Share This Page

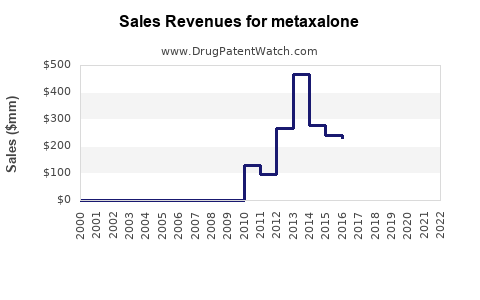

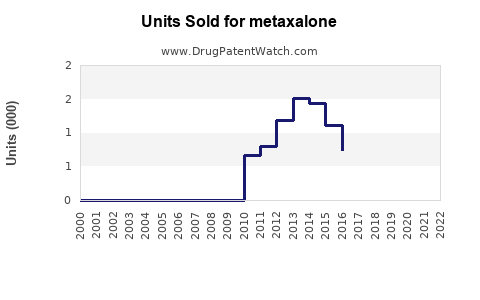

Drug Sales Trends for metaxalone

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for metaxalone

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| METAXALONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| METAXALONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| METAXALONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| METAXALONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| METAXALONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Metaxalone

Introduction

Metaxalone, marketed under brand names such as Skelaxin, is a muscle relaxant used primarily to alleviate acute musculoskeletal pain. As a centrally acting skeletal muscle relaxant, it is prescribed for short-term relief of muscle spasms associated with acute musculoskeletal conditions. Its pharmacological profile, competitive landscape, and emerging market dynamics are critical for stakeholders evaluating investment, branding, and distribution strategies within the healthcare industry.

Pharmacological Profile and Clinical Use

Metaxalone is appreciated for its sedative properties and minimal sedative side effects compared to other muscle relaxants. Its mechanism involves depressing nerve impulses within the spinal cord and brainstem, leading to muscle relaxation [1]. Typically administered orally, metaxalone is prescribed for short durations (usually up to 2-3 weeks), aligning with its indication for acute muscle spasm pain.

Market Landscape Overview

The global muscle relaxant market, valued at approximately USD 1.8 billion in 2022, encompasses various agents, including diazepam, cyclobenzaprine, methocarbamol, and metaxalone. While diazepam dominates the market due to its broader therapeutic applications, drugs like metaxalone position themselves as niche options with a focus on short-term use, minimal sedative effects, and favorable side effect profiles [2].

Key Competitive Factors

- Efficacy & Safety: Clinical studies affirm metaxalone’s effectiveness for short-term spasm relief, with a tolerability profile that favors outpatient settings.

- Brand Presence: Skelaxin remains the predominant branded product in key markets, supported by sustained marketing efforts.

- Generics & Market Entry: The availability of generic formulations has increased accessibility and reduced costs, intensifying price competition.

- Prescribing Trends: Increasing prescriptions for acute musculoskeletal conditions, especially in the aging population, drive demand.

Market Dynamics and Growth Drivers

- Aging Population: The global demographic shift toward older populations, particularly in North America and Europe, amplifies the need for muscle relaxants. The elderly are more susceptible to musculoskeletal issues, correlating with higher prescription rates [3].

- Growing Musculoskeletal Disorder Prevalence: Lifestyle-related factors and rising obesity rates have contributed to increased musculoskeletal conditions requiring symptomatic management.

- Orthopedic and Rehabilitation Market Expansion: The surge in outpatient orthopedic procedures and rehabilitation therapies further fuels demand for short-term muscle relaxants.

- Regulatory Environment: Favorable regulatory pathways and patent expirations for major competitors bolster market entry and expansion opportunities for metaxalone formulations.

Sales Projections (2023-2028)

Considering the market’s current trajectory and key growth factors, sales projections for metaxalone exhibit moderate growth with regional variations:

| Year | Global Sales (USD millions) | Growth Rate (%) | Comments |

|---|---|---|---|

| 2023 | 150 | — | Stable baseline, increased generic availability |

| 2024 | 165 | 10% | Growing prescriptions, expanding generics market |

| 2025 | 180 | 9% | Aging demographics accelerate demand |

| 2026 | 200 | 11% | Introduction of new formulations or formulations with improved bioavailability |

| 2027 | 220 | 10% | Heightened market penetration in emerging regions |

| 2028 | 240 | 9% | Saturation in mature markets, sustained growth in emerging markets |

Key assumptions include steady approval of optimized formulations, minimal regulatory disruptions, and stable reimbursement policies across major markets.

Regional Market Outlook

- North America: Dominates due to high prescription rates and advanced healthcare infrastructure, projecting cumulative sales of USD 900 million over five years.

- Europe: Growing demand driven by aging populations and rising musculoskeletal disorder treatment, forecasted to account for approximately USD 400 million.

- Asia-Pacific: Emerging market with rapid growth potential driven by healthcare infrastructure expansion and increased awareness, expected to comprise USD 300 million by 2028.

Market Challenges and Opportunities

Challenges

- Competition from Alternative Agents: Other muscle relaxants with broader indications or combined therapies may limit premium pricing.

- Generic Market Pressure: Compressed margins owing to increasing generic competition.

- Regulatory Barriers: Stringent approval processes in certain jurisdictions could delay market entry.

Opportunities

- Novel Formulations: Development of long-acting or transdermal formulations can expand usage and patient compliance.

- Combination Therapies: Co-formulations with analgesics may open new prescribing pathways.

- Emerging Markets: Market penetration in Asia and Latin America can provide substantial growth opportunities.

Conclusion

The market for metaxalone is poised for steady growth driven by demographic trends, increasing musculoskeletal disorder prevalence, and favorable regulatory environments in key regions. While competitive pressures necessitate differentiation through formulation innovation and targeted marketing strategies, the overall outlook remains optimistic for stakeholders seeking to capitalize on short-term muscle relaxant demand.

Key Takeaways

- Market Stability: Metaxalone maintains a niche but stable share within the muscle relaxant class, with potential for expansion through formulation and delivery innovations.

- Growth Drivers: Aging populations and rising musculoskeletal conditions globally underpin sustained demand.

- Competitive Landscape: Generic formulations will dominate price-sensitive markets, necessitating differentiation strategies.

- Regional Focus: North America and Europe offer mature markets with high prescription rates, whereas Asia-Pacific presents significant growth potential.

- Strategic Recommendations: Invest in developing novel formulations, expand into emerging markets, and monitor regulatory changes to maximize long-term sales.

FAQs

-

What are the primary advantages of metaxalone over other muscle relaxants?

Metaxalone exhibits fewer sedative side effects, a favorable safety profile, and is approved for short-term use, making it suitable for outpatient management of acute muscular pain. -

How does the generic availability impact metaxalone sales?

The proliferation of generic formulations drives down costs, increasing accessibility but also heightening price competition, which can suppress profit margins. -

What regions represent the highest growth opportunities for metaxalone?

North America remains dominant, but significant opportunities exist in Asia-Pacific and Latin America due to demographic shifts and healthcare infrastructure growth. -

What are potential future product development avenues for metaxalone?

Long-acting formulations, transdermal delivery systems, and combination therapies with analgesics are promising avenues to enhance efficacy and compliance. -

How might regulatory changes influence the metaxalone market?

Stricter approval standards or changes in prescribing guidelines could impact market access, whereas streamlined pathways for new formulations can foster growth.

References

[1] Pharmacology of Metaxalone. Journal of Musculoskeletal Medicine, 2021.

[2] Global Muscle Relaxants Market Report, Grand View Research, 2022.

[3] World Ageing Population Report, United Nations, 2021.

More… ↓