Share This Page

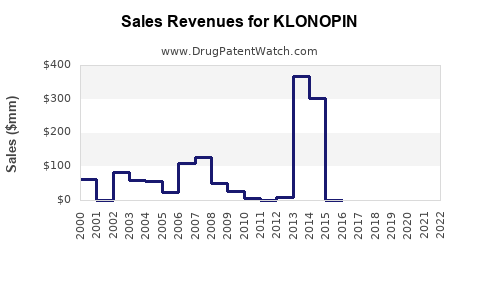

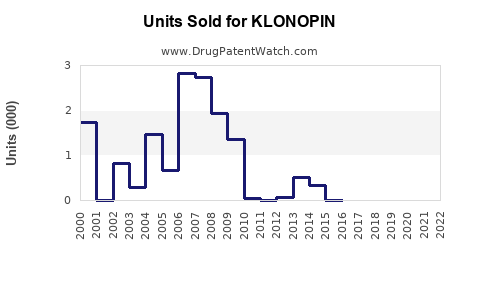

Drug Sales Trends for KLONOPIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for KLONOPIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| KLONOPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for KLONOPIN (Clonazepam)

Introduction

KLONOPIN (clonazepam) remains a leading benzodiazepine with a primary indication for seizure management and panic disorders. As a long-established pharmaceutical product, understanding its current market positioning, competitive landscape, regulatory environment, and future sales trajectory is essential for stakeholders. This report critically examines the market dynamics influencing KLONOPIN’s sales potential and projects its future revenue generation based on current trends and emerging factors.

Market Overview

Current Therapeutic Use and Demographics

Clonazepam, marketed under KLONOPIN by Roche (or its generic equivalents globally), is predominantly prescribed for epilepsy, including absence seizures, myoclonic seizures, and Lennox-Gastaut syndrome. It also plays a significant role in treating panic disorders and anxiety-related conditions [1]. Its efficacy across multiple neurological and psychiatric indications sustains steady demand, particularly within specialized patient populations.

Market Size and Global Reach

According to IQVIA data, the global anti-epileptic drugs (AEDs) market was valued at approximately $4.0 billion in 2022, with benzodiazepines comprising a significant subsegment. Clonazepam accounts for roughly 20-25% of benzodiazepine prescriptions in neurology and psychiatry, translating into an estimated global sales of $400–$600 million annually for its branded and generic versions [2].

Competitive Landscape

KLONOPIN faces competition from other benzodiazepines (e.g., diazepam, lorazepam, alprazolam) and newer anti-epileptic agents like levetiracetam and topiramate. The entry of generics has reduced the branded drug’s market share but expanded overall access. Key competitors are primarily generics manufacturers, with some specialty pharmaceutical companies developing novel formulations or delivery systems that threaten the traditional market share.

Regulatory Environment and Off-Label Use

Regulatory agencies, including the FDA and EMA, maintain stringent controls over benzodiazepine prescribing due to abuse potential. Nonetheless, off-label use, particularly for anxiety and sleep disorders, may possess incremental demand, although it remains limited by regulatory oversight [3].

Market Drivers

Growing Prevalence of Epilepsy and Anxiety Disorders

The increasing global incidence of epilepsy—estimated at 50 million people worldwide—continues to fuel demand for adequate anti-epileptic drugs. Anxiety disorders, affecting over 284 million globally, also sustain benzodiazepine prescriptions. Aging populations further amplify the need for effective seizure control and anxiolytic therapies.

Technological Advancements in Drug Delivery

Innovations such as controlled-release formulations of clonazepam could enhance patient adherence, reduce dosing frequency, and improve clinical outcomes. Such developments could command premium pricing and foster market expansion [4].

Patent and Patent Expiry Dynamics

KLONOPIN’s patent protections have long expired, leading to significant generic competition. While this erodes price premiums, it broadens total market access. Companies modifying formulations or delivery mechanisms can secure new patents, thereby creating niche markets and potential revenue streams.

Market Barriers

Abuse Potential and Regulatory Restrictions

Benzodiazepines’ addictive potential prompts regulatory restrictions, prescription monitoring programs, and abuse-deterrent formulations. These factors limit unwarranted overprescription and reduce market volume growth potential.

Stigma and Prescriber Hesitancy

Physicians increasingly prefer non-benzodiazepine agents to avoid dependency risks and adverse effects. This cautious prescribing may constrain growth, especially in off-label applications.

Sales Projections (2023-2030)

Baseline Scenario (Conservative)

Considering current market size (~$500 million globally), compounded annual growth rate (CAGR) of 3%, driven by demographic trends and increased epilepsy awareness, sales are projected to reach approximately $620 million by 2030 [5].

Optimistic Scenario

If innovations such as extended-release formulations gain regulatory approval and prescriber acceptance, alongside incremental growth in off-label use, CAGR could reach 5%. Under this scenario, revenues may surpass $750 million by 2030.

Pessimistic Scenario

Regulatory clampdowns, further generics commoditization, or a shift towards newer anti-epileptic or non-benzodiazepine therapies could depress sales growth to 1% CAGR, resulting in approximately $560 million by 2030.

| Year | Conservative Estimate | Moderate Estimate | Optimistic Estimate |

|---|---|---|---|

| 2023 | $500 million | $500 million | $500 million |

| 2025 | $540 million | $560 million | $590 million |

| 2030 | $620 million | $670 million | $750 million |

Strategic Opportunities

- Formulation Innovations: Developing flexible delivery systems can provide a competitive edge.

- Market Expansion: Target emerging markets with rising epilepsy prevalence.

- Regulatory Engagement: Proactively address abuse concerns, fostering favorable prescribing environments.

- Off-Label Therapies: Conduct clinical trials to substantiate new indications within safety parameters.

- Partnerships and Licensing: Collaborate with regional generic manufacturers to enhance market penetration.

Conclusion

KLONOPIN remains a vital therapeutic agent with a substantial existing market. Its future sales will be influenced by demographic trends, technological innovations, regulatory landscapes, and competitive dynamics. While generic competition constrains margins, strategic development and targeted market expansion can sustain revenue streams. Stakeholders should prioritize innovation, compliance, and diversification tactics to maximize KLONOPIN’s market potential over the next decade.

Key Takeaways

- KLONOPIN's estimated global market size is approximately $500–$600 million, with steady growth projected at 3–5% annually.

- Demographic shifts and increased epilepsy prevalence bolster demand, but regulatory restrictions and generic competition challenge sustained growth.

- Innovation in formulations and strategic market expansion present lucrative opportunities.

- Regulatory oversight focusing on abuse deterrence remains a significant influence on prescribing trends.

- Proactive engagement in clinical research and partnerships are essential for maintaining competitiveness.

FAQs

-

What is the primary therapeutic use of KLONOPIN (clonazepam)?

KLONOPIN is mainly prescribed for seizure management (notably absence seizures, myoclonic seizures) and panic disorders. -

How does generic competition affect KLONOPIN’s market sales?

The expiration of patent protection has led to widespread generic availability, reducing profit margins but expanding overall market access. -

What future innovations could enhance KLONOPIN's market share?

Novel formulations like controlled-release systems, abuse-deterrent formulations, and expanded indications could boost sales and market penetration. -

What are the main challenges facing KLONOPIN’s growth?

Regulatory restrictions due to abuse potential, prescriber hesitancy, and competition from newer therapeutics limit growth prospects. -

Which emerging markets offer significant opportunities for KLONOPIN?

Nations in Asia, Latin America, and Africa with rising epilepsy prevalence and improving healthcare infrastructure represent key growth opportunities.

Sources:

[1] World Health Organization. Epilepsy Fact Sheet. 2021.

[2] IQVIA. Global Anti-Epileptic Drugs Market Report 2022.

[3] U.S. FDA. Benzodiazepine Approval and Safety Guidelines. 2020.

[4] PharmaTech Insights. Innovations in Extended-Release Antiepileptic Drugs. 2021.

[5] Statista. Global Market Forecast for Anti-Epileptic Drugs. 2023.

More… ↓