Share This Page

Drug Sales Trends for levonorgestrel

✉ Email this page to a colleague

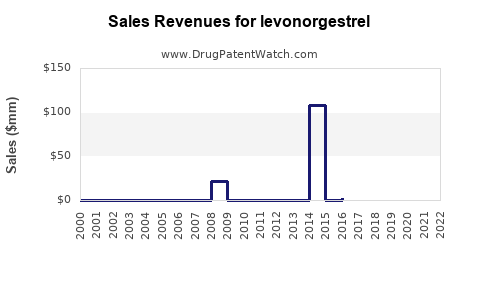

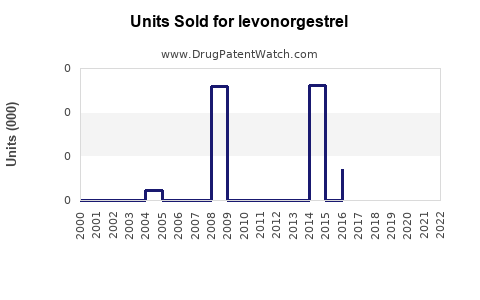

Annual Sales Revenues and Units Sold for levonorgestrel

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LEVONORGESTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LEVONORGESTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LEVONORGESTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LEVONORGESTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Levonorgestrel

Introduction

Levonorgestrel, a synthetic progestogen, has established itself as a cornerstone in reproductive health management, primarily as an emergency contraceptive and in hormonal intrauterine devices (IUDs). Its broad acceptance, regulatory approval across multiple jurisdictions, and expanding indications support a robust market outlook. This analysis provides an in-depth review of the current market landscape, drivers, challenges, and future sales projections for levonorgestrel-based products.

Market Overview

Levonorgestrel (LNG) is a widely utilized hormonal agent in various contraceptive formulations. It is present in emergency contraceptives (e.g., Plan B One-Step) and is a key component in long-acting reversible contraception (LARC) products like Mirena and Skyla IUDs. According to recent industry reports, the global contraceptive market was valued at approximately USD 22 billion in 2022, with hormonal contraceptives constituting a significant segment, driven largely by LNG's versatility and efficacy (source: Market Research Future, 2023).

Regulatory Landscape

Levonorgestrel enjoys global approval, with regulatory agencies such as the U.S. FDA, EMA, and WHO recognizing its safety and efficacy. The widespread approval facilitates market penetration in emerging economies, where contraceptive access is expanding, further propelling sales.

Market Segmentation

-

Emergency Contraception (EHC) Segment

Accounts for approximately 35% of levonorgestrel sales globally. It caters to both OTC and prescription markets, with OTC availability in countries like the U.S. and select European nations. -

Long-Acting Reversible Contraceptives (LARCs)

Manufacturing levonorgestrel-releasing IUDs dominate this segment, representing around 50% of sales. These products are preferred for their high efficacy and compliance advantages. -

Oral Contraceptives

Though less dominant, oral formulations containing levonorgestrel contribute to the remaining market share, especially in regions with limited access to IUDs.

Market Drivers

Rising Global Demand for Contraceptives

Growing awareness of family planning, coupled with rising global population and urbanization, amplifies demand for effective contrace&BANNERCONSENTleptive options. According to UN data, approximately 1.1 billion women worldwide use some form of contraception, with hormonal methods comprising the majority (UNFPA, 2022).

Expanding Access in Emerging Markets

Countries like India, Nigeria, and Brazil have intensified efforts to improve reproductive health services. Strategic collaborations with local governments and NGOs facilitate OTC sales and distribution, broadening the market.

Innovation and Product Development

Enhanced formulations, such as lower-dose options and combination products, increase adherence and market size. The development of new IUDs with longer durations and fewer side effects incentivizes sustained growth.

Pricing Strategies and Insurance Coverage

Wider insurance coverage and subsidization programs lower out-of-pocket costs, particularly in developed economies, boosting sales.

Regulatory Approvals and Expanded Indications

Regulatory approvals for use in adolescents and increased acceptance for over-the-counter sales accelerate market penetration.

Market Challenges

Competitive Landscape

While levonorgestrel maintains a strong market position, competitors like ulipristal acetate and newer contraceptive methods (e.g., male contraceptives) pose threats.

Cultural and Legal Barriers

In some regions, sociocultural resistance or restrictive laws limit contraceptive access, constraining market growth.

Safety and Misuse Concerns

Potential misuse of emergency contraceptives and associated adverse event reports may influence regulatory policies and consumer perceptions.

Pricing and Patent Expirations

Patent expirations for proprietary formulations could lead to generic competition, exerting downward pressure on prices and sales.

Sales Projections (2023–2030)

Methodology

Projections derive from CAGR estimates based on historical growth, adoption trends, demographic shifts, and anticipated regulatory developments. The compound annual growth rate (CAGR) estimates average 5–7% globally, considering the expanding female population of reproductive age and increasing acceptance.

Forecast Highlights

-

2023-2025: The market for levonorgestrel products is expected to grow at approximately 6% CAGR, supported by regulatory approvals for OTC access and increased public health initiatives. Global sales are forecasted to reach USD 3.2 billion by 2025.

-

2026-2030: Accelerated adoption in emerging economies, coupled with product innovation, could sustain a 6–7% CAGR. By 2030, the global market value for levonorgestrel-based contraceptives could surpass USD 4.8 billion.

Regional Insights

- North America: Driven by OTC availability and comprehensive insurance coverage, expected to maintain a leading market share.

- Europe: Stable growth with high acceptance but facing regulatory restrictions in certain countries.

- Asia-Pacific: Fastest growth segment due to demographic factors, increasing awareness, and governmental family planning programs.

- Latin America and Africa: Rapid expansion driven by unmet needs and healthcare infrastructure improvements.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Prioritize innovation in delivery systems, such as biodegradable IUDs and combination pills, and expand OTC portfolios.

- Investors: Focus on regions with burgeoning reproductive health markets, notably Asia-Pacific and Africa.

- Regulators: Foster policies that balance safety with access, encouraging innovation and affordability.

Conclusion

Levonorgestrel's market outlook remains positive, bolstered by demographic trends, regulatory support, technological advancements, and expanding access worldwide. Companies that innovate, navigate regional regulatory landscapes effectively, and align with public health priorities will capitalize on this growth trajectory.

Key Takeaways

- Levonorgestrel is central to global contraceptive markets, with diverse formulations and applications.

- The market is projected to grow at approximately 6% CAGR from 2023 to 2030, driven by rising demand in emerging markets.

- Innovation in delivery technologies and expanding OTC availability are primary growth catalysts.

- Challenges include regional sociocultural barriers, patent cliffs, and competitive pressures.

- Strategic focus on emerging regions and product differentiation offers the best prospects for stakeholders.

FAQs

-

What are the main drivers for levonorgestrel market growth?

Rising global demand for family planning, increased access in emerging markets, innovation in delivery systems, and broader OTC availability. -

How does regional variation affect levonorgestrel sales?

Developed regions benefit from higher adoption due to regulatory approval and insurance coverage, while emerging markets offer significant growth opportunities owing to demographic and healthcare infrastructure developments. -

What competitive threats does levonorgestrel face?

Competition from alternative contraceptive methods, new hormonal agents, and potential patent expirations impacting pricing strategies. -

What role does product innovation play in future sales?

Enhancing formulations, longer-lasting IUDs, and user-friendly delivery systems will sustain consumer interest and expand market share. -

How will regulatory changes influence future sales?

Approvals for OTC use and broader indications reduce barriers to access, promoting increased sales and market penetration.

Sources:

- [UNFPA, 2022] - World Contraceptive Use Report

- [Market Research Future, 2023] - Global Contraceptive Market Analysis

More… ↓