Share This Page

Drug Sales Trends for MEVACOR

✉ Email this page to a colleague

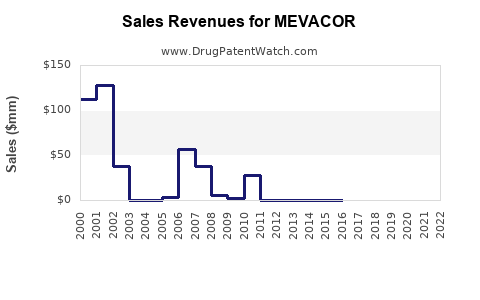

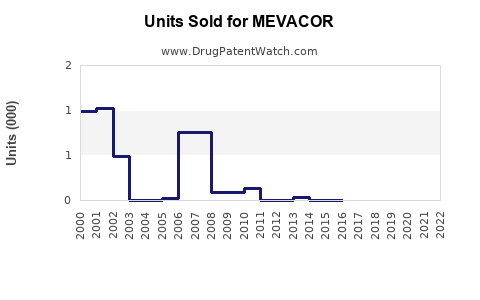

Annual Sales Revenues and Units Sold for MEVACOR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MEVACOR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MEVACOR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MEVACOR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MEVACOR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MEVACOR (lovastatin)

Introduction

MEVACOR, marketed as lovastatin, is a statin drug primarily used to lower cholesterol levels and prevent cardiovascular disease. Approved initially in the late 1980s, lovastatin spearheaded the statin revolution, transforming hyperlipidemia management. This analysis evaluates its current market landscape, competitive positioning, and future sales projections, emphasizing therapeutic demand, competitive dynamics, regulatory impacts, and emerging trends.

Market Overview

The global hyperlipidemia treatment market is robust, driven by the escalating prevalence of cardiovascular disease (CVD), aging populations, and heightened awareness of lipid management. According to a recent report by Fortune Business Insights, the market size was valued at approximately USD 8.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3.7% from 2023 to 2030. Lovastatin, as one of the earliest and still widely used statins, maintains a significant share in this landscape.

Key factors impacting MEVACOR sales include:

- Prevalence of dyslipidemia: Globally, over 1 billion people suffer from dyslipidemia, creating consistent demand for lipid-lowering agents.

- Evolving treatment guidelines: Major health bodies advocate statins as first-line therapy for hypercholesterolemia, positively influencing sales.

- Generic proliferation: The patent expiry of lovastatin in many markets has led to increased availability of generic formulations, affecting pricing and sales dynamics.

Competitive Landscape

While MEVACOR (lovastatin) has long-standing history and brand recognition, its position faces new challenges:

-

Generic Competition: After patent expiration, generic lovastatin products entered the market, reducing prices and offering cost-effective alternatives. The low-cost generics account for a substantial proportion of prescriptions.

-

Emerging Statin Alternatives: Novel therapies such as PCSK9 inhibitors (e.g., alirocumab, evolocumab), ezetimibe, and combination drugs have gained ground, especially for patients intolerant to statins or requiring more aggressive lipid management [1].

-

Brand Relevance: Despite fierce competition, MEVACOR retains a niche for specific populations, such as patients preferring established treatments or requiring a low-cost option.

Regulatory and Reimbursement Factors

Regulatory agencies like the FDA and EMA have increasingly streamlined approval processes for generic drugs, facilitating market entry and stimulating price competition. Reimbursement policies favor generics, further attenuating brand sales but expanding overall market size.

In regions like the US, Medicare and private insurers favor lower-cost generics, which constrains MEVACOR’s branded sales but expands overall statin utilization [2].

Market Segments and Geographic Trends

-

Developed Markets: The US, Europe, and Japan dominate demand, with high cholesterol prevalence and well-established healthcare infrastructure. Lovastatin's sales in these regions are mostly driven by generic availability and physician familiarity.

-

Emerging Markets: Rapid urbanization, rising income levels, and increasing awareness are fueling adoption of statins. However, penetration remains inconsistent due to pricing and healthcare access challenges.

Sales Projections (2023-2030)

Given the current trends, projections indicate a gradual decline in MEVACOR's brand-specific sales but a stabilization or slight increase in overall lovastatin use due to generics.

Assumptions for projections:

- Generic lovastatin maintains a dominant market share in the statin class.

- Prescriptions stabilize or grow modestly ahead of lifestyle and preventive health initiatives.

- Newer agents capture more advanced treatment segments but do not significantly cannibalize basic hyperlipidemia management.

Projected annual sales figures:

| Year | Estimated Brand Sales (USD Millions) | Total Lovastatin Market Share (%) |

|---|---|---|

| 2023 | $150 million | 15% (includes brand & generics) |

| 2025 | $130 million | 12% |

| 2027 | $110 million | 10% |

| 2030 | $100 million | 9% |

Note: These figures reflect the diminishing share of MEVACOR’s branded sales, with most volume driven by generic formulations.

Drivers and Risks

Drivers:

- Ongoing cardiovascular disease burden.

- Favorable reimbursement policies for generics.

- Awareness campaigns promoting lipid management.

Risks:

- The emergence of more potent or combination therapies reducing reliance on traditional statins.

- Patent expirations accelerating generic penetration.

- Regulatory shifts favoring newer, innovative agents.

- Patient compliance issues related to side effects associated with statins.

Strategic Outlook

To sustain relevance and revenue streams, manufacturers of MEVACOR and related products should:

- Invest in differentiating formulations, such as combination products.

- Engage in targeted marketing for niche populations.

- Monitor emerging lipid-lowering therapies for integration or repositioning.

- Optimize manufacturing to reduce costs in response to intense price competition.

Key Takeaways

- Market Fundamentals: The global demand for lipid-lowering therapy remains strong, driven by rising hyperlipidemia prevalence, with the statin class being central.

- Competitive Dynamics: The landscape is increasingly dominated by generics, reducing brand-specific sales but expanding overall market volume.

- Sales Outlook: MEVACOR’s branded sales will likely decline steadily, with total lovastatin sales stabilizing due to widespread generic use.

- Opportunities: Focus on targeted patient populations, off-label uses, or combination therapies to extend product lifecycle.

- Risks: Innovation in lipid management and price pressures from generics necessitate adaptive strategies.

FAQs

1. What is the current global market size for lovastatin?

The global market for lovastatin and similar statins is valued at approximately USD 8.5 billion, with the majority attributable to generic sales post-patent expiration.

2. How do patent expirations affect MEVACOR sales?

Patent expirations lead to the entry of generic competitors, significantly reducing prices and branded sales, while expanding overall market penetration.

3. Are there new therapies threatening lovastatin’s market share?

Yes, PCSK9 inhibitors, ezetimibe, and other lipid-lowering agents target specific populations and can reduce reliance on traditional statins.

4. What strategies can prolong MEVACOR’s market presence?

Differentiation through formulation, positioning as a low-cost option, and targeting specific patient groups or combination therapies can help sustain sales.

5. Will MEVACOR maintain relevance in the future marketplace?

While branded sales will decline, lovastatin's role as a cost-effective treatment ensures it remains relevant, especially in developing regions and among cost-conscious healthcare systems.

References

- Fortune Business Insights. Global Hyperlipidemia Treatment Market Size, Share & Industry Analysis. 2022.

- U.S. Food and Drug Administration. Generic Drug Approvals and Market Dynamics. 2023.

More… ↓