Last updated: July 29, 2025

Introduction

Pramipexole, a dopamine agonist, is primarily prescribed for Parkinson’s disease and restless leg syndrome (RLS). As a well-established medication, its market landscape is shaped by demographic trends, competitive dynamics, regulatory environment, and evolving treatment paradigms. This analysis delineates current market conditions, explores growth drivers, assesses competitive positioning, and projects sales trajectory over the next five years, offering strategic insights for stakeholders.

Pharmacological Profile and Therapeutic Indications

Pramipexole (brand names: Mirapex, Sifrol) acts by stimulating dopamine receptors (primarily D2/D3), alleviating motor symptoms characteristic of Parkinson’s and RLS [1]. Its efficacy and tolerability have cemented its role in neurological therapeutics. The drug's patent expiry and subsequent generic availability have broadened access but also intensified competiton [2].

Market Landscape Overview

Global Epidemiology

- Parkinson’s Disease (PD): Estimated 10 million cases worldwide; incidence rises with age (average diagnosis at 60+ years) [3].

- Restless Leg Syndrome: Affects approximately 7-10% of the adult population, with higher prevalence among women and older adults [4].

Market Segmentation

- By Indication: Parkinson’s disease initialization and management; RLS symptom control.

- By Geography:

- North America: Largest market due to high PD prevalence, robust healthcare infrastructure, and familiarization with dopamine agonists.

- Europe: Similar dynamics; strong adoption due to established treatment guidelines.

- Asia-Pacific: Growing prevalence of PD and RLS; increased healthcare access and awareness.

Market Drivers

- Aging populations globally.

- Increasing diagnosis rates owing to better awareness.

- Advances in symptomatic therapies emphasizing early intervention.

- Preferential shift towards dopamine agonists over levodopa in early PD stages [5].

Market Challenges

- Adverse effects: Nausea, hallucinations, impulse control disorders.

- Side effect management: Limits widespread use, especially in older or comorbid patients.

- Pricing and reimbursement constraints: Particularly in regions with cost-sensitive healthcare systems.

Competitive Dynamics

Key Players

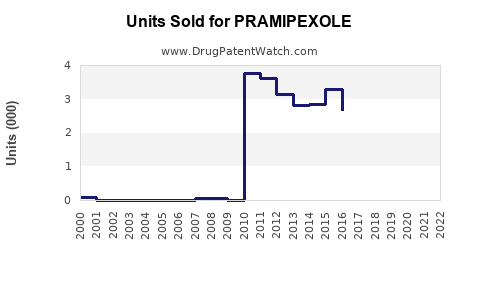

- Generic manufacturers: Dominate due to patent expiration in many regions.

- Innovator companies: Focus on formulations with improved safety and compliance.

- Alternative therapies: Levodopa, MAO-B inhibitors, and newer drugs like istradefylline.

Market Shares

- Post-patent expiration, generic pramipexole accounts for over 80% of prescriptions in mature markets.

- Innovator brand (Mirapex) retains premium pricing and physician loyalty through clinical data.

Pipeline and Innovation

- Trials assessing extended-release formulations.

- Combination therapies addressing specific symptom clusters.

- Exploration of biomarkers for personalized therapy.

Sales Projections (2023-2028)

Methodology

Projections incorporate epidemiological data, current market penetration rates, pricing trends, and competitive dynamics. Adjustments account for emerging therapies and regulatory shifts.

Estimated Market Size

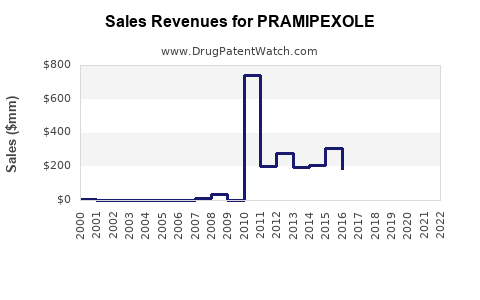

- Global pramipexole sales reached approximately USD 2.3 billion in 2022 [6].

- The segment is expected to grow at a Compound Annual Growth Rate (CAGR) of 4-5% over the forecast period, driven by expanding patient populations and increased treatment rates.

Projected Sales

| Year |

Estimated Global Sales (USD Billion) |

Notes |

| 2023 |

2.4 |

Base year; steady prescription patterns |

| 2024 |

2.5 |

Rising adoption in emerging markets |

| 2025 |

2.6 |

Market stabilization with approved generics |

| 2026 |

2.7 |

Slight uptick due to new formulations |

| 2027 |

2.8 |

Continued demographic expansion |

| 2028 |

3.0 |

Potential impact of new therapies |

Factors Influencing Sales Growth

- Regulatory Environment: Favorable approvals for extended-release formulations could enhance adherence and market share.

- Generic Competition: Price erosion may temper revenue growth but expand patient access.

- Emerging Markets: Rapid economic development and healthcare investment are expected to expand market size.

- Innovation: Improved safety profiles could invigorate demand among specific patient cohorts.

Strategic Implications

- Market Penetration: Expanding in emerging markets with targeted awareness campaigns.

- Formulation Development: Investing in formulations that improve compliance and reduce adverse effects.

- Pricing Strategies: Adjusting to product lifecycle stages, balancing profitability with affordability.

- Portfolio Diversification: Investing in companion diagnostics and combination therapies to maintain competitive edge.

Conclusion

Pramipexole remains a cornerstone dopamine agonist with a resilient market outlook, buoyed by demographic ageing, treatment paradigm shifts, and a broader acceptance of symptomatic therapies. While generic competition constrains margins, ongoing innovation and strategic expansion into emerging markets can sustain growth. Stakeholders should monitor evolving clinical data, regulatory changes, and technological advances to optimize market positioning.

Key Takeaways

- The global pramipexole market is projected to grow at a CAGR of approximately 4-5% through 2028, driven by demographic trends and expanded indication awareness.

- Generic formulations dominate market share location, necessitating differentiation via formulations or delivery methods.

- Emerging markets offer significant growth opportunities, given increasing healthcare infrastructure and disease prevalence.

- Market success hinges on balancing pricing strategies, innovation, and regulatory navigation amidst competition.

- Investment in advanced formulations and combination therapies can renew product relevance and extend market life cycle.

FAQs

1. How will patent expirations impact pramipexole sales?

Patent expirations have led to a surge in generic manufacturing, significantly reducing drug prices and expanding access but compressing profit margins for innovator brands. Competition remains fierce, and markets increasingly favor cost-effective generics, impacting overall sales revenue.

2. Are there upcoming formulations or delivery methods that could boost pramipexole sales?

Yes. Extended-release formulations aim to improve patient adherence and reduce side effects, potentially increasing market penetration, especially among elderly patients with compliance challenges.

3. How does the competitive landscape influence future sales?

The proliferation of generics limits pricing power but expands market access. Newer therapies targeting specific symptoms or personalized medicine approaches may threaten pramipexole’s market share but also offer adjacent opportunities if integrated strategically.

4. What regional differences are most significant for pramipexole sales?

North America and Europe represent mature markets with high adoption levels. Conversely, Asia-Pacific and Latin America present high-growth opportunities due to demographic shifts, increased diagnosis rates, and evolving healthcare infrastructure.

5. How might new clinical data influence the market?

Positive data demonstrating superior safety, efficacy, or adherence benefits can boost prescribing rates. Conversely, evidence of adverse effects or improved alternatives can diminish demand, underscoring the importance of ongoing research and strategic positioning.

Sources:

[1] European Medicines Agency. Pramipexole Monograph.

[2] U.S. FDA. Drug Approvals and Patent Data.

[3] World Health Organization. Parkinson’s Disease Fact Sheet.

[4] National Institute of Neurological Disorders and Stroke. Restless Legs Syndrome.

[5] International Parkinson and Movement Disorder Society. Treatment Guidelines.

[6] IQVIA. Pharmaceuticals Market Analytics, 2022.