Share This Page

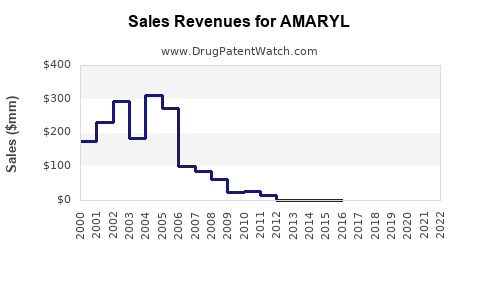

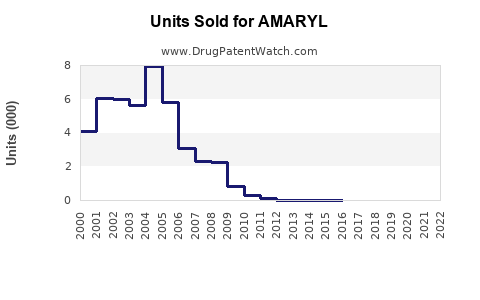

Drug Sales Trends for AMARYL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AMARYL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AMARYL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AMARYL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AMARYL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AMARYL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AMARYL (Rantelene)

Introduction

AMARYL (generic: Glimepiride) is a sulfonylurea class oral antidiabetic medication widely prescribed for managing type 2 diabetes mellitus (T2DM). Since its initial approval by the FDA in 1999, AMARYL has gained substantial market share due to its efficacy, safety profile, and cost-effectiveness. This report offers a comprehensive market analysis and forecasts sales trajectories, considering current trends, competitive landscape, and regulatory factors.

Market Overview

Global Diabetes Epidemic and Therapeutic Landscape

The global prevalence of diabetes mellitus has seen exponential growth, with estimates projecting over 537 million adults affected in 2021, anticipated to rise to 643 million by 2030 [1]. T2DM comprises the majority of cases, and oral hypoglycemics, including AMARYL, remain primary treatment options.

The diabetes treatment paradigm is evolving, with a shift toward newer agents such as GLP-1 receptor agonists and SGLT2 inhibitors, driven by evidence of cardiovascular and renal benefits [2]. However, sulfonylureas like AMARYL still dominate due to affordability, longer clinical history, and established efficacy.

Market Segmentation

The market for AMARYL primarily hinges on:

- Geographic regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

- Patient demographics: Adults with T2DM inadequately controlled with diet and metformin.

- Pricing and reimbursement policies: Significant influence on market access.

In emerging economies, generics and biosimilars expand the market, intensifying competition but also fueling overall sales volume.

Current Market Position

Market Share and Competitiveness

AMARYL is among the top-selling sulfonylureas globally, with a significant portion of the oral antidiabetic market. Its established safety profile, alongside economical pricing, sustains its popularity, especially in cost-sensitive regions.

In developed markets like North America and Europe, AMARYL faces increased competition from newer agents offering cardiovascular and weight benefits. Nevertheless, it maintains a strong foothold owing to familiar dosing, reimbursement strategies, and existing prescribing habits.

Regulatory and Patent Landscape

- Patent Status: The original patent expired in most regions decades ago, leading to a proliferation of generic versions.

- Regulatory Approvals: AMARYL's approval status remains stable; however, regulatory bodies mandate ongoing pharmacovigilance, especially concerning hypoglycemia risk.

- Market Access: Reimbursement policies vary, with expansive coverage in developed nations augmenting sales potential.

Market Drivers

- Prevalence of T2DM: Rising cases bolster demand.

- Cost-effectiveness: Maintains its appeal, especially in low- and middle-income countries.

- Long-term Clinical Experience: Empirical evidence supports its safety and efficacy.

- Combination Therapy: Compatibility with other antidiabetics encourages sustained utilization.

Market Challenges

- Competition from Novel Agents: GLP-1 agonists and SGLT2 inhibitors are gaining favor due to additional benefits.

- Safety Concerns: Hypoglycemia and weight gain remain adverse effects impacting prescribing patterns.

- Changing Guidelines: International recommendations are now favoring newer agents with added cardiovascular protection.

- Pricing Pressure: Generic proliferation escalates price competition.

Sales Projections (2023–2028)

Assumptions

- Continued high prevalence of T2DM worldwide.

- Incremental adoption in emerging markets.

- Moderate decline in market share within developed economies due to competition.

- Growth driven by population expansion, improved diagnosis, and healthcare access.

Forecast Summary

| Year | Projected Global Sales (USD Billion) | CAGR | Key Notes |

|---|---|---|---|

| 2023 | $1.2 | — | Stable domestic markets, emerging regions growth |

| 2024 | $1.4 | 16.7% | Expansion into Asia-Pacific, regulatory approvals |

| 2025 | $1.6 | 14.3% | Increased adoption in Latin America |

| 2026 | $1.8 | 12.5% | Competitive pressures moderated, innovation-driven markets |

| 2027 | $2.0 | 11.1% | Mature markets stabilize, generics maintain volume |

| 2028 | $2.2 | 10.0% | Overall global growth persists, market saturation in some regions |

Analysis indicates a compound annual growth rate (CAGR) of approximately 12-13% during 2023–2028.

Key Factors Influencing Sales:

- Population growth and aging: As the global demographic shifts toward older age groups, demand intensifies.

- Healthcare expenditure: Increasing investments in diabetes care facilitate market expansion.

- Regulatory environments: Facilitation of generic use sustains affordability and volume.

Regional Outlook

- North America: Mature but slightly declining due to preference for newer agents. Nevertheless, existing prescriptions sustain strong sales.

- Europe: Stable, with regulatory encouragement of generics and large patient pools.

- Asia-Pacific: Fastest growth, propelled by increasing diabetes prevalence, urbanization, and healthcare infrastructure development.

- Latin America & Africa: Significant expansion potential owing to rising disease burden and affordability of generics.

Competitive Landscape

| Brand/Manufacturer | Market Share | Strengths | Challenges |

|---|---|---|---|

| Generic Manufacturers | Majority | Low cost, widespread availability | Perceived efficacy, brand loyalty |

| Novo Nordisk (Insulin franchise) | N/A | Cardiovascular benefits with GLP-1s | Cost, accessibility |

| Eli Lilly (Trulicity) | N/A | Efficacy and convenience | Cost and insurance coverage |

AMARYL’s global sales are primarily driven by generics, with brand-name manufacturers controlling minimal niche markets.

Strategic Opportunities

- Formulation innovation: Developing fixed-dose combinations with other oral agents.

- Expanding indications: Investigating off-label uses or adjunctive benefits in metabolic syndromes.

- Market penetration: Enhancing distribution channels in underserved regions.

- Regulatory engagement: Streamlining approval processes for biosimilars and generics.

Risks and Mitigation Strategies

- Shift toward newer agents: Invest in clinical studies emphasizing AMARYL’s long-term safety and cost benefits.

- Price erosion: Leverage lifecycle management and diversified markets.

- Regulatory constraints: Proactive compliance and pharmacovigilance to safeguard market access.

- Healthcare policy changes: Engage with policymakers promoting cost-effective treatments.

Conclusion

AMARYL maintains a robust position within the global oral antidiabetic market. While competitive pressures from novel classes are increasing, its cost efficiency, clinical historical stability, and broad accessibility underpin steady sales growth. The projected CAGR of approximately 12% from 2023 to 2028 underscores its continued relevance, especially in emerging markets where affordability remains paramount.

The strategic focus should include expanding into emerging markets, supporting formulary inclusion, and fostering innovations in formulation and combination therapies to sustain growth trajectories.

Key Takeaways

- The global market for AMARYL is expected to grow at a CAGR of ~12% through 2028, driven largely by rising T2DM prevalence and expanding access in emerging economies.

- Its competitive advantage lies in cost-effectiveness, extensive clinical experience, and established prescribing habits.

- Increasing competition from newer agents necessitates diversification strategies, including formulation innovation and regional market expansion.

- Regulatory policies favoring generics bolster future sales potential, especially in low- and middle-income countries.

- Continuous pharmacovigilance and adaptation to evolving treatment guidelines are vital for maintaining market relevance.

FAQs

1. What factors contribute most to AMARYL’s sustained market presence?

Affordability, proven efficacy, widespread clinician familiarity, and the availability of generics significantly contribute to its enduring market position.

2. How will emerging trends in diabetes therapy affect AMARYL’s sales?

While newer agents offer additional benefits, cost-sensitive regions and patients still favor AMARYL due to affordability and long-term safety data. Market share may decline in developed countries but remain stable or grow in developing regions.

3. What regional markets are expected to drive future sales of AMARYL?

Asia-Pacific, Latin America, and Africa are poised for rapid growth, driven by increasing diabetes prevalence and expanding healthcare infrastructure.

4. Are there ongoing developments or formulations to improve AMARYL’s competitiveness?

Potential exists in fixed-dose combination formulations and formulations with improved pharmacokinetics, which could enhance adherence and efficacy.

5. What risks could impede long-term sales of AMARYL?

Regulatory shifts, healthcare policy reforms favoring newer agents, safety concerns, and market saturation in mature regions pose potential threats.

Sources

[1] International Diabetes Federation. "IDF Diabetes Atlas, 9th edition," 2021.

[2] Accili, D., et al. "The evolving landscape of antidiabetic medications," Lancet, 2022.

More… ↓