Last updated: July 28, 2025

Introduction

Norethindrone, a synthetic progestin, is a cornerstone in hormonal contraception, hormone replacement therapy, and other gynecological treatments. It is widely recognized for its efficacy and availability as both a standalone product and as part of combination regimens. Given its clinical versatility and regulatory approval in various markets, understanding the current market landscape and projecting future sales of norethindrone is crucial for pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Global Market Size and Trends

The global hormonal contraceptives market, within which norethindrone prominently features, was valued at approximately USD 19.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030 [1]. The increasing adoption of oral contraceptives, heightened awareness about reproductive health, and expanding healthcare infrastructure, especially in developing economies, underpin this growth.

Regulatory Environment

Many jurisdictions, including the United States and Europe, recognize norethindrone as a first-line oral contraceptive. The FDA-approved brand names, such as Ortho-Novum and Microgestin, alongside generic options, have broad market penetration. Regulatory approvals for extended-release forms and combination pills continue to expand the drug’s application scope.

Redistribution and Competitive Dynamics

Norethindrone faces competition from other progestins (e.g., levonorgestrel, desogestrel), non-hormonal methods, and newer contraceptive technologies. However, its extensive clinical history, proven safety profile, and cost-effectiveness sustain its market relevance. Additionally, its use in hormone replacement therapy (HRT) for menopausal symptoms has expanded its therapeutic portfolio.

Market Drivers and Challenges

Drivers

- Women’s Health Awareness: Rising consciousness about reproductive rights fuels demand.

- Regulatory Approvals: New formulations and combination therapies broaden usage.

- Market Penetration in Developing Economies: Growing healthcare infrastructure supports increased access.

- Longevity of Existing Products: Patents on original formulations expire, facilitating generic entry and price competition.

Challenges

- Emergence of Alternative Contraceptives: Non-hormonal methods and long-acting reversible contraceptives (LARCs) threaten oral pill dominance.

- Side Effect Profiles: Concerns about adverse effects such as thromboembolism may limit adoption among certain populations.

- Regulatory Fluctuations: Changing legal frameworks and approval processes may impact market stability.

Sales Projections

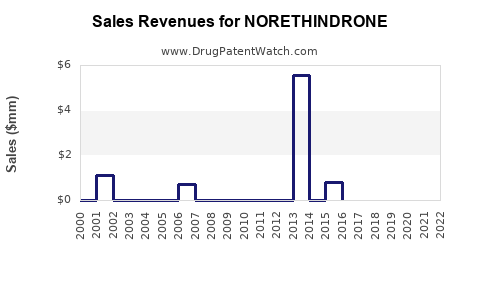

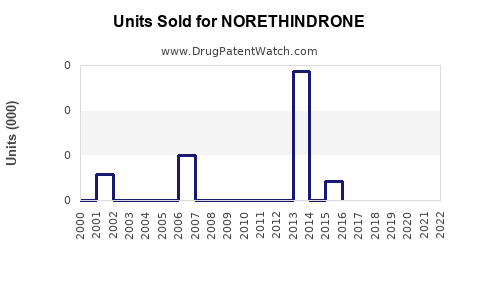

Historical Sales Data

In North America, sales of norethindrone formulations have exhibited steady growth, with annual revenues around USD 850 million in 2022 [2]. Globally, the sales are estimated at USD 1.5 billion when considering branded and generic products.

Future Growth Estimates

Based on current trends and market drivers, global sales are projected to reach approximately USD 2.3 billion by 2030, growing at an estimated CAGR of 4.2%. The following factors underpin this projection:

- Market Expansion in Emerging Economies: Doubling healthcare investments in Asia-Pacific and Latin America suggest increased demand for affordable oral contraceptives.

- Product Innovation: Development of longer-acting formulations may attract new users.

- Regulatory Approvals: Widespread approval for use in hormonal replacement therapy widens the application scope, contributing to sales growth.

Sales Segmentation

- By Region: North America (38%), Europe (25%), Asia-Pacific (20%), Latin America (10%), Middle East & Africa (7%).

- By Application: Contraception (~85%), HRT (~10%), other gynecological uses (~5%).

Key Market Players

Pfizer, Sandoz (Novartis), Mylan (now part of Viatris), and Teva Pharmaceuticals dominate the generic segment, contributing significantly to overall sales revenue. Branded products maintain premium pricing in developed markets, while generics drive volume growth in emerging economies.

Opportunities and Strategic Considerations

- Generic Expansion: Patent expirations open avenues for increased market share via generic formulations, reducing costs and expanding access.

- New Formulations: Extended-release and combination formulations can capture unmet patient needs.

- Partnerships with Healthcare Providers: Improving distribution channels, particularly in underserved markets, can drive sales.

- Regulatory Engagement: Proactive compliance and approval of new indications or formulations will sustain market relevance.

Risk Factors

- Competitive Innovation: Advances in non-invasive, implantable contraceptive devices threaten oral pill sales.

- Market Saturation: Established markets may display slower growth, necessitating penetration into new regions.

- Regulatory and Reimbursement Changes: Policy adjustments can impact profitability and access.

- Public Perception: Concerns regarding hormone-related side effects could impact user uptake.

Key Takeaways

- Norethindrone is a mature product in the hormonal contraceptive and gynecological market, with robust demand supported by existing clinical evidence, affordable pricing, and extensive regulatory approval.

- The global market is forecast to grow steadily at 4.2% CAGR, reaching USD 2.3 billion by 2030, driven primarily by expanding markets in Asia-Pacific and Latin America.

- Competitive dynamics favor generic manufacturers, with patent expiries facilitating increased market penetration.

- Opportunities for sales growth include product innovation, strategic partnerships, and expanding into emerging markets.

- Risks stem from increasing competition from alternative contraceptive methods, regulatory shifts, and evolving consumer preferences.

FAQs

1. What are the primary indications for norethindrone use?

Norethindrone is primarily indicated for oral contraception, treatment of menstrual disorders, and as part of hormone replacement therapy, especially for menopausal symptom management.

2. How does the market growth of norethindrone compare to other progestins?

Norethindrone generally maintains stable demand due to its long-standing clinical use, whereas newer progestins with additional benefits (e.g., drospirenone) are gaining popularity. Overall, norethindrone's market growth aligns with the broader contraceptive market CAGR.

3. What regulatory challenges could impact norethindrone sales?

Regulatory agencies may impose new safety guidelines, restrict indications, or require updated labeling, potentially affecting sales. Conversely, approval for new formulations or indications can enhance market expansion.

4. How is market competition shaping the future of norethindrone?

The competition from long-acting reversible contraceptives (LARCs), non-hormonal methods, and newer hormonal options pressures norethindrone's market share, emphasizing the need for innovation and strategic positioning.

5. What strategic actions can manufacturers take to maximize sales?

Manufacturers should focus on expanding access through affordable generics, developing extended-release formulations, partnering with global health organizations, and navigating regulatory pathways efficiently.

References

[1] MarketResearch.com, "Hormonal Contraceptives Market Forecast 2022-2030."

[2] IQVIA, "Global Pharmaceutical Sales Data, 2022."