Share This Page

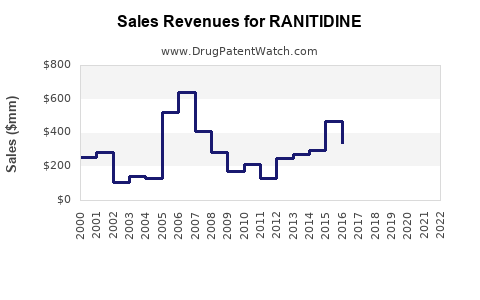

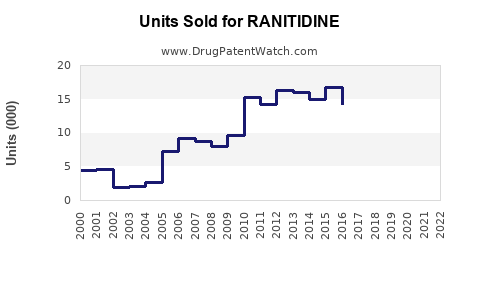

Drug Sales Trends for RANITIDINE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RANITIDINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RANITIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RANITIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RANITIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RANITIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RANITIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ranitidine

Introduction

Ranitidine, previously a cornerstone in the management of acid-related gastrointestinal disorders, faced widespread market withdrawal following safety concerns related to contamination with N-Nitrosodimethylamine (NDMA), a probable human carcinogen. This analysis evaluates the market dynamics, regulatory landscape, and sales potential of ranitidine, considering the evolving pharmaceutical environment.

Market Overview

Historically, ranitidine was among the top-selling over-the-counter (OTC) and prescription medications globally. It was widely prescribed for gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and peptic ulcers, with a peak global sales exceeding $2 billion in 2018 (IQVIA, 2019). Its affordability and efficacy contributed to broad uptake across multiple markets, particularly in North America, Europe, and Asia.

Regulatory Landscape and Market Withdrawal

In 2019, multiple regulatory agencies, including the U.S. Food and Drug Administration (FDA), issued recalls and advisories for ranitidine due to concerns over NDMA contamination, which was detected in multiple batches. The European Medicines Agency (EMA) and Health Canada followed suit. The swift regulatory actions led to the withdrawal of ranitidine products from markets worldwide, significantly impacting its market size.

Despite the market exit, a subset of companies and generic manufacturers have sought alternative formulations, including removal of NDMA risk through reformulation or manufacturing process improvements. The ongoing concern reduces market confidence and impacts sales projections.

Market Segmentation

1. Over-the-Counter (OTC) Segment

Before withdrawal, OTC ranitidine accounted for approximately 60% of total sales, primarily driven by consumer demand for accessible heartburn remedies. Post-2019, OTC sales diminishment was substantial, with a gradual potential for re-entry contingent on reformulation and regulatory approval.

2. Prescription Segment

Prescription ranitidine remained significant in hospital settings and for severe cases. The impact of withdrawal here was immediate, with prescribers pivoting towards alternative drugs like proton pump inhibitors (PPIs) or other H2 receptor antagonists such as famotidine and nizatidine.

3. Regional Differences

- North America: Dominated by OTC channels; regulatory actions led to near-total market retreat.

- Europe: Similar withdrawal, but with some agencies advocating for reformulated products, leading to potential reintroduction.

- Asia-Pacific: Larger market share historically; dependent on regulatory decisions and reforms.

Competitive Landscape

Post-2019, the market shifted significantly:

- Generic H2 blockers (famotidine, nizatidine) gained market share, with some rebranding efforts for reformulated ranitidine products.

- Proton pump inhibitors (PPIs) (omeprazole, esomeprazole, pantoprazole) have replaced ranitidine as primary therapy for acid suppression.

- Emerging therapies and novel agents are under development, aiming at safer, more effective options.

Future Market Opportunities

Reintroduction of ranitidine hinges on safety re-establishment. Several pharmaceutical firms are investigating:

- Reformulation with enhanced manufacturing controls to eliminate NDMA contamination.

- Regulatory approval processes, including extensive testing and risk mitigation strategies.

Pending successful reformulation, a modest market resumption could occur, primarily in regions with less stringent regulatory enforcement.

Sales Projections

Short-Term Outlook (1–2 Years)

Given the current regulatory stance and market skepticism, individual company projections forecast negligible to zero sales unless reformulated products receive approval. Sales could range from $0 to $50 million globally as niche or experimental products if reformulation and approval are achieved.

Medium-Term Outlook (3–5 Years)

If reformulated ranitidine products attain regulatory approval, a cautious recovery could target $200–$500 million globally, primarily driven by:

- Regulatory approvals in select jurisdictions.

- Existing brand recognition.

- Consumer demand for familiar medications.

However, this scenario faces competition from established alternatives, notably PPIs, which have a larger market presence.

Long-Term Outlook (5+ Years)

Long-term sales depend on:

- Regulatory acceptance of reformulated ranitidine.

- Market acceptance by physicians and consumers.

- Competitive pressure from alternative therapies, especially PPIs and new entrants.

If reformulated ranitidine fails to regain trust or regulatory approval, the drug's market potential remains minimal, with a projected < $50 million annual revenue globally.

Market Risks and Considerations

- Regulatory hurdles: Stringent safety assessments prolong approval processes.

- Consumer confidence: Restoring trust is crucial; adverse publicity may hinder re-entry.

- Legal liabilities: Past lawsuits related to NDMA contamination could impede market re-establishment.

- Market competition: Alternatives with proven safety profiles dominate now, reducing potential market share.

Strategic Recommendations

- Invest in reformulation to eliminate NDMA risks, emphasizing manufacturing quality.

- Engage with regulators early to streamline approval.

- Develop targeted marketing to rebuild consumer trust.

- Monitor competitor developments in alternative therapies.

Key Takeaways

- Ranitidine's market has contracted sharply following regulatory bans due to safety issues, with minimal current sales.

- The future market exists only if companies successfully reformulate and obtain regulatory approval for safe, NDMA-free ranitidine variants.

- Alternative therapies, notably PPIs, have solidified market dominance, making re-entry challenging.

- Prospective sales remain uncertain but could reach moderate levels (~$200–$500 million) if safety concerns are mitigated and regulatory hurdles overcome.

- Companies should prioritize safety compliance, regulatory engagement, and consumer confidence restoration to capitalize on potential reintroduction.

FAQs

1. Is ranitidine likely to return to the market?

Only if companies can develop reformulated versions free from NDMA contamination and secure regulatory approval. Currently, no reintroduction plans are official.

2. What are the main competitors replacing ranitidine?

Proton pump inhibitors (e.g., omeprazole, esomeprazole) and other H2 receptor antagonists like famotidine dominate the acid suppression market.

3. How has the market withdrawal impacted global sales?

Global sales plummeted from over $2 billion in 2018 to near zero in regions with bans. The residual market is niche and experimental.

4. What regulatory actions are necessary for reintroduction?

Manufacturers must demonstrate that reformulated ranitidine products are free of NDMA contamination through rigorous testing and meet safety standards set by agencies like the FDA and EMA.

5. What are the risks associated with reformulated ranitidine?

Potential challenges include proving safety and efficacy, gaining regulatory approval, rebuilding consumer trust, and competing against established therapies.

Sources:

[1] IQVIA, 2019. Global Pharmaceutical Market Data.

[2] FDA. "Memory of Ranitidine Recall" (2019).

[3] EMA. "Update on Ranitidine and NDMA Contamination" (2020).

[4] Pharmaceutical Market Reports. "Proton Pump Inhibitors and H2 Blockers."

[5] Industry Analysis. "Post-Recall Therapy Shifts in Gastrointestinal Drugs."

More… ↓