Last updated: July 28, 2025

Introduction

Acyclovir, a pioneering antiviral medication primarily used for herpes simplex viruses (HSV), varicella-zoster virus (VZV), and other herpesvirus infections, has maintained a significant presence in the pharmaceutical landscape since its introduction in the 1980s. Despite the emergence of newer antiviral agents, acyclovir’s well-established efficacy, safety profile, and cost-effectiveness sustain its demand across global markets. This analysis aims to dissect current market dynamics, projected sales growth, key drivers, challenges, and future opportunities for acyclovir.

Market Overview

Global Market Size

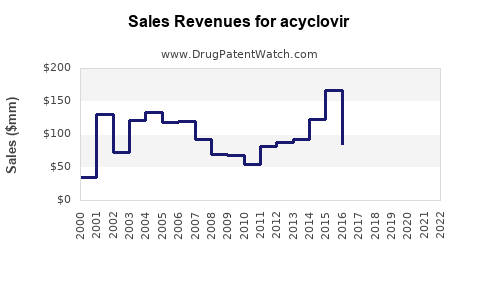

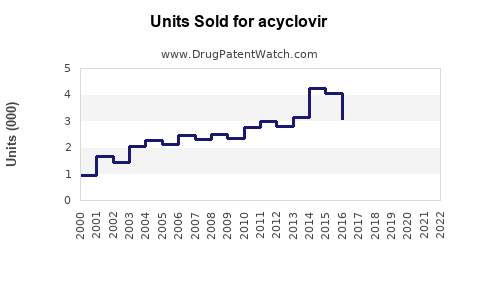

The global acyclovir market was valued at approximately USD 350 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of around 4% through 2028, reaching an estimated USD 460 million by that year. This steady growth is driven by an increasing prevalence of herpesvirus infections, expanding aging populations, and rising awareness of antiviral therapies.

Regional Market Distribution

- North America: The dominant market, accounting for roughly 45% of global sales, driven by high healthcare expenditure, widespread healthcare infrastructure, and advanced pharmaceutical research.

- Europe: The second-largest market, facilitated by aging demographics and robust healthcare systems.

- Asia-Pacific: The fastest-growing segment, projected to expand at a CAGR of about 6%, fueled by large populations, rising healthcare access, and expanding pharmaceutical manufacturing bases.

- Rest of the World: Latin America, the Middle East, and Africa display moderate growth potential, constrained by limited healthcare infrastructure and lower disease awareness.

Market Drivers

1. Rising Incidence of Herpesvirus Infections

Approximately 3.7 billion people under age 50 suffer from HSV-1 globally, with significant populations affected by HSV-2, which causes genital herpes[1]. The increasing incidence, especially among immunocompromised populations, sustains demand for acyclovir.

2. Aging Population and Immunocompromised Patients

Elderly populations are more susceptible to herpes zoster and recurrent herpes simplex outbreaks. Additionally, immunocompromised individuals — such as HIV/AIDS patients and organ transplant recipients — require continuous antiviral management.

3. Cost-Effectiveness and Accessibility

Acyclovir is available as generic formulations, making it an affordable option compared to newer antivirals like valacyclovir and famciclovir. This affordability supports continued use, especially in resource-limited settings.

4. Expanding Healthcare Infrastructure in Developing Countries

Increased healthcare access and improved diagnostic capabilities are leading to higher prescription rates in emerging markets.

Market Challenges

1. Competition from Next-Generation Antivirals

Agents like valacyclovir and famciclovir boast improved pharmacokinetics, once-daily dosing, and better patient compliance, challenging acyclovir's market dominance.

2. Patent Expirations and Price Competition

The widespread availability of generic acyclovir has driven prices downward, reducing profit margins for manufacturers.

3. Limited Orally-Available Advanced Formulations

Compared with newer drugs offering extended-release formulations, acyclovir’s dosing regimens may be less convenient, influencing prescribing patterns.

4. Lack of New Indications

Acyclovir's clinical use remains focused on herpesvirus infections, with limited scope for new indications, constraining growth opportunities.

Key Market Players

- Bristol-Myers Squibb (original patent holder)

- Teva Pharmaceutical Industries

- Mylan (now part of Viatris)

- Sandoz

- Serum Institute of India

These firms predominantly operate in markets where generics constitute the mainstay of supply.

Sales Projections and Future Outlook

Short-Term Outlook (2023-2025):

Sales are expected to grow modestly, driven chiefly by emerging markets’ increasing adoption of generic acyclovir. Market saturation in developed regions may temper growth, but ongoing awareness campaigns and expanding patient pools support steady revenue streams.

Medium to Long-Term Outlook (2026-2028):

Potential growth could accelerate with technological advancements, such as the development of topical or injectable formulations, and improved delivery systems. Moreover, the potential for reformulations with extended-release properties may bolster compliance and patient outcomes, fostering increased prescribing.

Factors Influencing Future Sales:

- New Formulation Development: Innovations could enhance patient adherence.

- Global Health Initiatives: Programs targeting herpesvirus infections can expand indications and patient access.

- Emerging Market Penetration: Continual improvement in healthcare infrastructure in Asia-Pacific and Africa poised to drive sales further.

- Competitive Landscape: The entrance of novel antivirals might restrict acyclovir’s growth.

Market Opportunities

- Topical and Parenteral Formulations: Enhancing formulations for local application or injectable use can target specific patient niches, such as immunocompromised or neonatal populations.

- Combination Therapies: Synergistic regimens combining acyclovir with other antiviral agents could open new therapeutic avenues.

- Diagnostics and Monitoring: Coupling antiviral therapy with rapid diagnostic tests may improve patient management, indirectly supporting drug sales.

Conclusion

Acyclovir’s legacy as a cost-effective antiviral with proven efficacy sustains its relevance amid evolving treatment landscapes. While competition from newer agents and pricing pressures challenge its market share, ongoing disease prevalence, aging demographics, and healthcare expansion in developing regions underpin steady growth. Innovative formulations and strategic collaborations can further enhance sales trajectories, making acyclovir a resilient player in the antiviral market through 2028.

Key Takeaways

- The global acyclovir market is projected to grow at a CAGR of 4% from 2023 to 2028, reaching USD 460 million.

- North America and Europe dominate current sales, but Asia-Pacific offers significant growth opportunities.

- Cost-effectiveness and existing healthcare infrastructure are key drivers, especially in emerging markets.

- Intense competition from newer antivirals, patent expirations, and formulation limitations pose challenges.

- Innovations in drug delivery, combination therapies, and expanding diagnostic tools can unlock future growth.

FAQs

1. How does acyclovir compare to newer antivirals like valacyclovir or famciclovir?

Acyclovir requires multiple daily doses and has variable bioavailability, whereas valacyclovir and famciclovir offer once-daily dosing and better patient adherence. Despite this, acyclovir remains affordable and widely used, especially where cost is a critical factor.

2. What are the primary markets driving acyclovir sales?

North America and Europe currently lead due to high healthcare spending. However, Asia-Pacific presents rapid growth potential due to expanding healthcare access and large patient populations.

3. Are there any emerging formulations of acyclovir?

Yes, recent developments focus on topical gels, injectable forms, and extended-release tablets aimed at improving compliance and expanding therapeutic applications.

4. How does patent status influence acyclovir’s market?

Since patent expirations, generic manufacturers dominate supply, leading to price competition but broad market access.

5. What future innovations could impact acyclovir’s market share?

Potential innovations include novel delivery systems, combination antiviral therapies, and improved diagnostic tools enabling targeted treatment, which could sustain or grow acyclovir’s position in the antiviral market.

Sources:

- World Health Organization. "Herpes simplex virus." WHO, 2021.

- MarketWatch. "Acyclovir Market Size, Share & Trends Analysis." 2022.

- Statista. "Global prevalence of herpes simplex virus." 2022.