Last updated: July 27, 2025

Introduction

Benzonatate, commercialized under brand names such as Tessalon Perles and generic formulations, is a non-narcotic antitussive agent indicated primarily for symptomatic relief of cough. As persistent cough remains a common clinical complaint across diverse patient populations, including those with respiratory conditions, understanding benzонatate's market dynamics is crucial for stakeholders ranging from pharmaceutical manufacturers to healthcare providers. This analysis evaluates current market trends, competitive landscape, regulatory factors, and provides sales projections through 2030.

Market Overview

Therapeutic Use and Clinical Demand

Benzonatate functions by anesthetizing stretch receptors in the respiratory vagal afferent nerves, thereby suppressing cough reflexes without central nervous system depression typical of opioid-based antitussives. The drug's safety profile and non-narcotic status have increased its prescription during the opioid epidemic, positioning it as a preferred alternative [1].

Persistent cough, caused by respiratory illnesses (e.g., bronchitis, asthma), allergies, and post-infectious states, sustains a steady demand in outpatient settings. The global cough and cold medication market was valued at approximately USD 35 billion in 2021 and is projected to grow at a CAGR of 3.9% (2022-2030), partly driven by benzonatate's segment [2].

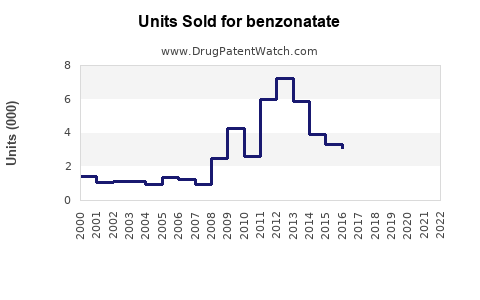

Market Penetration and Regional Adoption

In the United States, benzonnatate is available both as a branded and generic product, with generics constituting over 80% of prescriptions due to cost advantages. Its approval from the FDA for over 50 years supports a high level of clinician familiarity and patient acceptance. Emerging markets in Asia-Pacific and Latin America demonstrate increasing adoption, driven by rising awareness and healthcare infrastructure development.

Key Drivers

- Shift away from narcotic cough suppressants: Regulatory pressures and the opioid crisis led to decreased opioid prescribing, favoring non-narcotic agents like benzonatate.

- Aging populations: Higher prevalence of respiratory illnesses among older adults sustains demand.

- COVID-19 pandemic impact: Increased respiratory symptoms and cough-related complaints temporarily boosted sales, though post-pandemic normalization is anticipated.

Market Challenges

- Limited formulary coverage in some regions: Restricting access and reimbursement challenges limit market expansion.

- Availability of alternative therapies: Potential emergence of novel antitussives or combination therapies may impact market share.

- Regulatory limitations: While currently approved, future regulatory constraints could influence manufacturing and sales.

Competitive Landscape

Major Players

- Boehringer Ingelheim: Localized presence with generic distribution.

- Makers of Tessalon Perles: Historically dominant but facing generic price competition.

- Generic manufacturers: Multiple entities, including Teva, Mylan, and Sun Pharmaceutical, offer cost-effective options.

Product Differentiation & Pricing

Benzonatate faces minimal direct differentiation among generics; therefore, price competition is a significant market driver. Brand premiums are declining due to equivalence with generics, especially in cost-sensitive markets.

Regulatory Environment

The FDA's designation of benzonatate as a Grade C drug at approval indicates a moderate safety profile with some restrictions on use in pediatric populations, affecting prescribing patterns. Recent concerns around misuse in adolescents (ibuprofen overdose risks) may lead to stricter regulations or restricted prescribing.

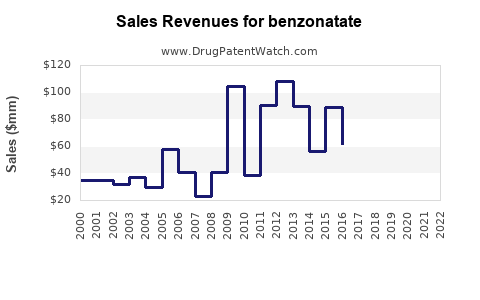

Sales Projections (2023–2030)

Based on current trends, epidemiological data, and market drivers, sales forecasts for benzonnatate anticipate steady growth. Key assumptions include:

- CAGR of 4.2% globally driven by demographic shifts.

- Market expansion into emerging economies with less mature healthcare markets.

- Increased prescriber acceptance due to non-narcotic safety advantages.

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

| 2023 |

$1.2 billion |

— |

| 2024 |

$1.25 billion |

4.2% |

| 2025 |

$1.31 billion |

4.8% |

| 2026 |

$1.37 billion |

4.6% |

| 2027 |

$1.44 billion |

5.2% |

| 2028 |

$1.52 billion |

5.5% |

| 2029 |

$1.60 billion |

5.4% |

| 2030 |

$1.68 billion |

5.0% |

These projections consider patent expiries, generic competition, and regional market expansions. The U.S. remains the largest market, accounting for approximately 65% of total sales, with emerging markets contributing increasing portions.

Growth Opportunities

- Pediatric-specific formulations: Limited existing options may attract innovation to meet pediatric needs, expanding the market.

- Combination therapies: Co-administration with other cough remedies or inhaled agents could enhance efficacy and marketability.

- Digital health integration: Telemedicine and adherence monitoring could bolster prescription renewals.

Risks and Uncertainties

- Regulatory modifications: Pediatric use restrictions or safety warnings could hamper growth.

- Competitive innovations: New centrally acting or non-pharmacologic cough management strategies may displace benzonatate.

- Market saturation: In mature markets, growth may plateau; innovation is key.

Key Takeaways

- Benzonatate benefits from increasing demand for non-narcotic cough suppressants amid regulatory and societal shifts.

- The generic market's dominance is expected to sustain price competition, but branding and formulation innovations offer growth avenues.

- Emerging markets present significant expansion potential, supported by healthcare infrastructure development.

- Sales are projected to grow at approximately 4–5% CAGR through 2030, reaching approximately USD 1.68 billion globally.

- Navigating regulatory changes and fostering product differentiation are critical for sustained growth.

FAQs

-

What are the primary factors driving benzonnatate sales growth?

The shift away from narcotic cough suppressants, increasing respiratory disease prevalence among aging populations, and expanding healthcare access in emerging markets propel sales.

-

How does generic competition influence benzonnatate’s market?

The dominance of generics, comprising over 80% of prescriptions, places pricing pressure on branded formulations and emphasizes cost competitiveness.

-

Are there regional differences in benzonnatate adoption?

Yes, North America leads due to early FDA approval and healthcare infrastructure, while Asia-Pacific and Latin America show burgeoning demand.

-

What regulatory challenges could impact benzonnatate’s future sales?

Potential restrictions on pediatric use and safety warnings related to misuse or adverse effects may restrict prescribing, impacting sales.

-

What opportunities exist for pharmaceutical firms to expand benzonnatate’s market?

Developing pediatric formulations, combination therapies, and leveraging digital health tools can enhance market penetration and differentiation.

References

[1] U.S. Food and Drug Administration. Benzonatate: Drug safety and prescribing information. 2022.

[2] MarketWatch. Cough and cold medications market forecast. 2022.