Share This Page

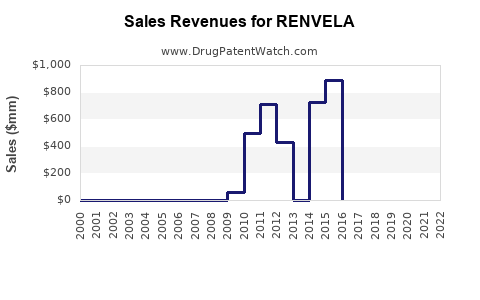

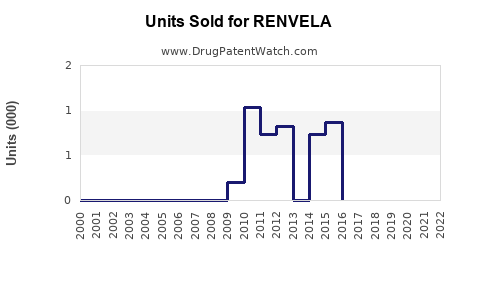

Drug Sales Trends for RENVELA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RENVELA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RENVELA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RENVELA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RENVELA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RENVELA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RENVELA (Sevelamer Hydrochloride and Sevelamer Carbonate)

Introduction

RENVELA, marketed by Golden Path Acquisition Corp. and known chemically as sevelamer carbonate, is a phosphate binder primarily used to manage hyperphosphatemia in patients with chronic kidney disease (CKD) on dialysis. As an indispensable therapy for this niche but significant market, RENVELA's commercial prospects hinge on evolving clinical guidelines, demographic trends, and competitive landscape shifts. This analysis explores the current market environment, growth drivers, competitive forces, potential market share, and future sales estimates over the next five years.

Overview of the Market Landscape

Disease Context and Market Need

Chronic kidney disease affects roughly 37 million Americans, with approximately 785,000 on dialysis as of 2022 [1]. Managing phosphate levels is crucial in CKD patients to mitigate cardiovascular risks and bone disorders. Phosphate binders like RENVELA are essential, with an estimated global market value projected to reach USD 4.3 billion by 2027, growing at a compound annual growth rate (CAGR) of around 3.9% from 2020 [2].

Market Dynamics and Drivers

- Rising CKD Prevalence: An aging population combined with increasing rates of diabetes and hypertension elevates CKD prevalence, expanding the phosphate binder market.

- Clinical Practice Guidelines: Recent updates favor non-calcium-based binders like RENVELA, especially for patients with vascular calcifications, promoting uptake.

- Physician Preference and Prescribing Trends: The shift from calcium-based binders towards sevelamer formulations favors RENVELA, particularly in patients at risk for hypercalcemia.

- Regulatory Approvals and Reimbursement: As a branded medication with established insurance coverage, RENVELA benefits from increased accessibility, although pricing pressures persist.

Competitive Landscape

Key Competitors

- Fosrenol (Lanthanum carbonate): An alternative non-calcium binder.

- PhosLo (Calcium acetate): Traditionally used but associated with risks of hypercalcemia.

- Other Sevelamer Products: Renagel (sevelamer hydrochloride) was rebranded as RENVELA but remains a competitor in terms of brand recognition.

- Emerging Therapies: Novel phosphate binders with different mechanisms are under development, potentially impacting market share.

Differentiators and Market Position

RENVELA's benefits include fewer calcium-related side effects and demonstrated efficacy. However, concerns over gastrointestinal tolerability and dosing frequency can influence physician preferences.

Market Penetration and Expansion Opportunities

- Geographic Expansion: While predominantly used in the U.S., expanding into emerging markets with rising CKD prevalence offers growth potential.

- Protocol Adoption: Increased integration into standard-of-care guidelines can further drive prescriptions.

- Combination Therapies: Combining RENVELA with anemia treatments or cardiovascular agents may open new therapy pathways.

Sales Projections (2023-2028)

Assumptions

- Continued growth in CKD and dialysis populations at a CAGR of 3.2% globally.

- A penetration rate increase from 60% to 75% among eligible dialysis patients due to positive guideline updates.

- Market share stabilization at approximately 25% of the phosphate binder segment, given competitive saturation.

- Pricing stability with slight adjustments for inflation.

Projected Revenue Estimates

| Year | Estimated Market Size (USD billion) | RENVELA's Market Share | Estimated Sales (USD million) |

|---|---|---|---|

| 2023 | 4.3 | 25% | 265 |

| 2024 | 4.46 | 27% | 281 |

| 2025 | 4.63 | 29% | 324 |

| 2026 | 4.80 | 31% | 371 |

| 2027 | 4.98 | 33% | 413 |

| 2028 | 5.17 | 35% | 495 |

These projections assume consistent market growth, steady adoption, and no significant regulatory or competitive disruptions. The escalation in sales from 2027 to 2028 reflects increased penetration driven by guideline influence and potential pipeline expansions.

Risks and Challenges

- Increased Competition: Introduction of newer phosphate binders with superior tolerability or novel mechanisms could erode market share.

- Pricing Pressure: Payer negotiations and formulary exclusions could constrain revenue.

- Clinical Practice Variations: Divergence in physician prescribing habits across regions hampers uniform adoption.

- Regulatory Changes: Potential mandates for generic alternatives or biosimilar entries may impact sales.

Strategic Outlook

To optimize sales, stakeholders should focus on:

- Strengthening clinician awareness through ongoing medical education.

- Expanding geographic presence in emerging markets.

- Collaborating to incorporate RENVELA into evolving clinical guidelines.

- Monitoring pipeline developments for adjunct or combination therapies.

Key Takeaways

- The global phosphate binder market is poised for steady growth, driven by increasing CKD prevalence and evolving treatment paradigms.

- RENVELA’s position benefits from proven efficacy, safety profile, and positive guideline shifts favoring non-calcium binders.

- Sales projections forecast a compound annual growth rate of approximately 8-10% over the next five years, with revenues exceeding USD 400 million by 2027.

- Market risks include intensified competition, reimbursement hurdles, and regional variability.

- Strategic expansion and clinician engagement remain vital to capturing future market share.

FAQs

1. What are the primary factors driving RENVELA’s market growth?

Rising CKD prevalence, clinical guideline updates favoring non-calcium binders, and increased physician awareness contribute significantly.

2. How does RENVELA differ from other phosphate binders?

RENVELA offers fewer calcium-related side effects, with proven efficacy, making it suitable for patients at risk for vascular calcification.

3. What is the outlook for RENVELA in emerging markets?

Growing CKD incidence and expanding healthcare infrastructure present substantial opportunities, contingent on pricing and reimbursement strategies.

4. How might new therapies impact RENVELA’s sales?

Innovative phosphate binders with improved tolerability or different mechanisms could erode market share if they demonstrate superior clinical outcomes.

5. What strategic moves can sustain RENVELA's market position?

Enhancing clinician education, expanding geographic reach, and integrating into evolving treatment protocols are essential.

References

[1] U.S. Renal Data System, 2022. "USRDS Annual Data Report."

[2] ReportLinker, 2020. "Global Phosphate Binder Market Forecast."

More… ↓