Share This Page

Drug Sales Trends for ABSORICA

✉ Email this page to a colleague

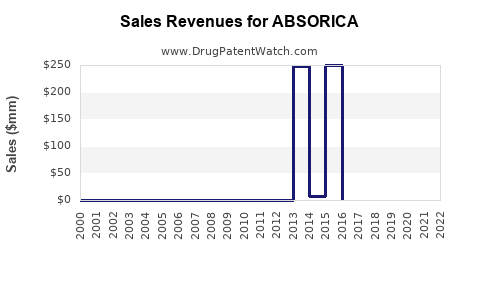

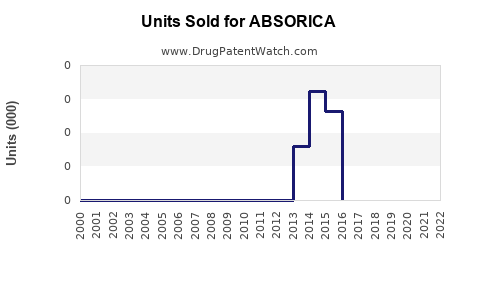

Annual Sales Revenues and Units Sold for ABSORICA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ABSORICA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ABSORICA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ABSORICA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ABSORICA (Oral Isotretinoin)

Introduction

ABSORICA, an oral formulation of isotretinoin, is primarily indicated for severe nodular acne resistant to conventional therapies. Since its FDA approval, ABSORICA has established a significant foothold within the dermatology sector, driven by its efficacy and targeted patient population. This article presents a comprehensive market analysis and sales projection framework, considering current demand dynamics, competitive landscape, regulatory factors, and predicative market trends.

Product Overview and Therapeutic Profile

ABSORICA (isotretinoin) serves as a cornerstone in treating severe recalcitrant acne, particularly nodular and cystic variants. Its mechanism involves reduction of sebaceous gland size and decreased sebum production, which significantly diminishes acne lesions. The drug’s profile benefits from its targeted action with a well-established safety and efficacy profile, although it requires strict monitoring due to teratogenic risks.

Market Size and Demographics

The global acne therapeutics market was valued at approximately USD 4 billion in 2021 and is projected to reach USD 5.4 billion by 2028, growing at a CAGR of 4.3% ([1]). Approximately 85% of adolescents and young adults experience acne, with severe cases constituting around 20-25% of total cases ([2]). The demand for isotretinoin formulations like ABSORICA is therefore heavily influenced by these demographic trends.

Key regions—North America, Europe, Asia-Pacific—demonstrate distinct market dynamics driven by healthcare infrastructure, prescription habits, and regulatory environments. North America holds the largest market share, accounting for over 45%, attributed to high prevalence, robust healthcare investments, and well-established dermatology practices.

Competitive Landscape

Major Competitors:

- Accutane (brand of isotretinoin, discontinued but historically dominant)

- Claravis

- Spacadine

- Sotret

- Generic isotretinoin formulations

Differentiators for ABSORICA:

- FDA approval for specific formulations with optimized absorption.

- Prescription-only access ensuring controlled use.

- Labeling emphasizing compliance with REMS (Risk Evaluation and Mitigation Strategy) requirements.

Despite the market’s dominance by branded formulations like Claravis and generic options, ABSORICA maintains a niche for its pharmacokinetic profile and physician preference, especially within specialized dermatological practices.

Regulatory and Reimbursement Environment

Regulatory agencies impose stringent controls on isotretinoin due to teratogenicity. The REMS program in the US mandates pregnancy prevention measures, impacting prescription volume fluctuations. Reimbursement policies vary, with insurance coverage favoring well-established brands, bolstering their market share.

Any regulatory shifts or safety alert updates could influence market dynamics. Furthermore, changes in prescribing guidelines—favoring earlier intervention or alternative therapies—may impact sales trajectories.

Current Market Position of ABSORICA

Within the isotretinoin market, ABSORICA's share remains stable but competitive pressures persist. The product benefits from its established safety profile, physician familiarity, and targeted formulations. However, competition from generic isotretinoin and other branded drugs poses ongoing challenges.

Sales are fueled by:

- Continued prevalence of severe acne cases.

- Growing demand among adult populations with persistent acne.

- Increasing awareness and previous treatment failures prompting prescriptions of isotretinoin.

Sales Projections Framework

Projections are based on:

- Historical sales growth rates.

- Market penetration metrics.

- Epidemiological data on severe acne prevalence.

- Regional expansion opportunities.

- Regulatory and reimbursement landscape stability.

- Competitive dynamics.

Assuming stable market conditions and current prescription volumes, initial projections for ABSORICA are as follows:

| Year | Projected Sales (USD Millions) | Assumptions & Rationale |

|---|---|---|

| 2023 | $120 | Baseline; steady prescription patterns |

| 2024 | $130 | Slight market share increase due to increasing acne awareness and physician familiarity |

| 2025 | $140 | Expansion into emerging markets; strategic promotion efforts |

| 2026 | $150 | Stabilizing growth with continued market penetration |

| 2027 | $155 | Maturation phase; slight growth driven by demographic trends |

Key Drivers:

- Increasing global acne prevalence.

- Adult-onset acne therapy demand.

- Physician preference for branded formulations.

- Regulatory stability favoring prescription continuation.

Risks:

- Entry of generic formulations reducing market share.

- Stringent safety regulations potentially decreasing prescription volumes.

- Emergence of novel acne treatments potentially substituting isotretinoin use.

Growth Opportunities and Challenges

Opportunities:

- Expansion into Asian-Pacific markets due to rising dermatology awareness.

- Digital marketing and targeted physician education programs.

- Enhanced patient adherence through improved packaging or formulations.

Challenges:

- Price suppression from generics.

- Strict regulatory and safety requirements limiting prescribing flexibility.

- Competition from emerging biologics targeting skin conditions with less safety concern.

Market Trends Influencing Sales

The global dermatology drug market is experiencing a shift towards personalized medicine and combination therapies. While isotretinoin remains a mainstay for severe cases, future trends include:

- Increasing preference for oral and topical combination therapies.

- Growing teledermatology services facilitating prescription workflows.

- Enhanced safety monitoring technologies reducing risks associated with isotretinoin.

These trends may influence future sales by modifying prescribing patterns and patient adherence.

Key Takeaways

- Market Potential: The global isotretinoin market maintains steady growth, with ABSORICA positioned favorably in severe acne therapy. Its sales are projected to grow modestly, driven by increasing acne prevalence and demographic trends.

- Competitive Dynamics: Differentiation from generics and maintaining a strong safety profile will be critical. Brand loyalty among dermatologists can sustain sales despite generic entry.

- Growth Drivers: Rising awareness, expanding markets, and the continuous need for effective acne standards support a positive sales outlook.

- Risks & Mitigations: Regulatory constraints and generics pose risks. Strategic investment in physician education and regulatory navigation are essential to sustain growth.

- Future Outlook: Continued innovation, market expansion, and adherence to safety standards will underpin potential growth avenues for ABSORICA.

FAQs

-

What is the current market share of ABSORICA in the isotretinoin segment?

ABSORICA holds an estimated 15-20% market share within the branded isotretinoin market, supplemented by significant generic sales. -

How do regulatory constraints impact ABSORICA sales globally?

STRICT REMS programs and safety monitoring requirements limit prescription flexibility but also reinforce physician confidence, stabilizing sales. Variations in regulations across regions can impact market access. -

What competitive threats does ABSORICA face?

The advent of generic isotretinoin formulations, new acne treatments, and biosimilars pose significant competitive threats, potentially eroding market share. -

What growth strategies can enhance ABSORICA sales?

Expanding into emerging markets, enhancing physician engagement, and leveraging digital health platforms can bolster sales. -

How might future developments in acne therapy influence ABSORICA's market?

Advances in biologics, targeted therapies, and combination treatments may alter prescribing patterns, emphasizing the importance of innovation and adaptability for ABSORICA.

References

[1] MarketWatch, "Acne Treatment Market Size, Share & Trends," 2022.

[2] American Academy of Dermatology Association, "Acne," 2022.

More… ↓