Last updated: July 29, 2025

Introduction

TEGRETOL (carbamazepine), a longstanding anticonvulsant and mood-stabilizing medication, holds a significant position in the global pharmaceutical market. Approved initially in the 1960s, it has established a broad therapeutic profile, primarily indicated for epilepsy, trigeminal neuralgia, and bipolar disorder. This analysis explores current market dynamics, competitive landscape, regulatory factors, demographic influences, and future sales projections. The goal: to provide strategic insights for stakeholders considering investment, distribution, or R&D in relation to TEGRETOL.

Market Overview

Historical Context and Market Penetration

TEGRETOL's patent expired decades ago, transforming it into a generic drug, which has substantially lowered its pricing and expanded access. Despite newer agent options, TEGRETOL remains a first-line therapy for certain indications, credited to its proven efficacy, well-established safety profile, and cost-effects. The global anticonvulsant market was valued at approximately USD 5.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4% through 2030[1].

The drug’s utilization is primarily driven by the prevalence of epilepsy (~50 million globally) and trigeminal neuralgia (estimated 4 per 100,000 annually), with the bipolar disorder segment growing due to increasing mental health awareness.

Competitive Landscape

While TEGRETOL faces competition from newer antiseizure medications such as levetiracetam, lamotrigine, and oxcarbazepine, its entrenched position and clinicians' familiarity sustain its demand. Generic competition has intensified price competition but also facilitated its widespread use in low- and middle-income countries (LMICs).

Emerging formulations and delivery systems, including long-acting and controlled-release variants, threaten to reshape the market dynamics. Yet, as of 2023, TEGRETOL remains a pivotal product, especially in regions with limited access to newer medications.

Regulatory and Demographic Factors

Regulatory Environment

Globally, TEGRETOL’s manufacturing complies with stringent standards, with approval and marketing rights held by multiple pharmaceutical companies. Regulatory bodies like the FDA and EMA classify carbamazepine as a second-generation anticonvulsant, with warnings concerning the risk of serious adverse effects, notably Stevens-Johnson syndrome[2].

Regulatory pressures focus on safety monitoring, especially considering ethnic-specific genetic markers like HLA-B*1502 among Asian populations, influencing prescribing protocols. These factors can impact sales by modifying healthcare provider preferences and reimbursement policies.

Demographic Trends

The aging population worldwide increases the prevalence of neuropsychiatric conditions treatable by TEGRETOL. Furthermore, the rising incidence of epilepsy in LMICs—where TEGRETOL's affordability is advantageous—drives demand growth.

Mental health initiatives worldwide bolster the bipolar disorder market segment, also contributing to TEGRETOL’s continued relevance.

Market Dynamics and Growth Drivers

- Persistent Medical Need: Despite newer options, TEGRETOL remains effective and cost-efficient, especially for refractory cases.

- Global Accessibility: Generic availability enhances utilization in LMICs, which account for an estimated 60% of epileptic patients.

- Reimbursement and Insurance: Favorable coverage policies in developed markets sustain steady sales levels.

- New Formulations: Development of controlled-release versions aims to improve patient adherence and expand indications, supporting incremental sales.

- COVID-19 Impact: While initial disruptions affected supply chains, utilization levels recovered by late 2021, with telehealth easing prescription access.

Sales Projections: 2023–2030

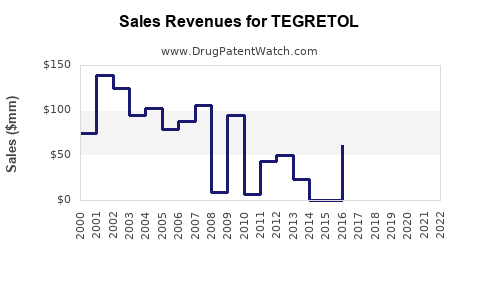

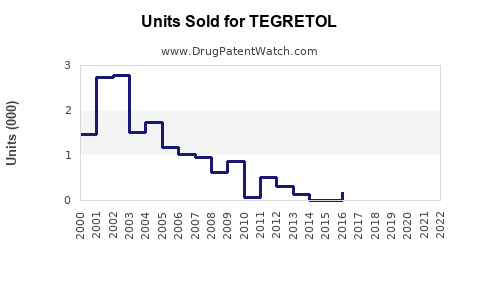

Based on current market conditions, epidemiological data, and emerging trends, TEGRETOL's global sales are projected to grow modestly at a CAGR of around 3-4% over the next seven years.

Key Supporting Factors:

- Stable Demand in Established Markets: With well-established prescribing patterns and approval for multiple indications.

- Expanding Use in LMICs: Driven by cost-effectiveness and growing healthcare infrastructure.

- Pipeline Developments: Limited direct pipeline competition, but incremental innovations in formulations are expected to sustain relevance.

Regional Breakdown

- North America: USD 1.2 billion in 2022; projected growth at 2.5% CAGR, stabilized by mature markets and tight safety protocols.

- Europe: USD 800 million; similar growth trajectory, with regulatory caution impacting expansion.

- Asia-Pacific: USD 1.0 billion; fastest growth at 6% CAGR, fueled by rising epilepsy and bipolar disorder cases, increasing healthcare access, and generic affordability.

- Africa & Latin America: Combined USD 600 million, with potential for accelerated growth contingent upon healthcare infrastructure development.

Overall Global Sales Estimate for 2030: Approximately USD 7.0–7.5 billion, assuming steady expansion.

Strategic Considerations for Stakeholders

- Continued Generic Competition: Optimize manufacturing efficiencies to maintain competitiveness.

- Formulation Innovation: Invest in long-acting formulations or fixed-dose combinations to differentiate products.

- Regulatory Monitoring: Stay abreast of safety warnings and genetic screening guidelines to mitigate compliance risks.

- Market Penetration: Focus on LMICs through partnerships, ensuring affordable pricing and distribution channels.

- Educational Outreach: Support clinician education regarding safe prescribing, especially for populations with genetic susceptibilities.

Key Takeaways

- Stable Market Position: TEGRETOL remains a cornerstone anticonvulsant with consistent demand, particularly in developing countries.

- Growth Prospects: Moderate annual growth (~3-4%) driven by demographic trends, expanding healthcare access, and formulation advancements.

- Competitive Landscape: Generic market saturation pressures necessitate strategic innovation and cost management.

- Regulatory and Safety Considerations: Evolving safety guidelines, especially concerning genetic risks, influence prescribing patterns and market access.

- Regional Opportunities: Asia-Pacific and LMICs represent the most promising growth avenues, owing to demographic shifts and cost advantages.

FAQs

1. What factors influence TEGRETOL’s market sales?

Sales are primarily affected by epilepsy and bipolar disorder prevalence, generic competition, safety regulations, healthcare infrastructure, and the adoption of new formulations.

2. How does the demographic landscape affect TEGRETOL’s future?

An aging global population and rising neuropsychiatric conditions increase demand, especially in LMICs where affordable treatment options are crucial.

3. What upcoming innovations could impact TEGRETOL’s market share?

Long-acting formulations, fixed-dose combinations, and alternative delivery systems could enhance adherence and broaden use, potentially influencing demand dynamics.

4. What regulatory challenges does TEGRETOL face?

Safety concerns related to severe adverse reactions and ethnicity-specific genetic markers necessitate ongoing guidelines that may impact prescribing and market access.

5. How can companies maximize TEGRETOL's market potential?

Through formulation innovation, expanding access in emerging markets, and ensuring compliance with safety regulations, stakeholders can sustain and grow sales.

References

[1] MarketsandMarkets, "Anticonvulsants Market," 2022.

[2] U.S. Food and Drug Administration, "Carbamazepine: Drug Safety Communication," 2021.