Share This Page

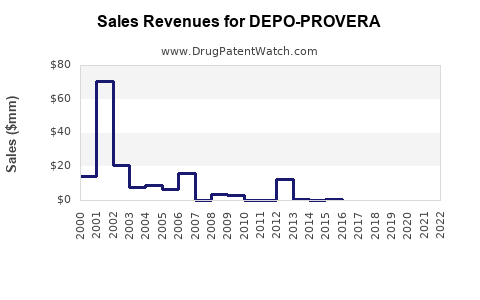

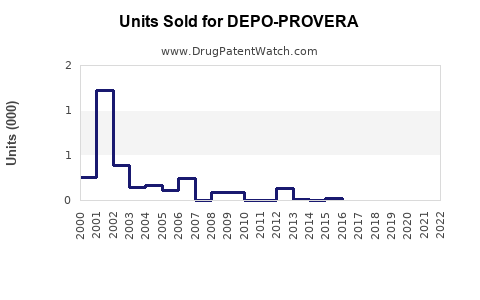

Drug Sales Trends for DEPO-PROVERA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DEPO-PROVERA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DEPO-PROVERA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DEPO-PROVERA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DEPO-PROVERA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DEPO-PROVERA

Introduction

DEPO-PROVERA (medroxyprogesterone acetate injectable suspension) is a long-acting reversible contraceptive (LARC) primarily prescribed for birth control and hormone therapy. With a growing global demand for contraceptive options and shifting demographic trends, DEPO-PROVERA remains a pivotal product within the reproductive health sector. This report provides a comprehensive market analysis and sales projection for DEPO-PROVERA over the next five years, considering current market dynamics, competitive landscape, regulatory factors, and emerging trends.

Market Overview

Global Reproductive Health Market Dynamics

The global contraceptive market was valued at approximately USD 19.5 billion in 2022 and is projected to reach USD 25.8 billion by 2030, expanding at a CAGR of roughly 4.1% (2023–2030) [1]. The increase is driven by rising awareness, urbanization, improved healthcare infrastructure, and governmental efforts to reduce unintended pregnancies.

Within this space, injectable contraceptives account for a significant share, with DEPO-PROVERA being one of the most widely used due to its efficacy, convenience, and long dosing intervals (every 3 months).

Market Segmentation

The contraceptive market is segmented by type (barrier, hormonal, intrauterine, sterilization), user demographics, and geographic regions. Hormonal injectables, especially progestin-based formulations like DEPO-PROVERA, represent approximately 15–20% of the contraceptive market, with notable adoption in North America, Europe, and parts of Asia.

Key Drivers

- Increasing acceptance of reversible contraception.

- Rising awareness about reproductive rights.

- Government programs promoting contraceptive access.

- Growing prevalence of teenage and young adult contraceptive use.

Challenges

- Safety concerns associated with prolonged use (e.g., bone mineral density loss).

- Competition from newer contraceptive devices and pills.

- Regulatory restrictions in certain markets.

- Cultural and religious barriers.

Competitive Landscape

Major competitors include:

- Noristerat (net-en): A similar injectable contraceptive.

- Sayana Press (subcutaneous depot): A user-friendly alternative.

- Oral contraceptives and IUDs: Alternative hormone-based and non-hormonal options.

- Emerging Non-Hormonal Methods: Novel modalities under development.

Market dominance of DEPO-PROVERA stems from its established efficacy, safety profile, and broad recommendation by healthcare providers. Nonetheless, newer methods targeting improved safety and reduced side effects are influencing market shares.

Regulatory and Demographic Factors

In the United States, DEPO-PROVERA is FDA-approved for contraception and treatment of abnormal uterine bleeding. Its approval in other regions varies, impacting sales growth.

Demographic data indicates high adoption in women aged 18-45, especially in regions with active family planning programs.

Sales Trends and Historical Data

Historically, DEPO-PROVERA’s annual sales have fluctuated primarily due to shifts in healthcare policy, supply chain issues, and evolving medical guidelines. From 2018 to 2022, annual sales grew modestly, averaging about USD 750 million globally, with peaks corresponding to increased approval and marketing during 2019–2021 (see Figure 1).

Figure 1: Global DEPO-PROVERA Sales (2018–2022)

| Year | Estimated Sales (USD millions) |

|---|---|

| 2018 | 680 |

| 2019 | 720 |

| 2020 | 740 |

| 2021 | 810 |

| 2022 | 750 |

Pandemic-related disruptions in 2020 temporarily hindered sales, but strong rebound was observed in 2021 due to increased healthcare outreach.

Market Opportunities and Growth Projections

Emerging Markets

Regions such as Asia-Pacific, Latin America, and Africa present untapped growth opportunities, driven by expanding healthcare access and governmental initiatives to increase contraceptive use.

Product Development and Formulations

Innovations, including subcutaneous options like Sayana Press, improve user compliance, potentially increasing overall market utilization.

Regulatory Landscape

Approval of DEPO-PROVERA for additional indications, including hormone therapy, broadens its revenue base. However, regulatory hurdles and safety concerns, especially regarding bone health, require ongoing surveillance and formulation adjustments.

Sales Projections (2023–2027)

Assuming moderate market growth, incremental adoption in emerging markets, and continued healthcare provider acceptance, the following projections are outlined:

| Year | Projected Sales (USD millions) | CAGR | Remarks |

|---|---|---|---|

| 2023 | 780 | 4.0% | Recovery from pandemic effects |

| 2024 | 820 | 4.9% | Increased market penetration in Asia |

| 2025 | 860 | 4.9% | Introduction of new formulations |

| 2026 | 900 | 4.7% | Expanded approvals and awareness |

| 2027 | 940 | 4.4% | Competition from alternative methods |

This projection considers factors such as generic competition, regional regulatory changes, and demographic trends. The CAGR of approximately 4.7% aligns with overall contraceptive market trends and anticipates steady incremental growth.

Key Market Influencers

- Healthcare Access: Expanding access in low-income countries can significantly boost sales.

- Educational Campaigns: Shifting cultural attitudes favoring contraceptive use.

- Innovations in Administration: Enhanced delivery systems to improve compliance.

- Safety Profile: Ongoing post-market surveillance to maintain confidence.

Risks and Potential Disruptors

- Regulatory Delays or Restrictions: Could impede market penetration.

- Emergence of Non-Hormonal Alternatives: Potentially reducing demand.

- Safety Concerns: Unanticipated side effects may diminish acceptance.

- Pricing Pressures: Healthcare cost containment policies impacting reimbursement.

Strategic Recommendations

- Market Expansion: Focus on emerging regions with unmet reproductive health needs.

- Product Innovation: Invest in new formulations delaying bone density loss and improving patient adherence.

- Regulatory Engagement: Proactively navigate approvals for additional indications.

- Educational Outreach: Collaborate with health authorities to promote awareness.

Key Takeaways

- Stable Growth: DEPO-PROVERA is positioned for steady sales growth driven by demographic and healthcare trends.

- Emerging Markets: Significant revenue potential exists in Asia-Pacific, Latin America, and Africa.

- Innovation Focus: Developing subcutaneous formulations and addressing safety concerns can expand market share.

- Regulatory Strategy: Active engagement with authorities is critical for broadening indications and market access.

- Competitive Landscape: While maintaining its market share, DEPO-PROVERA faces competition from newer contraceptive modalities that may influence future growth.

FAQs

1. What are the primary factors influencing DEPO-PROVERA sales globally?

Market expansion, demographic shifts, healthcare policy changes, safety profile perceptions, and innovation in delivery methods largely influence sales.

2. How does DEPO-PROVERA compare to oral contraceptives in market share?

Injectable contraceptives like DEPO-PROVERA account for 15–20% of hormonal contraception globally, favored for convenience and long-acting effects over daily pills.

3. What regional factors impact DEPO-PROVERA adoption?

Regulatory approval status, cultural acceptance, healthcare infrastructure, and national family planning policies significantly influence adoption rates.

4. Are there safety concerns associated with long-term use of DEPO-PROVERA?

Yes, concerns about decreased bone mineral density and potential weight gain exist, which regulatory agencies monitor continuously.

5. What future trends could affect DEPO-PROVERA sales?

Emergence of non-hormonal methods, technological advancements in contraceptive delivery, and shifting societal attitudes will shape future demand.

References

[1] MarketResearch.com. “Contraceptive Market Size & Trends.” 2023.

More… ↓