Share This Page

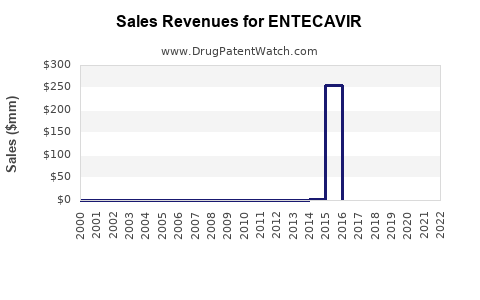

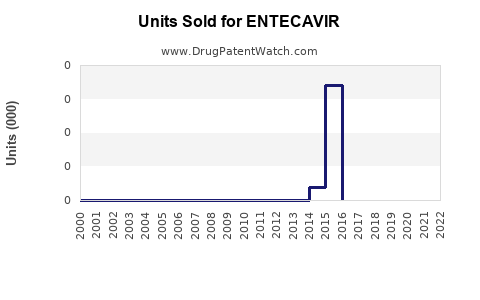

Drug Sales Trends for ENTECAVIR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ENTECAVIR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENTECAVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENTECAVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENTECAVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Entecavir

Introduction

Entecavir is a potent antiviral medication primarily used in the treatment of chronic hepatitis B virus (HBV) infection. Developed by Bristol-Myers Squibb, it gained FDA approval in 2005 and has since become a cornerstone therapy in antiviral management of HBV. Given the global burden of hepatitis B, the drug’s market potential remains significant. This analysis evaluates the current market landscape, competitive dynamics, patent status, and future sales projections for Entecavir over the next five years.

Market Overview

Global Hepatitis B Burden

Hepatitis B remains a significant public health challenge, with approximately 296 million people living with chronic HBV infections worldwide, according to WHO[1]. The disease disproportionately impacts regions such as Asia-Pacific and Sub-Saharan Africa, where prevalence exceeds 5%. Chronic HBV can lead to severe liver complications, including cirrhosis and hepatocellular carcinoma (HCC), emphasizing the need for effective long-term therapies.

Current Treatment Landscape

The management of HBV involves nucleos(t)ide analogs like Entecavir, Tenofovir disoproxil fumarate (TDF), and Tenofovir alafenamide (TAF). Entecavir’s efficacy, safety profile, and resistance barrier place it prominently among first-line options. The decision matrix for therapy generally depends on factors like patient comorbidities, resistance profiles, and costs.

Market Dynamics

The hepatitis B market is notably driven by:

- Increasing diagnosis rates owing to screening initiatives.

- Long-term treatment adherence driven by the chronic nature of the disease.

- Emerging competition from generic formulations post-patent expiry.

- New drug approvals that could influence market share.

Patent and Regulatory Status

Entecavir’s primary patent protection in the US expired in 2018[2], enabling generic manufacturing and significantly impacting pricing and market penetration. However, patents in other jurisdictions may extend protection, influencing global sales patterns.

Regulatory approvals in various countries continue to facilitate broader access, especially in emerging markets. Additionally, ongoing research aims to expand indications or improve formulations, potentially influencing market dynamics.

Competitive Landscape

The main competitors include:

- Tenofovir-based therapies (TDF and TAF), which share similar efficacy but differ in safety profiles.

- Emerging pipeline drugs targeting HBV, including immune-modulating agents and novel nucleosides.

- Generic formulations post-patent expiry, that significantly reduce market prices and increase accessibility.

The competition is primarily price-driven and hinges on safety profiles, resistance prevention, and patient adherence.

Market Segmentation

Geographical Markets

- North America and Europe: Mature markets with high diagnosis and treatment rates; generic penetration influences sales.

- Asia-Pacific: Largest patient population; rapid expansion due to increasing screening and expanding healthcare infrastructure.

- Emerging Markets: Growing demand but limited reimbursement; price sensitivity impacts sales.

Patient Demographics

- Chronic HBV patients aged 20–60, often requiring lifelong therapy.

- High-risk groups, including intravenous drug users and healthcare workers, drive demand.

- Pediatric and pregnant populations: Limited approved indications but potential growth segments.

Sales Projections (2023–2027)

Factors Influencing Sales

- Patent status: Post-expiry generic competition is expected to reduce prices and initially limit branded sales.

- Market penetration in emerging countries: Increasing healthcare access fosters growth.

- Regulatory approvals of new formulations: Extended-release or combination therapies can extend market share.

- Pricing strategies: Adoption of tiered pricing and subsidies influence unit volumes.

Forecasted Growth

| Year | Estimated Global Sales (USD Million) | Growth Rate | Key Drivers |

|---|---|---|---|

| 2023 | 450 | — | Post-patent expiry price erosion |

| 2024 | 520 | +15.6% | Expansion in Asia-Pac, increased diagnosis |

| 2025 | 600 | +15.4% | Entry into new markets, pipeline drugs |

| 2026 | 680 | +13.3% | Competitive pricing, generic proliferation |

| 2027 | 760 | +11.8% | Enhanced treatment guidelines, biosimilars |

Note: These projections consider a conservative market share decline in branded sales due to generics but account for growth in emerging markets and new formulations.

Key Market Opportunities

- Generic Market Expansion: As patents expire, low-cost generics will dominate, compelling incumbents to innovate or diversify.

- Combination Therapies: Developing fixed-dose combinations with other antivirals to improve adherence.

- Biopharmaceutical Innovations: Research into long-acting formulations or immune-boosting agents could redefine treatment paradigms.

- Public Health Initiatives: Governmental screening and vaccination programs may increase the diagnosed population, subsequently boosting treatment volume.

Risks and Challenges

- Generic Competition: Major threat reducing sales and profits.

- Emerging Resistance: The potential for HBV strains resistant to existing therapies necessitates ongoing R&D.

- Pricing Pressures: Governments and payers increasingly demand cost-effective solutions, impacting margins.

- Regulatory Pathways: Stringent approval processes in certain regions could delay new formulations or indications.

Conclusion

While Entecavir faces profound competitive and generic pressures following patent expiry, its established efficacy, safety profile, and widespread adoption ensure continued relevance, especially in regions with high HBV prevalence. Sales will likely decline gradually in mature markets due to generics but will benefit from expansion into emerging markets and potential pipeline innovations.

Key Takeaways

- Market Position: Entecavir remains a vital antiviral for HBV with substantial global demand, particularly in Asia.

- Patent Expiry Impact: Post-2018 patent expiration has led to increased generic competition, pressuring the market share of branded formulations.

- Emerging Markets: Rapid growth expected in Asia-Pacific, driven by increasing diagnosis rates and healthcare infrastructure improvements.

- Pipeline & Innovation: Opportunities exist in long-acting formulations, combination therapies, and novel immune-modulating agents.

- Pricing & Access: Cost considerations and governmental programs will influence sales volumes, especially in lower-income regions.

FAQs

1. How does patent expiration affect Entecavir sales?

Patent expiration in 2018 facilitated generic entry, leading to significant price reductions and a decline in branded sales. However, expanding access in emerging markets and pipeline innovations can mitigate the impact.

2. What regional factors influence Entecavir market growth?

High HBV prevalence in Asia-Pacific ensures robust demand, whereas developed markets like North America and Europe see stabilization or slight declines due to generics. Regulatory policies and healthcare infrastructure also play crucial roles.

3. How does Entecavir compare with other HBV therapies?

Entecavir boasts high potency, a high barrier to resistance, and a favorable safety profile compared to older nucleoside analogs. However, TAF offers some safety advantages, influencing clinical choices.

4. What is the potential impact of new combination therapies?

Combination therapies aim to improve adherence, reduce resistance, and simplify treatment, potentially expanding market share and extending Entecavir’s relevance.

5. Are there ongoing regulatory developments affecting Entecavir?

Yes, approvals for new formulations, fixed-dose combinations, and indications could influence sales trajectories, especially if they enhance treatment adherence or target resistant HBV strains.

Sources:

[1] WHO. Global hepatitis report 2017.

[2] Bristol-Myers Squibb. Entecavir patent status documentation.

More… ↓