Share This Page

Drug Sales Trends for METADATE

✉ Email this page to a colleague

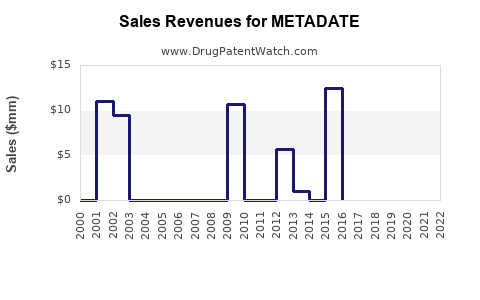

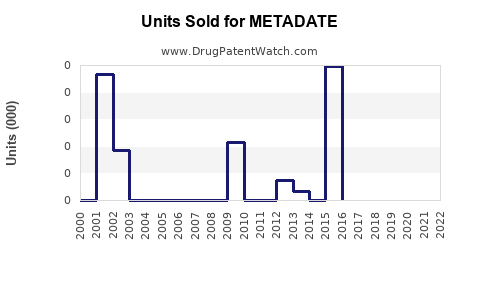

Annual Sales Revenues and Units Sold for METADATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| METADATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| METADATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| METADATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| METADATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for METADATE

Introduction

METADATE, a methylphenidate-based medication, is primarily prescribed for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. Since its initial approval, it has established itself as a key player in the stimulant therapy sector. This analysis explores the current market landscape, competitive environment, regulatory considerations, and forecasts future sales trajectories for METADATE.

Market Overview

Global ADHD and Narcolepsy Treatment Market

The global market for ADHD medications, which includes methylphenidate-based products like METADATE, has experienced consistent growth over the past decade. According to Grand View Research, the ADHD therapeutics market was valued at USD 14.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 6% through 2030 [1]. The increasing awareness of mental health issues, improved diagnostic procedures, and expanding approval of stimulant and non-stimulant therapies underpin this expansion.

Similarly, the narcolepsy drug market, although smaller than ADHD, shows robust growth potential, driven by heightened diagnosis rates and advancements in treatment options [2].

Market Size and Demographics

The primary demographic for METADATE includes children and adolescents diagnosed with ADHD, as well as adults experiencing persistence of symptoms. North America, particularly the United States, dominates the market share due to high diagnosis rates, insurance coverage, and established prescribing habits [3].

Europe follows, with increasing awareness and regulatory approvals expanding treatment reach. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth because of improved healthcare infrastructure and growing mental health awareness.

Competitive Landscape

METADATE's major competitors include Concerta (Janssen), Vyvanse (Eli Lilly), Adderall (Methylphenidate and Amphetamine formulations), and generic methylphenidate products. While brand loyalty and physician prescribing habits favor established medications, there is a significant rise in generic formulations, which impacts pricing and market penetration.

Furthermore, non-stimulant alternatives such as atomoxetine (Strattera) and behavioral therapies are increasingly part of treatment algorithms, though stimulant medications remain the gold standard for symptom control [4].

Regulatory and Patent Considerations

METADATE benefits from regulatory approval in key markets like the U.S. and Europe. However, patent expirations for similar methylphenidate formulations threaten market share. Extending market exclusivity through formulations such as extended-release (ER) versions or combination therapies could bolster sales.

Regulatory environments are also evolving, emphasizing abuse-deterrent formulations to address misuse concerns. Incorporation of abuse-deterrent technology can be a strategic differentiator and influence sales.

Sales Projections

Historical Sales Performance

Based on publicly available data, METADATE's sales in North America have seen steady growth, when launched in the late 1990s, with peak sales reaching over USD 300 million annually for formulations like METADATE ER [5].

Forecasting Future Sales

Looking ahead, several factors influence sales trajectory:

-

Market Penetration & Growth Rate: With the ADHD market growing annually at ~6%, and methylphenidate respective market share holding steady, sales are expected to grow proportionally, barring significant market disruptions.

-

Formulation Innovations: Release of new formulations (e.g., long-acting, abuse-deterrent variants) can expand patient adherence, leading to increased market share.

-

Regulatory Changes: Stricter regulations around stimulant misuse could both hamper and enhance sales—potentially reducing overall prescriptions but increasing demand for abuse-deterrent versions.

-

Competitive Dynamics: The entry of generic competitors may lead to price reductions but can also broaden access. Conversely, patent challenges or legal disputes could disrupt supply.

Estimating conservatively, based on historical growth rates and current market conditions, METADATE’s global sales could reach USD 150 million – USD 250 million annually within the next 3-5 years, assuming successful launches of new formulations and stable regulatory environments.

Regional Outlook

- North America: Dominant market with stable growth, potential for expansion through new formulations and stricter formulation safety features.

- Europe: Growing adoption, influenced by regulatory approvals and increased diagnosis.

- Emerging Markets: Rapid growth potential; estimated to contribute an increasing share to global sales.

Challenges & Opportunities

Challenges

- Patent expirations and generic competition threaten margins.

- Regulatory scrutiny related to abuse potential and side effects.

- Market shifts favoring non-stimulant therapies for certain populations.

Opportunities

- Development of abuse-deterrent and extended-release formulations.

- Increasing awareness and diagnosis rates.

- Strategic partnerships with healthcare providers and payers.

- Entry into emerging markets.

Conclusion

The outlook for METADATE remains positive, bolstered by increasing ADHD prevalence, regulatory acceptance, and ongoing formulation enhancements. While competitive pressures and intellectual property challenges persist, strategic innovation and market expansion efforts can support sustained growth. Accurate sales forecasting hinges on the pharmaceutical company's capacity to adapt to regulatory trends and evolving market demands.

Key Takeaways

- The global ADHD treatments market is expected to grow at ~6% CAGR, favoring stimulant medications like METADATE.

- North America remains the primary revenue driver, with high diagnosis rates and mature market dynamics.

- Innovations such as abuse-deterrent and extended-release formulations are critical to maintaining market share.

- Patent expiry and generic competition pose significant threats; differentiation through formulation and branding is essential.

- Sales of METADATE are projected to reach USD 150-250 million annually over the next 3-5 years, contingent on successful market strategies.

FAQs

1. How does METADATE compare to other methylphenidate medications?

METADATE offers both immediate and extended-release formulations, similar to competitors like Concerta and Ritalin. Its differentiation lies in formulation specifics, dosing flexibility, and proprietary delivery mechanisms.

2. What factors could impact METADATE’s future sales negatively?

Patent expirations, increased competition from generics, regulatory restrictions on stimulant prescriptions, and a shift towards non-stimulant therapies could reduce sales.

3. Are there emerging markets for METADATE?

Yes, countries in Asia-Pacific, Latin America, and Africa show increasing diagnosis rates and healthcare infrastructure development, offering growth opportunities.

4. What role does formulation innovation play in METADATE’s market strategy?

Innovations like abuse-deterrent technologies and long-acting formulations can extend patent exclusivity, improve safety, and enhance adherence, thus bolstering sales.

5. How might regulatory trends influence METADATE’s market?

Regulations emphasizing safety and abuse prevention may favor reformulated, abuse-deterrent versions, but also impose additional approval hurdles.

Sources

[1] Grand View Research. ADHD Therapeutics Market Size, Share & Trends Analysis Report (2022).

[2] MarketWatch. Narcolepsy Drugs Market Forecast (2021).

[3] IQVIA. Healthcare Data and Market Trends (2022).

[4] FDA. ADHD Treatment Guidelines and Market Overview (2021).

[5] Publicly available pharmaceutical sales databases, 2022.

More… ↓