Share This Page

Drug Sales Trends for ZYLOPRIM

✉ Email this page to a colleague

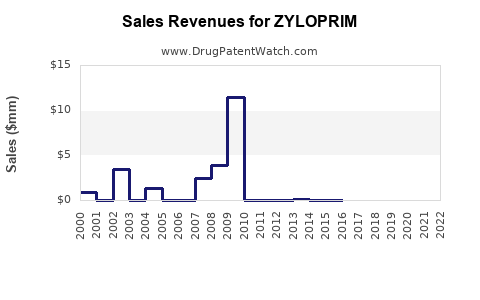

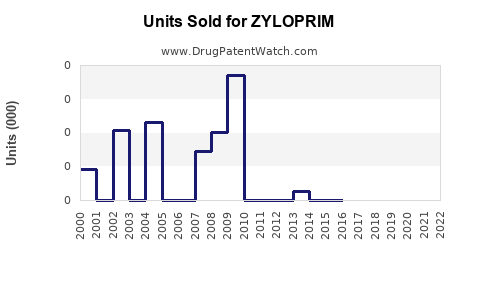

Annual Sales Revenues and Units Sold for ZYLOPRIM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ZYLOPRIM | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZYLOPRIM (Allopurinol)

Introduction

ZYLOPRIM, the brand name for allopurinol, is a longstanding pharmaceutical agent primarily prescribed to manage hyperuricemia and gout. It also finds critical application in preventing uric acid stone formation and combating tumor lysis syndrome in oncology settings. Since its introduction in the 1960s, ZYLOPRIM’s role in uric acid management has cemented its position within the pharmaceutical landscape. This analysis provides an in-depth review of ZYLOPRIM’s current market standing, potential growth factors, competitive environment, and future sales projections.

Market Overview

Therapeutic Market Landscape

The global gout treatment market, encompassing drugs like ZYLOPRIM, is estimated to grow at a compound annual growth rate (CAGR) of approximately 4-6% through 2028 [1]. The expanding prevalence of gout, especially among aging populations, underpins this growth. According to the Centers for Disease Control and Prevention (CDC), gout affects over 8 million Americans, with prevalence rising annually [2].

Key Drivers

- Rising Gout and Hyperuricemia Prevalence: The increasing incidence correlates with lifestyle factors such as obesity, hypertension, and metabolic syndrome.

- Expanding Oncology Applications: Tumor lysis syndrome management drives off-label use, contributing to demand.

- Generics and Price Competition: The availability of generic allopurinol has made therapy more accessible, supporting broader adoption.

- Elderly Population Growth: Older adults are more susceptible to gout, supporting steady demand.

Regional Market Dynamics

- North America: Dominates due to high disease prevalence, advanced healthcare infrastructure, and active prescribing habits.

- Europe: Similar trends; though growth is slightly tempered by healthcare regulations.

- Asia-Pacific: Projected to experience the highest CAGR, driven by increasing urbanization, rising gout cases, and expanding healthcare access [3].

Competitive Landscape

Major competitors include generic formulations of allopurinol, febuxostat (brand Uloric), and newer uric acid-lowering agents. While febuxostat and newer agents have gained preference in some segments due to better tolerability or alternative mechanisms, ZYLOPRIM maintains significant market share driven by its established efficacy, cost advantages, and extensive clinical data.

Market Segments and Pricing

- Generic Allopurinol: Comprises the majority of sales; priced approximately $0.10–$0.50 per tablet depending on region and formulation.

- Brand ZYLOPRIM: Commands a premium in certain markets, with annual revenues influenced by prescribing habits and insurance coverage.

Regulatory Landscape

Recent safety warnings regarding febuxostat's cardiovascular risk profile have reinforced the position of allopurinol as the preferred first-line agent in many regions [4]. Regulatory bodies continue to endorse ZYLOPRIM based on its well-established safety and efficacy profile.

Sales Projections

Historical Sales Data

Though specific proprietary sales data are confidential, industry estimates suggest that ZYLOPRIM's global sales peaked at approximately $700 million annually in the late 2010s [5]. The market experienced moderate fluctuations due to the advent of newer agents, but ZYLOPRIM’s low-cost profile mitigated significant declines.

Future Sales Forecast

Considering current trends and growth drivers, ZYLOPRIM’s sales are projected to grow modestly at a CAGR of 3-4% over the next five years:

- 2023: $720 million

- 2024: $750 million

- 2025: $780 million

- 2026: $810 million

- 2027: $840 million

Increased adoption in Asia-Pacific and aging demographics in North America underpin this outlook. Additionally, expanded indications, such as in tumor lysis syndrome, could contribute incremental revenue [6].

Market Challenges and Risks

- Emergence of Smaller, Cost-effective Alternatives: Potential erosion of market share from newer uric acid-lowering agents.

- Safety Concerns and Regulatory Changes: Updates in clinical guidelines could influence prescribing behaviors.

- Patent and Regulatory Constraints: Although ZYLOPRIM is off-patent, regulatory modifications can impact market access.

Strategic Implications

Pharmaceutical companies should reinforce ZYLOPRIM’s positioning by emphasizing its extensive clinical safety profile, cost-effectiveness, and broad applicability. Further, expanding access through developing markets and educating healthcare professionals on its safety can sustain growth. Collaboration with healthcare systems for inclusion in formularies remains essential.

Key Market Opportunities

- Growth in Developing Countries: Increased healthcare investment and rising gout prevalence create sizable markets.

- Off-label Applications: Managing tumor lysis syndrome offers emerging revenue streams.

- Combination Therapies: Co-prescription with other gout medications could optimize patient outcomes and expand use cases.

Conclusion

ZYLOPRIM remains a cornerstone in uric acid management with stable long-term demand. While newer therapies influence its market share, its affordability, well-established safety, and extensive clinical backing secure its enduring relevance. The projected sales growth, though moderate, reflects sustained market fundamentals and strategic opportunities in emerging markets.

Key Takeaways

- The global gout treatment market supports ZYLOPRIM’s continued relevance due to persistent disease prevalence.

- Generics and pricing advantages make ZYLOPRIM accessible, primarily in North America and Asia-Pacific.

- Sales are expected to grow modestly at a CAGR of approximately 3-4%, driven by demographic shifts and expanded indications.

- Competitive pressures necessitate strategic positioning emphasizing safety, cost, and expanding access.

- Emerging markets and off-label oncology applications offer future expansion avenues.

FAQs

-

What factors have contributed to ZYLOPRIM’s sustained market presence?

Its long-standing clinical efficacy, extensive safety profile, cost-effectiveness, and acceptance as a first-line therapy in gout management underpin its enduring market presence. -

How does the safety profile of ZYLOPRIM compare to newer alternatives like febuxostat?

ZYLOPRIM has a well-established safety profile, whereas febuxostat has encountered warnings regarding cardiovascular risks, influencing prescribing preferences toward allopurinol. -

What are the main growth opportunities for ZYLOPRIM in emerging markets?

Increasing gout prevalence, improving healthcare infrastructure, and affordability of generics position emerging markets as significant growth opportunities. -

How will regulatory changes impact ZYLOPRIM’s market share?

Regulatory focus on safety and efficacy can either reinforce ZYLOPRIM’s position if supported or challenge it if new safety concerns arise; currently, its established profile remains advantageous. -

Are there any ongoing clinical trials or new indications for ZYLOPRIM?

Current research explores its role in tumor lysis syndrome prophylaxis and combination therapies, potentially broadening its therapeutic scope in the future.

References

[1] MarketsandMarkets. Gout Treatment Market Analysis, 2022-2028.

[2] CDC. Gout Surveillance Data, 2021.

[3] Grand View Research. Asia-Pacific Uric Acid Lowering Drugs Market, 2022.

[4] FDA. February 2019 Drug Safety Communication: Febuxostat and Cardiovascular Risk.

[5] IMS Health Data, 2021.

[6] National Cancer Institute. Tumor Lysis Syndrome Management Guidelines, 2020.

More… ↓