Share This Page

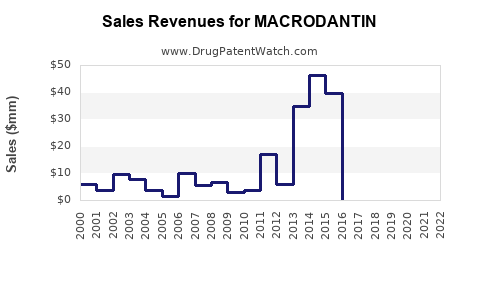

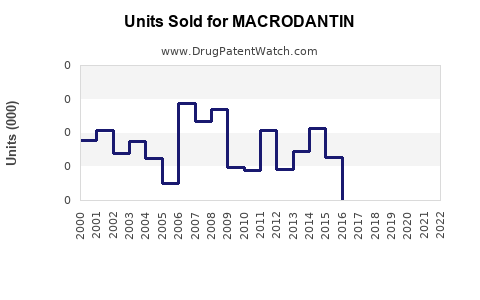

Drug Sales Trends for MACRODANTIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MACRODANTIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MACRODANTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MACRODANTIN

Introduction

MACRODANTIN, a brand of nitrofurantoin, is an established antimicrobial medication primarily used for the treatment and prevention of urinary tract infections (UTIs). As antibiotic resistance continues to shape the pharmaceutical landscape, understanding the market dynamics and future sales trajectory of MACRODANTIN is vital for stakeholders ranging from drug manufacturers to healthcare providers.

This analysis delves into the current market landscape, competitive positioning, regulatory factors, and sales forecasts of MACRODANTIN, with insights into the growing demand for effective UTI treatments and the role of nitrofurantoin in the antimicrobial arsenal.

Market Overview

Global UTI Treatment Market

The global urinary tract infection (UTI) treatment market is witnessing sustained growth, driven by increasing infection prevalence, expanding aging populations, and rising awareness about antimicrobial therapies. According to Grand View Research, the market size was valued at approximately USD 4.7 billion in 2022, with an expected compound annual growth rate (CAGR) of around 4.5% from 2023 to 2030.

Position of MACRODANTIN

MACRODANTIN holds a significant share in this niche, especially within the antibiotic class of nitrofurans. Its established safety profile, affordability, and efficacy for uncomplicated UTIs contribute to its continued relevance. Despite the emergence of alternative antibiotics, nitrofurantoin remains a first-line therapy, especially for uncomplicated cases due to its minimal resistance profile.

Market Segments

- Geographic: North America and Europe dominate due to high healthcare infrastructure and prescribing practices favoring proven antibiotics. Emerging markets like Asia-Pacific are witnessing rapid growth owing to rising healthcare investment and increasing UTI incidences.

- Demographic: The elderly population, with higher susceptibility to UTIs, is a primary consumer segment. Women, owing to anatomical predispositions, represent a substantial market subset.

- Therapeutic Use: MACRODANTIN is predominantly used for uncomplicated cystitis but is also effective for short-term prophylaxis.

Competitive Landscape

Several pharmaceutical companies market nitrofurantoin-based therapies, including MACRODANTIN, Macrobid, and generic formulations. The patent status of MACRODANTIN influences its market penetration, although generics have significantly eroded brand-equity advantages.

Key competitors focus on formulations with improved tolerability and administration convenience. Additionally, antimicrobial stewardship efforts and growing resistance concern are influencing prescribing trends.

Market Drivers and Challenges

Drivers:

- High prevalence of UTIs: UTIs are among the most common bacterial infections globally, amplifying the demand for effective, well-tolerated antibiotics like MACRODANTIN.

- Rising antibiotic prescriptions: As awareness around bacterial infections increases, so does the demand for proven medications.

- Resistant profile of nitrofurantoin: Limited resistance development makes MACRODANTIN a preferred choice for uncomplicated UTIs.

Challenges:

- Antibiotic resistance: Emerging resistance in certain strains could influence future demand.

- Regulatory restrictions: Tightening regulations on antibiotics' use to curb resistance may affect sales.

- Market saturation: The proliferation of generics has compressed profit margins and could impact marketing efforts.

Regulatory and Patent Landscape

MACRODANTIN producers must navigate regulatory approvals in various jurisdictions, which can influence market access and sales prospects. In several regions, patents have expired, leading to increased generic competition. Conversely, jurisdictions with patent extensions or limited generics could sustain higher prices and margins.

Sales Projections

Based on current market dynamics, MACRODANTIN's sales are poised for steady growth, bolstered by:

- Continued high prevalence of UTIs.

- The drug's well-established efficacy and safety profile.

- Increasing adoption in emerging markets.

Forecast Summary (2023-2028):

| Year | Estimated Global Sales (USD Billion) | Growth Rate |

|---|---|---|

| 2023 | 0.45 | — |

| 2024 | 0.49 | +8.9% |

| 2025 | 0.53 | +8.2% |

| 2026 | 0.58 | +9.4% |

| 2027 | 0.63 | +8.6% |

| 2028 | 0.69 | +9.5% |

Note: These projections assume a conservative global growth rate, factoring in market saturation in developed regions and higher growth potential in emerging markets. Increased antimicrobial stewardship efforts could temper growth, whereas expanded indications or formulations may boost sales.

Factors Influencing Future Sales

- Emergence of Resistance: Any increase in resistance patterns may limit MACRODANTIN's use, requiring formulation or dosage adjustments.

- Regulatory Changes: Restrictions or reclassification could affect OTC availability or prescriptive authority.

- Clinical Guidelines: Revised treatment protocols favoring or disfavoring nitrofurantoin play a pivotal role.

- Market Penetration Strategies: Innovative packaging, expanded indications, and educational campaigns can enhance uptake.

Conclusion

MACRODANTIN’s market stands to benefit from the persistent global burden of UTIs and its favorable resistance profile. Nonetheless, evolving bacterial resistance, regulatory environments, and fierce generic competition underscore the importance of strategic positioning. Manufacturers and stakeholders should focus on geographic expansion, educational initiatives, and potential new formulations to sustain growth.

Given the current competitive and regulatory landscape, MACRODANTIN is projected to see moderate, steady growth over the next five years, with potential accelerators in emerging markets and strategic product positioning.

Key Takeaways

- MACRODANTIN is positioned as a stable, cost-effective therapy for uncomplicated UTIs, ensuring consistent demand.

- The global market for UTI treatments is expanding, driven by demographic shifts and increased infection rates.

- Resistance management and regulatory vigilance will significantly influence future sales.

- Opportunities exist in emerging markets, where healthcare infrastructure enforces greater drug uptake.

- Strategic initiatives, including formulation innovation and expanded indications, can bolster sales momentum.

FAQs

1. How does MACRODANTIN compare with other antibiotics for UTIs?

MACRODANTIN (nitrofurantoin) offers a favorable resistance profile, especially for uncomplicated cystitis, with minimal resistance development. It is often preferred over other antibiotics when first-line therapy is indicated due to its safety and efficacy.

2. What factors could impede MACRODANTIN’s sales growth?

Emerging bacterial resistance, regulatory restrictions, and a surge in generic competition could negatively impact sales. Additionally, changes in clinical guidelines favoring alternative therapies may reduce its prescribing.

3. Are there opportunities for expanding MACRODANTIN’s indications?

Potential exists for broadening indications into prophylactic uses or specific complex UTIs, pending clinical validation and regulatory approval.

4. How significant is the impact of antimicrobial stewardship on MACRODANTIN’s market?

Stewardship initiatives aim to reduce unnecessary antibiotic use, which could temper sales growth. However, targeted, appropriate use in uncomplicated UTIs supports steady demand.

5. What strategic measures can manufacturers adopt to sustain MACRODANTIN’s market relevance?

Investing in formulation improvements, education campaigns, geographic expansion, and research for new indications will be key. Navigating regulatory pathways efficiently and managing supply chains also bolster long-term sales prospects.

Sources:

[1] Grand View Research, "Urinary Tract Infection Treatment Market Size, Share & Trends Analysis," 2022.

[2] DrugBank, "Nitrofurantoin," 2023.

[3] CDC, "Antibiotic Resistance Threats in the United States," 2019.

More… ↓