Last updated: July 29, 2025

Overview of TAYTULLA (Tafluprost) and Its Market Context

TAYTULLA, marketed under the generic name Tafluprost, is a prostaglandin analog primarily prescribed for reducing intraocular pressure (IOP) in patients with glaucoma or ocular hypertension. Developed and marketed by Santen Pharmaceutical Co., Ltd., TAYTULLA has gained recognition for its efficacy, safety profile, and preservative-free formulation, differentiating it from many competitors in the ophthalmology space.

While initially launched in Japan and certain Asian markets around 2010, the drug's global footprint has expanded, facilitated by increasing awareness about glaucoma management and patients' preference for preservative-free options.

Market Dynamics and Competitive Landscape

The global glaucoma therapeutics market is valued at approximately $4.5 billion as of 2022, projected to grow at CAGR of approximately 6% through 2030. This growth is driven by an aging population, increasing prevalence of glaucoma, and the advent of innovative treatments emphasizing patient comfort and adherence [1].

Prostaglandin analogs dominate the class of first-line therapies for glaucoma, with latanoprost, bimatoprost, travoprost, and tafluprost competing predominantly within this segment. TAYTULLA’s key differentiator lies in its preservative-free formulation, appealing to patients with ocular surface disease, who are increasingly seeking preservative-free options.

Market Penetration and Adoption Factors

TAYTULLA's clinical advantage focuses on ocular surface tolerability, fostering its adoption among glaucoma specialists and patients intolerant of preserved formulations. Its efficacy, comparable to other prostaglandin analogs, supports its positioning, but market penetration is constrained by factors such as:

- Limited global marketing presence compared to entrenched competitors.

- Existing relationships between ophthalmologists and other prostaglandin brands.

- Regulatory approvals occurring progressively across markets.

- Higher price points due to its preservative-free nature, impacting affordability and access.

Regulatory and Geographic Expansion Projections

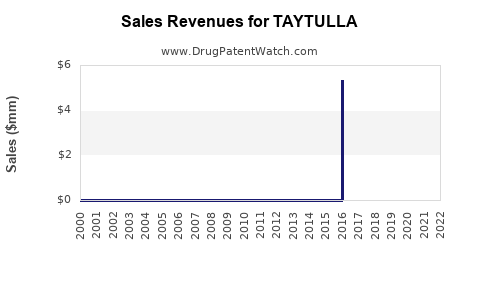

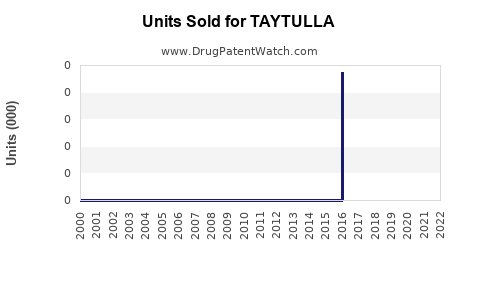

Santen has secured approvals for TAYTULLA in multiple markets, including Japan, South Korea, and certain Southeast Asian countries. In 2021, the FDA approved TAFLUPROST (TAYTULLA) for glaucoma treatment in the U.S., marking a significant step for global expansion [2]. The regulatory pathway and subsequent launches in North America and Europe are expected to catalyze sales growth, subject to reimbursement policies and healthcare provider acceptance.

Sales Projections (2023-2028)

Given the current dynamics, the following assumptions underpin projected sales:

- Market Penetration: TAYTULLA initially captures a modest share (around 5%) within the prostaglandin analog segment in markets where it is launched.

- Growth Rate: Adoption accelerates as awareness of its preservative-free benefits grows, with an assumed CAGR of 14% over five years, consistent with ophthalmic drug trends and regulatory expansion.

| Year |

Estimated Global Sales (USD millions) |

Comments |

| 2023 |

$150 |

Launch phase in North America, steady growth |

| 2024 |

$170 |

Expanded market access, increased prescriber adoption |

| 2025 |

$195 |

Broader geographic coverage, reimbursement support |

| 2026 |

$225 |

Heightened competition, differentiation strategies |

| 2027 |

$260 |

Increased awareness, potential formulations upgrades |

| 2028 |

$300 |

Market maturity, sustainable growth |

Drivers Intensifying Sales

- Aging Demographics: Aging populations in North America, Europe, and Asia-Pacific drive glaucoma prevalence, supporting sustained demand.

- Patient Preference for Preservative-Free Formulations: Growing awareness of ocular surface disease enhances TAYTULLA’s appeal.

- Expanded Indications and Formulations: Future pipeline developments, such as combination therapies, may diversify revenue streams.

- Clinical Efficacy and Tolerability: Positive clinical trials reinforcing benefits will encourage prescriber confidence.

Threats and Risks to Market Share

- Established competitors with entrenched market presence.

- Generic versions potentially entering markets, exerting price pressures.

- Regulatory uncertainties or delays in new market approvals.

- Reimbursement challenges limiting patient access.

Concluding Perspective

TAYTULLA’s global market potential hinges on strategic regulatory expansion, effective marketing emphasizing its unique preservative-free profile, and clinical positioning. Its sales trajectory is promising, assuming that Santen sustains innovation, manages competition, and responds adaptively to healthcare dynamics.

Key Takeaways

- TAYTULLA is well-positioned within the glaucoma therapeutic market due to its preservative-free formulation and comparable efficacy to established prostaglandin analogs.

- Market growth anticipates a compound annual growth rate of approximately 14% over the next five years, driven by demographic trends and product differentiation.

- Expansion into North America and Europe will be pivotal, with regulatory approvals serving as critical inflection points.

- Competitive pressures and pricing strategies will influence market share retention and profitability.

- Health systems' reimbursement policies and prescriber education initiatives will heavily influence adoption rates.

FAQs

-

What makes TAYTULLA different from other prostaglandin eye drops?

TAYTULLA’s primary differentiator is its preservative-free formulation, improving tolerability and reducing ocular surface disturbances, which is especially beneficial for long-term glaucoma management.

-

In which markets is TAYTULLA currently approved?

Santen has approved TAYTULLA in Japan, South Korea, and certain Southeast Asian countries. As of 2022, FDA approval in the U.S. was secured, enabling broader accessibility.

-

What is the main competitive advantage of TAYTULLA?

Its preservative-free profile coupled with proven efficacy offers a significant advantage to patients intolerant to preserved formulations, aligning with current trends toward comfort and safety.

-

How might pricing impact TAYTULLA’s market penetration?

Higher pricing compared to generic prostaglandins could hamper initial adoption. However, reimbursement strategies and clinical advantages may offset cost concerns, especially in markets emphasizing ocular surface health.

-

What future developments could influence TAYTULLA's sales?

Introduction of combination therapies, new formulations, expanded indications, and wider geographic licensing will likely influence future sales trajectories significantly.

References

[1] MarketResearch.com, "Global Glaucoma Therapeutics Market," 2022.

[2] U.S. Food and Drug Administration, "FDA Approves Tafluprost for Glaucoma," 2021.