Share This Page

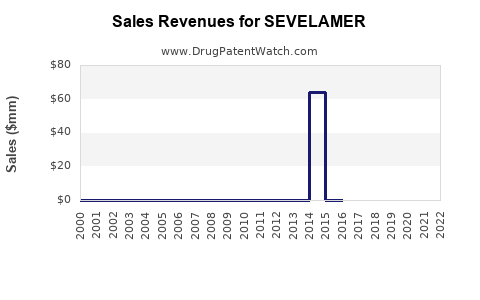

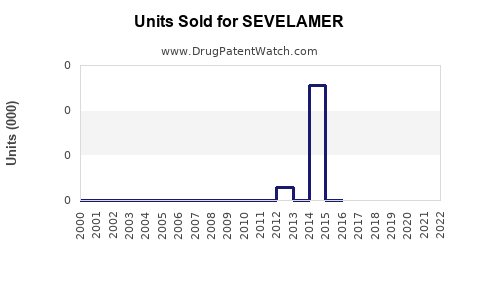

Drug Sales Trends for SEVELAMER

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SEVELAMER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SEVELAMER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SEVELAMER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SEVELAMER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Sevelamer

Introduction

Sevelamer, a non-absorbed polymeric resin, is primarily indicated for the management of hyperphosphatemia in patients with chronic kidney disease (CKD), notably those on dialysis. Its mechanism involves binding dietary phosphate in the gastrointestinal tract, thereby reducing serum phosphate levels without prompting calcium or vitamin D supplementation. The drug’s role in preventing secondary hyperparathyroidism, vascular calcification, and cardiovascular morbidity has cemented its clinical value. This analysis evaluates Sevelamer's current market positioning, growth drivers, competitive landscape, and forecasts its sales trajectory over the next five years.

Market Overview

The global market for phosphate binders, including Sevelamer, is driven by the rising prevalence of CKD and end-stage renal disease (ESRD). According to the Global CKD Prognosis Consortium, approximately 9.1% of the global population suffers from CKD stages 3-5, with ESRD affecting an estimated 2 million individuals, a figure expected to rise due to aging populations and increasing incidence of diabetes and hypertension [1].

Sevelamer's differentiation from calcium-based binders—reducing hypercalcemia risks—has secured its preference in many treatment regimens, especially among patients with vascular calcification risk factors. The expanding CKD patient cohort, combined with evolving clinical guidelines favoring non-calcium phosphate binders, positions Sevelamer for sustained growth.

Current Market Size

In 2022, the global phosphate binder market was valued at approximately USD 2.7 billion, with Sevelamer-containing formulations accounting for roughly 45% of the market share, equating to USD 1.2 billion. North America dominates the market, representing approximately 50%, driven by high CKD prevalence, advanced healthcare infrastructure, and favorable reimbursement policies [2].

Key products include:

- Sevelamer carbonate (e.g., Renvela, Renagel)

- Sevelamer hydrochloride (less common, replaced by carbonate)

Market Drivers

1. Rising CKD and ESRD Incidence

Prevalence rates for CKD are escalating globally. Factors like aging demographics, increasing diabetes cases, and hypertension fuel CKD growth, subsequently elevating demand for phosphate management solutions like Sevelamer.

2. Clinical Preference for Non-Calcium Binders

Guidelines from KDIGO recommend non-calcium-based binders for patients at high cardiovascular risk, favoring Sevelamer over calcium-based alternatives such as calcium carbonate or calcium acetate. This preference enhances Sevelamer's market share.

3. Regulatory and Reimbursement Policies

Stringent regulatory standards for calcium-based binders due to cardiovascular concerns boost adoption of Sevelamer. Additionally, reimbursement coverage in major markets reduces patient out-of-pocket costs, facilitating higher utilization.

4. Product Innovations and Formulations

Introduction of new formulations, such as Sevelamer carbonate, with improved tolerability and dosing convenience, supports increased adherence and sales.

Competitive Landscape

Sevelamer faces competition primarily from calcium-based phosphate binders and other non-calcium agents like lanthanum carbonate, Ferric citrate, and sucroferric oxyhydroxide. Despite competition, Sevelamer’s distinct advantages in cardiovascular protection sustain its market position.

Major manufacturers include:

- Genzyme (Sanofi Genzyme)

- Keryx Biopharmaceuticals (Aeterna Zentaris)

- Other regional players

Patent expiries and biosimilar entry could challenge pricing structures in the future, but current exclusivity and brand recognition uphold Sevelamer’s dominance.

Sales Forecasting (2023-2027)

Assumptions

- The global CKD prevalence will grow at an annual rate of 4%, reflecting demographic trends.

- The adoption of non-calcium binders will continue to rise, capturing an additional 5% market share annually.

- Price per patient remains relatively stable, with minor increases due to inflation and formulation enhancements.

- Regulatory guidelines remain favorable toward Sevelamer, without significant policy reversals.

Projected Market Size

| Year | Estimated Market Size (USD billion) | Sevelamer Market Share | Sevelamer Sales (USD billion) |

|---|---|---|---|

| 2023 | 3.1 | 45% | 1.39 |

| 2024 | 3.3 | 48% | 1.59 |

| 2025 | 3.5 | 50% | 1.75 |

| 2026 | 3.8 | 52% | 1.98 |

| 2027 | 4.1 | 54% | 2.22 |

Analysis:

By 2027, Sevelamer sales are projected to reach approximately USD 2.22 billion, driven by expanding CKD prevalence, increased adoption of non-calcium binders, and supportive clinical guidelines.

Regional Breakdown

- North America: Continues to dominate due to advanced healthcare systems, accounting for an estimated 55% of sales.

- Europe: Steady growth aligns with CKD epidemiology and regulatory acceptance.

- Asia-Pacific: Rapidly increasing prevalence of CKD, with emerging markets expanding Sevelamer usage, projected to contribute approximately 20-25% of total sales by 2027.

Risks and Challenges

- Potential patent expirations or biosimilar entrants could exert downward pressure on pricing.

- Market saturation in mature regions could limit growth.

- Political and healthcare policy changes might influence reimbursement and prescribing practices.

- Competition from new phosphate binder technologies remains a threat.

Strategic Opportunities

- Extended Indications: Exploring Sevelamer use for conditions like hypercalcemia in cancer therapy could open new revenue streams.

- Formulation Innovations: Developing once-daily formulations to improve adherence.

- Market Expansion: Focused marketing efforts in emerging markets with rising CKD burdens.

- Partnerships: Collaborations with regional distributors to accelerate penetration.

Key Takeaways

- The global Sevelamer market is projected to grow at a CAGR of approximately 12% between 2023 and 2027, reaching USD 2.2 billion in sales.

- The rising prevalence of CKD, combined with clinical guidelines favoring non-calcium binders, sustains demand.

- North America and Europe remain dominant, but Asia-Pacific’s growth potential is significant.

- Patent protections, formulation enhancements, and regional market expansion are critical factors influencing future sales.

- Market competition from alternative phosphate binders necessitates continuous innovation and strategic positioning.

Conclusion

Sevelamer’s unique clinical profile positions it favorably within the phosphate binder market amid increasing CKD burden worldwide. Companies that leverage regional growth opportunities, invest in innovative formulations, and align with evolving clinical practices will be well-placed for sustained sales growth. Continued monitoring of regulatory landscapes and competitive developments is essential for strategic planning.

FAQs

Q1: What makes Sevelamer preferable over calcium-based phosphate binders?

A1: Sevelamer reduces hyperphosphatemia without increasing calcium load, thereby lowering the risk of vascular calcification and cardiovascular complications compared to calcium-based binders.

Q2: How is the CKD epidemic impacting the Sevelamer market?

A2: The increasing prevalence of CKD and ESRD globally is a primary driver of demand for phosphate binders like Sevelamer, contributing to market expansion.

Q3: What regional factors influence Sevelamer’s sales growth?

A3: Healthcare infrastructure, prevalence of CKD, reimbursement policies, and clinical guideline adoption significantly influence regional sales growth, with North America leading and Asia-Pacific showing rapid potential.

Q4: What competitive pressures does Sevelamer face?

A4: Competitors include calcium-based binders and newer non-calcium agents like lanthanum carbonate and ferric citrate. Patent expiries and biosimilars could further impact pricing and market share.

Q5: What strategic actions can manufacturers take to maximize Sevelamer sales?

A5: Developing new formulations, expanding into emerging markets, forming strategic partnerships, and exploring additional indications are vital strategies for growth.

Sources:

[1] Global CKD Prognosis Consortium, 2022.

[2] MarketWatch, 2022.

More… ↓