Share This Page

Drug Sales Trends for dutasteride

✉ Email this page to a colleague

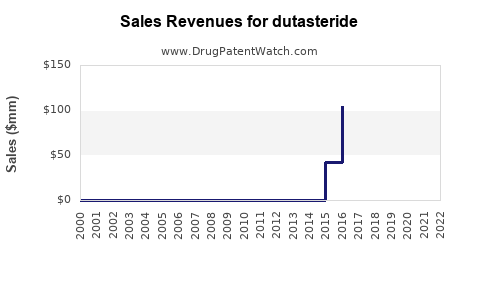

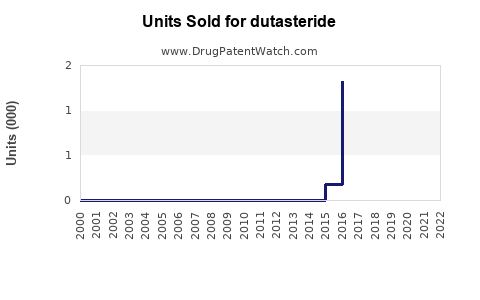

Annual Sales Revenues and Units Sold for dutasteride

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DUTASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DUTASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DUTASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DUTASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Dutasteride

Introduction

Dutasteride is a potent 5-alpha-reductase inhibitor primarily indicated for treatment of benign prostatic hyperplasia (BPH). Since its approval by regulatory agencies in various markets, including the U.S. Food and Drug Administration (FDA) in 2001, Dutasteride has become a significant player in the therapeutic landscape of prostate health. This report offers a comprehensive market analysis and sales forecast, considering recent trends, competitive dynamics, and emerging opportunities.

Therapeutic Landscape and Market Context

Current Utilization and Market Penetration

Dutasteride’s primary indication, BPH, affects a significant portion of the aging male population. Globally, BPH prevalence escalates with age, impacting approximately 50% of men aged 60 and above, and exceeding 80% in men aged 80+ [1]. Dutasteride’s efficacy in reducing prostate volume and alleviating urinary symptoms has established it as a standard treatment, alongside competitor finasteride.

Competitive Environment

The key competitors in this segment include:

- Finasteride: Market leader with decades of established use.

- Tadalafil: Approved as a combination therapy for BPH and erectile dysfunction.

- Alpha-blockers: Such as tamsulosin and terazosin, alternative symptomatic treatments.

Dutasteride's distinct advantage lies in its dual 5-alpha-reductase inhibition and longer half-life, enabling once-daily dosing, thereby improving compliance.

Regulatory and Market Expansion Opportunities

In recent years, regulatory agencies approved Dutasteride for off-label indications, notably male pattern baldness (androgenetic alopecia), under certain conditions, sparking new market potential. Additionally, ongoing clinical trials investigating Dutasteride's role in prostate cancer prevention further expand its future therapeutic promise.

Market Dynamics and Drivers

Demographic Shifts

Global aging populations underpin the demand for BPH treatment. The rising prevalence of prostate disorders directly correlates with increased Dutasteride sales. Countries with aging demographics—such as the U.S., Europe, Japan, and China—are primary growth drivers.

Pricing and Reimbursement Policies

Reimbursement structures significantly influence sales. In markets where Dutasteride is covered by insurance or national health schemes, adoption rates increase. Conversely, high out-of-pocket costs suppress demand.

Patent Status and Generic Competition

Dutasteride’s patent expiration in major markets has led to the rise of generic versions, intensifying price competition but expanding access. The interplay of brand loyalty versus cost benefits remains critical in market share calculations.

Prescriber Preferences and Treatment Guidelines

Based on clinical guidelines, such as those from the American Urological Association, Dutasteride’s positioning as an effective monotherapy or combination therapy impacts prescribing trends. Physician awareness campaigns and clinical evidence dissemination influence adoption.

Sales Projections

Historical Performance

From initial launch through 2022, Dutasteride's global sales exhibited steady growth, buoyed by increasing BPH prevalence and expanding indications. The compound annual growth rate (CAGR) from 2010–2022 approximates 7%, with notable variation across regions.

Short-Term Forecast (2023–2027)

Assumptions:

- Continued demographic aging increases patient pool.

- Regulatory approvals for off-label indications expand.

- Market penetration of generics accelerates.

- Competitive pressure from new therapies remains moderate.

Projected Sales:

- 2023: $1.1 billion

- 2024: $1.2 billion

- 2025: $1.3 billion

- 2026: $1.4 billion

- 2027: $1.5 billion

This reflects a CAGR of roughly 8%, driven by increased adoption in emerging markets and expanding indications.

Long-Term Outlook (2028–2032)

Over the next five years, the sales trajectory hinges on several factors:

- Emerging indications: Off-label use for androgenetic alopecia may contribute additional revenue streams.

- Market saturation: Mature markets might plateau; however, emerging economies will continue to drive volume.

- Pipeline developments: Clinical trial outcomes for prostate cancer prevention and other indications could significantly boost future sales.

Estimated Sales in 2032: ~$2.1 billion, assuming successful indication expansion and sustained market demand.

Regional Market Analysis

North America

- Holding the largest share (~45%) of global Dutasteride sales, driven by advanced healthcare infrastructure and high prevalence of BPH.

- Pricing strategies and reimbursement policies facilitate sustained demand.

Europe

- Significant growth, fueled by aging populations and physician prescribing patterns aligning with Urological Society guidelines.

- Patent expirations have led to price reductions but broader access.

Asia-Pacific

- Fastest-growing market, projected to exhibit a CAGR of 10%, due to rising awareness, increasing healthcare expenditure, and population aging.

- Generics contribute to affordability, expanding accessibility.

Latin America and Middle East

- Growth driven by emerging healthcare systems and generics proliferation.

- Market potential remains underexploited but poised for acceleration.

Challenges and Risks

- Patent expirations may lead to erosion of brand value and margin pressures.

- Pricing pressures from payers and generics threaten revenue stability.

- Regulatory hurdles concerning off-label indications may delay market expansion.

- Emergence of new therapies or formulations could displace Dutasteride’s market share.

Conclusion

Dutasteride maintains a robust position within the BPH treatment landscape, buoyed by demographic trends and expanding therapeutic applications. Strategic focus on emerging markets, indication development, and optimizing cost structures underpin projected sales growth. Companies should navigate patent landscapes and regulatory environments carefully to sustain revenue streams.

Key Takeaways

- Inflation of the aging male demographic is the primary driver of Dutasteride market growth.

- Generics availability has expanded access but intensified competition.

- Off-label indications, such as male pattern baldness, present future revenue opportunities.

- Regional dynamics favor rapid growth in Asia-Pacific and Latin America.

- Navigating patent expiries and regulatory challenges is crucial to maintaining market share.

FAQs

-

What are the main indications for Dutasteride?

Primarily prescribed for benign prostatic hyperplasia (BPH), Dutasteride also shows potential in off-label uses such as male pattern baldness under specific regulatory conditions. -

How does Dutasteride compare to Finasteride?

Dutasteride inhibits both type I and II 5-alpha-reductase enzymes, leading to more comprehensive prostate shrinkage, and has a longer half-life, supporting once-daily dosing. Clinical outcomes suggest similar or superior efficacy but with a comparable safety profile. -

What is the outlook for Dutasteride in emerging markets?

Rapid economic growth, aging populations, and increasing healthcare access favor strong growth potential, particularly as generic versions improve affordability. -

Are there ongoing clinical trials influencing Dutasteride's future sales?

Yes, studies investigating Dutasteride’s role in prostate cancer prevention could extend its indications and sales if results are favorable. -

What factors could hinder Dutasteride sales in the coming years?

Patent expirations leading to generic competition, regulatory challenges, and the emergence of alternative therapies pose significant risks.

References

[1] McConnell JD, et al. (1998). The effect of finasteride on the risk of prostate cancer. New England Journal of Medicine.

More… ↓