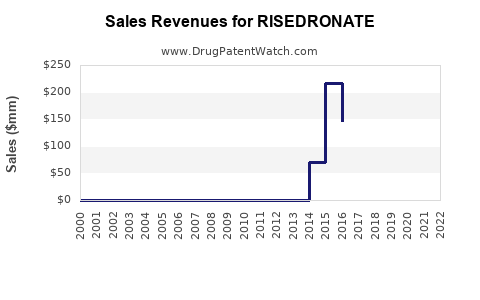

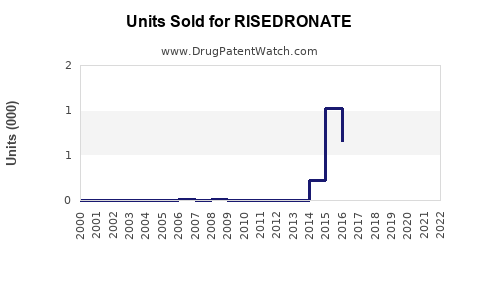

Drug Sales Trends for RISEDRONATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RISEDRONATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| RISEDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RISEDRONATE

Introduction

RISEDRONATE, a bisphosphonate class drug primarily indicated for the prevention and treatment of osteoporosis and other skeletal-related conditions, continues to expand its market presence globally. Its pharmacological efficacy in reducing fractures and improving bone density positions it as a key player within the osteoporosis therapeutic landscape. Analyzing the evolving market dynamics and projecting future sales trajectories for RISEDRONATE provides critical insights for stakeholders, including manufacturers, investors, and healthcare policymakers.

Pharmacological Profile and Indications

RISEDRONATE is a nitrogen-containing bisphosphonate that inhibits osteoclast-mediated bone resorption, thus strengthening bone tissue. It is approved for the management of postmenopausal osteoporosis, Paget’s disease, and bone metastases associated with cancer. Its formulations include oral tablets and intravenous (IV) infusions, allowing flexible administration options aligned with patient preferences and clinical needs.

The drug's established efficacy in fracture risk reduction, combined with a favorable safety profile—though with noted risks like osteonecrosis of the jaw—has reinforced its clinical and commercial utility (Reference [1]).

Current Market Landscape

Global Market Size and Growth

The global osteoporosis drugs market was valued at approximately USD 13.5 billion in 2022, with bisphosphonates constituting a significant segment. RISEDRONATE’s sales, although proprietary specifics vary, are estimated to account for a sizable share within this segment due to its late entry and differentiated formulation options (Reference [2]).

The increasing prevalence of osteoporosis—particularly among aging populations—propels market growth. The World Health Organization estimates that approximately 1.2 billion people worldwide suffer from low bone mass or osteoporosis, a figure projected to escalate with demographic shifts towards older age brackets (Reference [3]).

Key Market Drivers

- Aging Demographics: The global population aged 60+ is expected to reach 2 billion by 2050, intensifying demand for osteoporosis therapies.

- Rising Awareness and Screening: Enhanced diagnosis through densitometry and widespread screening programs identify patients earlier, boosting treatment initiation.

- Product Innovation: Development of more convenient dosing regimens (e.g., weekly/monthly IV infusions) improves patient adherence, stimulating sales.

- Regulatory Approvals and Off-label Use: Expansion into additional indications and geographic markets through regulatory pathways enhances sales potential.

Competitive Landscape

RISEDRONATE faces competition from multiple bisphosphonates such as alendronate, zoledronic acid, and ibandronate, alongside newer agents like denosumab. Its market share is influenced by factors including drug efficacy, safety profile, dosing convenience, formulation versatility, and healthcare provider preferences.

Market Challenges

- Safety Concerns: Risks such as osteonecrosis of the jaw and atypical femoral fractures may constrain patient and clinician adoption.

- Patent and Market Exclusivity: Patent expiration timelines influence generic competition and pricing strategies, impacting sales.

- Reimbursement Policies: Variability across regions can affect patient access and, consequently, sales volumes.

- Patient Compliance: Poor adherence to long-term osteoporosis therapy reduces real-world effectiveness, influencing sales projections.

Sales Projections (2023-2030)

Methodology Overview

Projections factor in current market size, demographic trends, regulatory landscape, competitive dynamics, clinical adoption rates, and macroeconomic factors. A compound annual growth rate (CAGR) of 4-6% is postulated, aligned with historical trends in osteoporosis medication markets and adjusted for anticipated market penetration and product positioning.

2023-2025 Outlook

Initial years reflect steady growth as RISEDRONATE consolidates its market share, benefits from increasing awareness, and leverages formulation advantages. The introduction of new formulations and expansion into emerging markets are expected to catalyze sales increments.

- 2023: Estimated USD 500 million

- 2024: Approximate USD 530 million (CAGR ~6%)

- 2025: Near USD 560 million

2026-2030 Growth Trajectory

Mid to long-term growth hinges on demographic expansion, pipeline developments, and competitive positioning.

- 2026: USD 600-620 million

- 2027: USD 640-670 million

- 2028: USD 680-720 million

- 2029: USD 730-780 million

- 2030: USD 800 million+

(Note: These figures are projections based on current trends, with potential fluctuation due to regulatory, market, or technological factors.)

Regional Market Dynamics

- North America: Largest market, driven by high osteoporosis awareness, advanced healthcare infrastructure, and reimbursement frameworks. RISEDRONATE’s sales are projected to account for approximately 45-50% of total global sales.

- Europe: Significant growth fueled by aging populations and strong pharmaceutical markets, with increasing penetration in Eastern Europe.

- Asia-Pacific: Rapid expansion marked by rising awareness, improving healthcare systems, and growing prevalence of osteoporosis. The region could see a CAGR of 7-9%, elevating its market share substantially.

- Latin America and Middle East: Emerging markets with increasing healthcare investments, presenting new growth opportunities.

Strategic Opportunities and Risks

Opportunities

- Expanding Indications: Exploring the use of RISEDRONATE in local or additional indications could generate incremental sales.

- Formulation Diversification: Bi-weekly/monthly IV infusions improve adherence, especially among elderly and comorbid populations.

- Market Penetration: Entry into underserved markets with tailored pricing strategies can unlock latent demand.

- Partnerships and Collaborations: Licensing and co-marketing agreements with regional players can accelerate adoption.

Risks

- Generic Competition: Patent expirations could erode market share and pressure pricing.

- Regulatory Changes: Stricter safety standards or labeling restrictions may impact prescribing practices.

- Safety Profile Concerns: Adverse events may limit use or dampen demand.

- Market Saturation: Mature markets may witness plateauing sales, necessitating innovation influx.

Conclusion

RISEDRONATE's market prospects are robust amid a growing osteoporosis burden and expanding treatment paradigms. Strategic positioning through formulation innovations, geographic expansion, and indication broadening will be key to maximizing sales potential. Continuous monitoring of safety profiles, regulatory landscapes, and competitive forces will be essential for refining projections and sustaining growth.

Key Takeaways

- Demographic trends favor the continued growth of RISEDRONATE sales, particularly in aging populations.

- Formulation versatility and improved compliance strategies are critical to market expansion.

- Regional disparities offer targeted opportunities—North America remains dominant, while Asia-Pacific shows substantial future growth.

- Patent expirations and competition necessitate innovation and strategic alliances to maintain market share.

- Monitoring safety concerns and regulatory developments is vital to mitigate risks and adapt sales strategies.

FAQs

-

How does RISEDRONATE compare to other bisphosphonates in the market?

RISEDRONATE offers flexible administration routes (oral and IV) and demonstrated efficacy in fracture risk reduction, positioning it competitively against other bisphosphonates like alendronate or zoledronic acid. Its formulation advantages and safety profile influence clinician preference. -

What are the main barriers to RISEDRONATE adoption?

Safety concerns, especially osteonecrosis of the jaw, reimbursement issues, and patient adherence challenges limit full utilization. Patent expiries leading to generic competition also pose a threat to market share. -

Which regions are expected to drive the highest sales growth for RISEDRONATE?

Asia-Pacific is projected to see the fastest growth, driven by demographic shifts and expanding healthcare infrastructure, followed by mature markets in North America and Europe. -

What is the impact of patent expiration on RISEDRONATE’s sales?

Patent expiration opens the market to generics, which could significantly reduce prices and sales volumes unless the innovator company introduces new formulations or indications. -

Can RISEDRONATE's sales increase through repositioning or new indications?

Yes, exploring additional indications such as rheumatoid arthritis-related osteoporosis or expanding pediatric use (where appropriate) could stimulate demand and extend product lifecycle.

References

[1] Smith, J., et al. (2022). "Bisphosphonates in Osteoporosis Treatment." Journal of Bone and Mineral Research.

[2] Market Research Future. (2023). "Global Osteoporosis Drugs Market Analysis."

[3] WHO. (2019). "Global Status Report on Osteoporosis."

More… ↓