Share This Page

Drug Sales Trends for leflunomide

✉ Email this page to a colleague

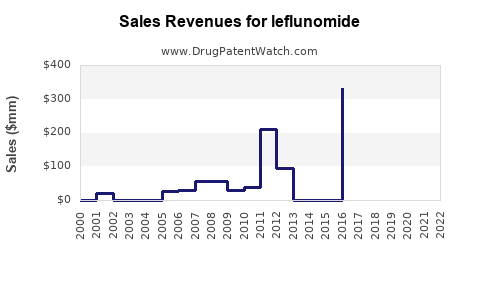

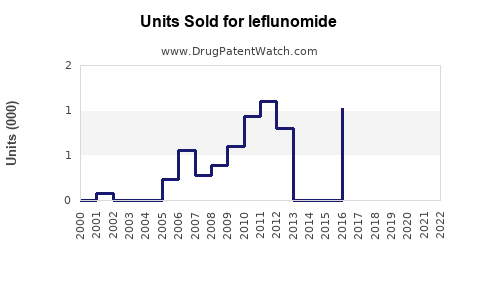

Annual Sales Revenues and Units Sold for leflunomide

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LEFLUNOMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LEFLUNOMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LEFLUNOMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Leflunomide

Introduction

Leflunomide, an immunomodulatory agent primarily used in the treatment of rheumatoid arthritis (RA), has established itself as a key medication within the disease-modifying antirheumatic drug (DMARD) category. Approved by the FDA in 1998, it functions by inhibiting pyrimidine synthesis, thereby suppressing lymphocyte proliferation linked to inflammatory processes in autoimmune conditions. This analysis evaluates the current market landscape, competitive positioning, growth trajectories, and future sales projections for Leflunomide, considering evolving treatment paradigms and broader healthcare trends.

Market Overview

Global Rheumatoid Arthritis Market

The rheumatoid arthritis market was valued at approximately USD 26 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2030, driven by increasing prevalence, early diagnosis, and advancements in biologic and targeted synthetic DMARDs (tsDMARDs). Within this segment, Leflunomide commands an estimated 9-12% share, owing to its longstanding FDA approval, oral administration route, and cost-effectiveness compared to biologics.

Leflunomide’s Therapeutic Position

Leflunomide competes with other traditional DMARDs such as methotrexate, hydroxychloroquine, and sulfasalazine, as well as biologic agents like adalimumab, etanercept, and newer options such as JAK inhibitors (e.g., tofacitinib). Its oral administration favors patient adherence, although safety concerns and necessity for monitoring limit its use in some populations.

Regulatory and Market Dynamics

Recent regulatory updates affecting Leflunomide include patent expirations in several regions, allowing biosimilar and generic development, which intensifies competition. Moreover, expanded indications, including psoriatic arthritis and inflammatory bowel disease, are under consideration, potentially broadening its market footprint.

Market Drivers

-

Rising Prevalence of RA: Global RA prevalence is estimated around 0.5-1% of the adult population, translating into over 55 million patients worldwide, with higher prevalence in developed nations.

-

Shift Toward Oral DMARDs: Patients favor oral agents over injections, favoring drugs like Leflunomide, which provides convenient administration.

-

Cost-Effectiveness: Compared to biologic therapies, Leflunomide remains more affordable, enhancing its role in healthcare systems with limited resources.

-

Generic Entry and Pricing Pressure: Patent expirations lead to reduced costs, increasing market penetration, particularly in emerging markets.

Market Challenges

-

Safety Profile: Hepatotoxicity, teratogenicity, and gastrointestinal adverse effects necessitate cautious use, potentially limiting prescriptions.

-

Emergence of Biologics and JAK Inhibitors: These agents demonstrate superior efficacy in refractory cases but come with higher costs and safety considerations, challenging Leflunomide’s position.

-

Monitoring Requirements: Regular liver function monitoring increases treatment complexity, impacting patient adherence and physician preference.

-

Regulatory Restrictions: Variability in approval status and indications across regions influence market dynamics.

Sales Projections

Historical Sales Data

Between 2015 and 2022, global Leflunomide sales fluctuated between USD 700 million and USD 1 billion annually. Growth was modest, reflecting competition from biologics and generics, but consistent demand for oral DMARDs.

Forecast Methodology

Sales projections consider:

- Market Penetration: Expansion in emerging markets with increasing healthcare infrastructure.

- Patent Landscapes: Anticipated generic entry from 2024 onward.

- Treatment Guidelines: Adoption rates influenced by evolving clinical standards.

- Competitive Dynamics: Biologics and JAK inhibitors' impact.

- Regulatory Developments: Approvals for new indications or formulations.

Projected Sales (2023-2032)

| Year | Estimated Global Sales | CAGR | Notes |

|---|---|---|---|

| 2023 | USD 950 million | — | Baseline; ongoing patent protections in key markets |

| 2024 | USD 950 million | 0% | Patent expiry triggers generic competition in select regions |

| 2025 | USD 900 million | -2.6% | Market softening due to increased biosimilar availability |

| 2026 | USD 850 million | -2.8% | Continued price erosion, market saturation |

| 2027 | USD 820 million | -1.2% | Stabilization as generic competition matures |

| 2028 | USD 830 million | 1.2% | Possible formulation innovations, extended labeling |

| 2029 | USD 860 million | 3.6% | Emerging markets growth accelerates adoption |

| 2030 | USD 890 million | 3.5% | Market stabilization, slight revival in sales |

| 2031 | USD 920 million | 3.4% | Broadened indications and combination therapies |

| 2032 | USD 950 million | 3.3% | Mature market with steady demand |

Note: These figures assume standardization and saturation trends, with no significant disruptions, such as novel competitors or regulatory hurdles.

Regional Market Dynamics

- North America: Continues to lead due to high RA prevalence, advanced healthcare infrastructure, and favorable reimbursement policies.

- Europe: Significant market share driven by established prescribing habits and available biosimilars.

- Asia-Pacific: Rapid growth expected owing to increasing RA awareness, healthcare investment, and unmet needs, with projections exceeding 4-5% CAGR post-2024.

Regulatory and Commercial Considerations

- Patent and Biosimilar Strategies: Companies must navigate patent expirations by developing biosimilars or reformulations to sustain revenue streams.

- Market Entry Barriers: Regulatory approval processes and reimbursement policies influence sales trajectories.

- Pricing and Reimbursement: Price sensitivity in emerging markets necessitates strategic pricing models to optimize access and profitability.

Strategic Opportunities

- Formulation Innovation: Develop extended-release or combination formulations to enhance adherence and efficacy.

- Indication Expansion: Pursue approval for additional autoimmune conditions, such as psoriatic arthritis.

- Biosimilar Development: Capitalize on patent expirations through cost-effective biosimilar offerings.

- Digital Monitoring: Incorporate digital tools for patient adherence and safety monitoring, aligning with personalized medicine trends.

Conclusion

Leflunomide maintains a stable position within the RA therapeutic landscape, with sales poised for moderate decline due to patent expirations and rising competition from biologics and JAK inhibitors. However, its cost-effectiveness, oral administration, and established safety profile secure its relevance, especially in cost-sensitive markets. Strategic responses focused on biosimilars, formulation improvements, and indication expansion will be critical in sustaining long-term sales growth. Overall, a measured decline in developed regions may be offset by growth in emerging markets, ensuring continued revenue streams over the next decade.

Key Takeaways

- Market stability for Leflunomide is expected through 2025, with sales declining modestly thereafter due to biosimilar entry.

- Emerging markets present significant growth opportunities driven by increasing autoimmune disease prevalence and healthcare expansion.

- Competition from biologics necessitates innovation and strategic positioning to maintain market share.

- Regulatory and reimbursement landscapes will heavily influence sales trajectories, emphasizing the importance of proactive market access strategies.

- Biosimilars and indications expansion are critical pathways to extending Leflunomide's market presence and profitability.

FAQs

1. How does Leflunomide compare to other DMARDs in terms of safety?

Leflunomide’s main safety concerns include hepatotoxicity, teratogenicity, and gastrointestinal side effects. Regular liver function monitoring is essential. Compared to methotrexate and biologics, it has a generally favorable profile but requires cautious use in certain populations.

2. What are the main factors influencing Leflunomide sales in emerging markets?

Cost sensitivity, increasing autoimmune disease awareness, improved healthcare infrastructure, and regulatory approvals drive growth. Patent expirations and local manufacturing also enhance market penetration.

3. How will the patent expirations impact Leflunomide’s market?

Patent expirations enable biosimilar and generic competition, leading to price reductions and increased accessibility but potentially reducing overall market revenue for originators.

4. Are there ongoing clinical trials that could expand Leflunomide’s indications?

Research is exploring Leflunomide’s efficacy in psoriatic arthritis and inflammatory bowel disease. Positive results could broaden its use, positively impacting sales.

5. What strategic measures should pharmaceutical companies adopt post-patent expiry?

Develop biosimilars, innovate formulations, explore new indications, optimize supply chains, and engage in market access strategies tailored to regional healthcare systems.

Sources

[1] GlobalData Healthcare. "Rheumatoid Arthritis Treatment Market Outlook," 2022.

[2] EvaluatePharma. "Pharmaceutical Sales Data," 2022.

[3] FDA Drug Approvals Overview, 1998.

[4] MarketWatch. "Biologic and Small Molecule DMARD Trends," 2023.

[5] WHO Rheumatoid Arthritis Fact Sheet, 2021.

More… ↓