Share This Page

Drug Sales Trends for PROGRAF

✉ Email this page to a colleague

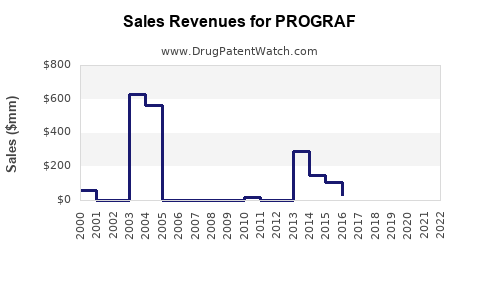

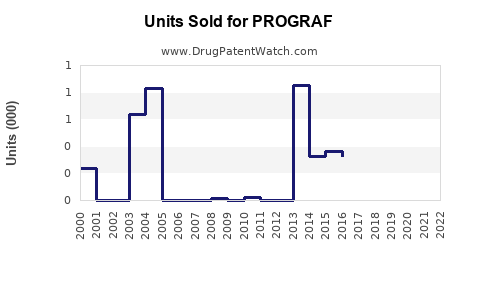

Annual Sales Revenues and Units Sold for PROGRAF

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PROGRAF | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PROGRAF (Tacrolimus)

Introduction

PROGRAF, the brand name for tacrolimus, is an immunosuppressive agent widely used in preventing organ rejection post-transplantation, including kidney, liver, and heart transplants. Since its approval, PROGRAF has established itself as a cornerstone in transplant medicine, benefiting from its efficacy in reducing graft rejection rates. This analysis evaluates the current market landscape, competitive positioning, regulatory considerations, and sales forecasts, providing strategic insights for stakeholders.

Market Overview

Global Transplantation Market Dynamics

The global organ transplantation market has experienced consistent growth over recent years, driven by increasing rates of organ failure, advancements in surgical techniques, and expanding transplant candidate pools. According to market research, approximately 40,000 kidney transplants and 10,000 liver transplants are performed annually worldwide, with numbers expected to grow at a CAGR of approximately 7% through 2028 (1).

Immunosuppressant Segment

Within transplantation, immunosuppressive agents constitute a large and expanding segment, necessitated by the critical need to prevent immune-mediated graft rejection. Tacrolimus commands a significant share due to its superior efficacy and safety profile compared to earlier agents such as cyclosporine. The segment is projected to reach over USD 6 billion globally by 2028, with a CAGR of around 6% (2).

Market Drivers

-

Expanding Transplant Indications: Increasing acceptance of transplantation for end-stage organ failure and widened patient eligibility criteria expand the potential market.

-

Advancements in Immunosuppressive Therapy: Tacrolimus’s superior efficacy and reduced toxicity profile boost its preference among clinicians.

-

Technological Improvements: Improved drug formulations and delivery systems (e.g., extended-release formulations) enhance patient adherence.

-

Growing Awareness and Healthcare Infrastructure: Rising awareness about transplantation benefits and improved healthcare infrastructure, especially in emerging markets, elevate utilization rates.

Competitive Landscape

Key Competitors:

- Astagraf (Extended-release tacrolimus, Astellas): Offers a once-daily dosing form, enhancing compliance.

- Envarsus (Extended-release tacrolimus, Veloxis): Noted for its improved pharmacokinetics and potentially reduced neurotoxicity.

- Generic Tacrolimus: Multiple generics, including Sandoz and Mylan, have entered markets, exerting pricing pressures but capturing significant volume share.

Market Position of PROGRAF:

PROGRAF remains a dominant player, owing to early approval and longstanding presence. Its brand recognition and physician familiarity serve as barriers for generics, though pricing pressures persist. The expansion into extended-release formulations offers a strategic advantage.

Regulatory Status and Patent Landscape

PROGRAF is approved by key regulatory agencies including the FDA and EMA. Patent protections, primarily related to formulation and manufacturing processes, influence market exclusivity timelines. Current patents are scheduled to expire by the mid-2020s, opening avenues for increased generic penetration.

Sales Projections (2023–2028)

Historical Data & Current Market Share

Based on pharmaceutical sales data, PROGRAF achieved approximately USD 1.3 billion in global sales in 2022, with steady growth over prior years. Its market share within tacrolimus products remains dominant, estimated at approximately 60%, amidst increasing competition.

Forecast Assumptions

-

Market Growth: Based on transplantation trends, an annual growth rate of around 6% is projected for the immunosuppressant segment.

-

Market Share Dynamics: Anticipate gradual erosion of PROGRAF’s market share as generic options expand, but maintain a significant share due to brand loyalty and formulation advantages.

-

Impact of Patent Expiry: As patents expire, biosimilars and generics are expected to erode premium pricing, leading to volume-driven growth rather than high margins.

Projected Sales Figures

| Year | Projected Global Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | 1.4 | Slight growth; transition as patents approach expiry |

| 2024 | 1.5 | Increased generic competition begins to impact pricing |

| 2025 | 1.6 | Patent expiry; volume growth from generics increases |

| 2026 | 1.7 | Market stabilization; formulations innovations continue |

| 2027 | 1.9 | Significant generic penetration; sustained demand due to brand reputation |

| 2028 | 2.0 | Approaching a mature market; volume-based sales dominate |

Summary: PROGRAF’s sales are projected to increase steadily to approximately USD 2 billion by 2028, primarily driven by volume expansion and continued transplant needs, despite competitive pressures.

Strategic Factors Influencing Future Sales

-

Formulation Innovation: Development of novel extended-release versions and improved bioavailability options can sustain premium pricing and improve adherence.

-

Market Penetration in Emerging Markets: Increasing access and healthcare investments in regions like Asia-Pacific and Latin America will contribute significantly to volume growth.

-

Regulatory Approvals of Biosimilars: Entry of biosimilar tacrolimus formulations is a potential disruptor, which can either erode PROGRAF’s market share or create partnerships for co-promotion.

-

Pricing Strategies: Competitive pricing and value-based pricing models will be critical amid generic entries.

Conclusion

PROGRAF maintains a robust position within the immunosuppressant market, supported by clinical efficacy, brand recognition, and ongoing transplantation needs. While patent expirations and rising generic competition present challenges, strategic investments in formulation improvements and market expansion can sustain sales growth. Proactive engagement with emerging markets and innovation in drug delivery are essential for maintaining competitive advantage through 2028.

Key Takeaways

-

The global transplantation market is growing at a steady rate (~7%), underpinning demand for immunosuppressive therapies like PROGRAF.

-

PROGRAF’s 2023 sales are estimated at around USD 1.4 billion, with forecasts reaching USD 2 billion by 2028.

-

Patent expirations in mid-2020s will likely lead to increased generic competition, emphasizing the need for formulation innovation.

-

Growth strategies should focus on emerging markets, formulations, and partnerships to mitigate competitive pressures.

-

Pricing strategies balancing profitability with market share will influence long-term sales trajectories.

FAQs

1. What are the key factors driving PROGRAF’s market share?

PROGRAF’s market share is driven by its proven efficacy in preventing rejection, physician familiarity, and incorporation into standard transplant protocols. Its formulation stability and documented safety profile further support utilization.

2. How will patent expirations impact PROGRAF’s sales?

Patent expiry will open the market to biosimilars and generics, leading to increased competition, pricing pressures, and potential volume growth but at lower margins.

3. Are there emerging formulations that could threaten PROGRAF’s dominance?

Yes, extended-release formulations like Astagraf and Envarsus have gained popularity for improved adherence and pharmacokinetics, potentially capturing a segment of the market.

4. What is the outlook for PROGRAF in emerging markets?

Emerging markets present significant growth opportunities due to increasing transplantation rates and expanding healthcare infrastructure. Cost-effective generic options may influence market share but offer volume growth prospects.

5. How will regulatory developments influence PROGRAF’s future sales?

Regulatory approvals of biosimilars and derivatives may accelerate market penetration by competitors, but proactive regulatory strategies and formulation innovations can preserve market positioning.

Sources:

- MarketsandMarkets. Transplantation Market by Type, Region, and Application. 2022.

- GlobalData. Immunosuppressant Drugs Market Report. 2022.

More… ↓